International Fuel Tax Agreement Quarterly Tax Return Form - Arkansas Department Of Finance & Administration

ADVERTISEMENT

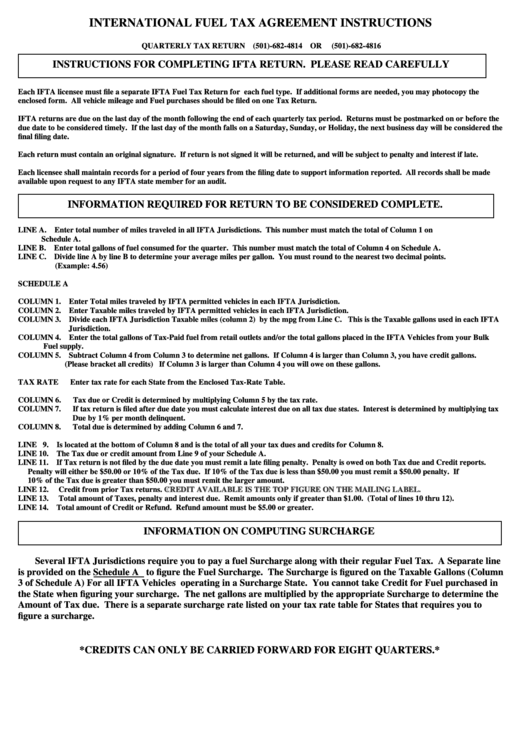

INTERNATIONAL FUEL TAX AGREEMENT INSTRUCTIONS

QUARTERLY TAX RETURN (501)-682-4814 OR

(501)-682-4816

INSTRUCTIONS FOR COMPLETING IFTA RETURN. PLEASE READ CAREFULLY

Each IFTA licensee must file a separate IFTA Fuel Tax Return for each fuel type. If additional forms are needed, you may photocopy the

enclosed form. All vehicle mileage and Fuel purchases should be filed on one Tax Return.

IFTA returns are due on the last day of the month following the end of each quarterly tax period. Returns must be postmarked on or before the

due date to be considered timely. If the last day of the month falls on a Saturday, Sunday, or Holiday, the next business day will be considered the

final filing date.

Each return must contain an original signature. If return is not signed it will be returned, and will be subject to penalty and interest if late.

Each licensee shall maintain records for a period of four years from the filing date to support information reported. All records shall be made

available upon request to any IFTA state member for an audit.

INFORMATION REQUIRED FOR RETURN TO BE CONSIDERED COMPLETE.

LINE A. Enter total number of miles traveled in all IFTA Jurisdictions. This number must match the total of Column 1 on

Schedule A.

LINE B. Enter total gallons of fuel consumed for the quarter. This number must match the total of Column 4 on Schedule A.

LINE C. Divide line A by line B to determine your average miles per gallon. You must round to the nearest two decimal points.

(Example: 4.56)

SCHEDULE A

COLUMN 1. Enter Total miles traveled by IFTA permitted vehicles in each IFTA Jurisdiction.

COLUMN 2. Enter Taxable miles traveled by IFTA permitted vehicles in each IFTA Jurisdiction.

COLUMN 3. Divide each IFTA Jurisdiction Taxable miles (column 2) by the mpg from Line C. This is the Taxable gallons used in each IFTA

Jurisdiction.

COLUMN 4. Enter the total gallons of Tax-Paid fuel from retail outlets and/or the total gallons placed in the IFTA Vehicles from your Bulk

Fuel supply.

COLUMN 5. Subtract Column 4 from Column 3 to determine net gallons. If Column 4 is larger than Column 3, you have credit gallons.

(Please bracket all credits) If Column 3 is larger than Column 4 you will owe on these gallons.

TAX RATE

Enter tax rate for each State from the Enclosed Tax-Rate Table.

COLUMN 6.

Tax due or Credit is determined by multiplying Column 5 by the tax rate.

COLUMN 7.

If tax return is filed after due date you must calculate interest due on all tax due states. Interest is determined by multiplying tax

Due by 1% per month delinquent.

COLUMN 8.

Total due is determined by adding Column 6 and 7.

LINE 9. Is located at the bottom of Column 8 and is the total of all your tax dues and credits for Column 8.

LINE 10. The Tax due or credit amount from Line 9 of your Schedule A.

LINE 11. If Tax return is not filed by the due date you must remit a late filing penalty. Penalty is owed on both Tax due and Credit reports.

Penalty will either be $50.00 or 10% of the Tax due. If 10% of the Tax due is less than $50.00 you must remit a $50.00 penalty. If

10% of the Tax due is greater than $50.00 you must remit the larger amount.

LINE 12.

Credit from prior Tax returns.

C

R

E

D

I

T

A

V

A

I

L

A

B

L

E

I

S

T

H

E

T

O

P

F

I

G

U

R

E

O

N

T

H

E

M

A

I

L

I

N

G

L

A

B

E

L .

C

R

E

D

I

T

A

V

A

I

L

A

B

L

E

I

S

T

H

E

T

O

P

F

I

G

U

R

E

O

N

T

H

E

M

A

I

L

I

N

G

L

A

B

E

L

LINE 13.

Total amount of Taxes, penalty and interest due. Remit amounts only if greater than $1.00. (Total of lines 10 thru 12).

LINE 14. Total amount of Credit or Refund. Refund amount must be $5.00 or greater.

INFORMATION ON COMPUTING SURCHARGE

Several IFTA Jurisdictions require you to pay a fuel Surcharge along with their regular Fuel Tax. A Separate line

is provided on the Schedule A to figure the Fuel Surcharge. The Surcharge is figured on the Taxable Gallons (Column

3 of Schedule A) For all IFTA Vehicles operating in a Surcharge State. You cannot take Credit for Fuel purchased in

the State when figuring your surcharge. The net gallons are multiplied by the appropriate Surcharge to determine the

Amount of Tax due. There is a separate surcharge rate listed on your tax rate table for States that requires you to

figure a surcharge.

*CREDITS CAN ONLY BE CARRIED FORWARD FOR EIGHT QUARTERS.*

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4