Form Cf: 0034 - Articles Of Dissolution Non Profit Corporation - 2007

ADVERTISEMENT

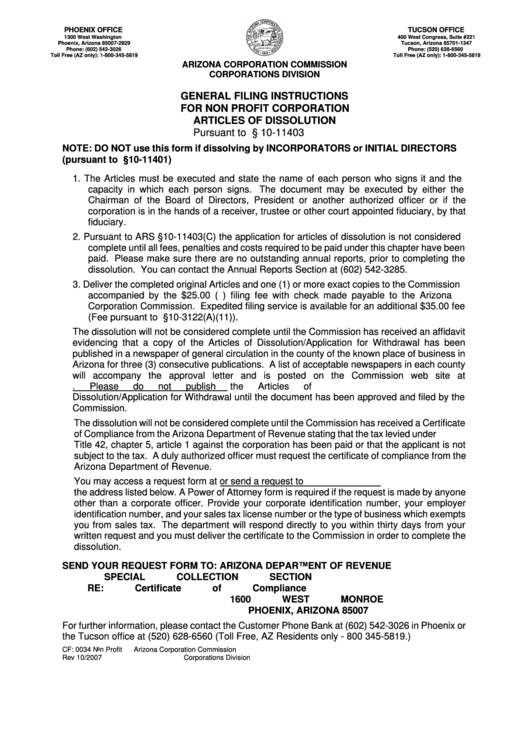

PHOENIX OFFICE

TUCSON OFFICE

1300 West Washington

400 West Congress, Suite #221

Phoenix, Arizona 85007-2929

Tucson, Arizona 85701-1347

Phone: (602) 542-3026

Phone: (520) 628-6560

Toll Free (AZ only): 1-800-345-5819

Toll Free (AZ only): 1-800-345-5819

ARIZONA CORPORATION COMMISSION

CORPORATIONS DIVISION

GENERAL FILING INSTRUCTIONS

FOR NON PROFIT CORPORATION

ARTICLES OF DISSOLUTION

Pursuant to A.R.S. § 10-11403

NOTE:

DO NOT use this form if dissolving by INCORPORATORS or INITIAL DIRECTORS

(pursuant to A.R.S. §10-11401)

1. The Articles must be executed and state the name of each person who signs it and the

capacity in which each person signs. The document may be executed by either the

Chairman of the Board of Directors, President or another authorized officer or if the

corporation is in the hands of a receiver, trustee or other court appointed fiduciary, by that

fiduciary.

2. Pursuant to ARS §10-11403(C) the application for articles of dissolution is not considered

complete until all fees, penalties and costs required to be paid under this chapter have been

paid. Please make sure there are no outstanding annual reports, prior to completing the

dissolution. You can contact the Annual Reports Section at (602) 542-3285.

3. Deliver the completed original Articles and one (1) or more exact copies to the Commission

accompanied by the $25.00 (U.S.) filing fee with check made payable to the Arizona

Corporation Commission. Expedited filing service is available for an additional $35.00 fee

(Fee pursuant to A.R.S. §10-3122(A)(11)).

The dissolution will not be considered complete until the Commission has received an affidavit

evidencing that a copy of the Articles of Dissolution/Application for Withdrawal has been

published in a newspaper of general circulation in the county of the known place of business in

Arizona for three (3) consecutive publications. A list of acceptable newspapers in each county

will accompany the approval letter and is posted on the Commission web site at

/divisions/corporations.

Please

do

not

publish

the

Articles

of

Dissolution/Application for Withdrawal until the document has been approved and filed by the

Commission.

The dissolution will not be considered complete until the Commission has received a Certificate

of Compliance from the Arizona Department of Revenue stating that the tax levied under A.R.S.

Title 42, chapter 5, article 1 against the corporation has been paid or that the applicant is not

subject to the tax. A duly authorized officer must request the certificate of compliance from the

Arizona Department of Revenue.

You may access a request form at or send a request to

the address listed below. A Power of Attorney form is required if the request is made by anyone

other than a corporate officer. Provide your corporate identification number, your employer

identification number, and your sales tax license number or the type of business which exempts

you from sales tax. The department will respond directly to you within thirty days from your

written request and you must deliver the certificate to the Commission in order to complete the

dissolution.

SEND YOUR REQUEST FORM TO:

ARIZONA DEPARTMENT OF REVENUE

SPECIAL COLLECTION SECTION

RE: Certificate of Compliance

1600 WEST MONROE

PHOENIX, ARIZONA 85007

For further information, please contact the Customer Phone Bank at (602) 542-3026 in Phoenix or

the Tucson office at (520) 628-6560 (Toll Free, AZ Residents only - 800 345-5819.)

CF: 0034 Non Profit

Arizona Corporation Commission

Rev 10/2007

Corporations Division

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2