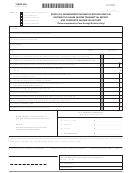

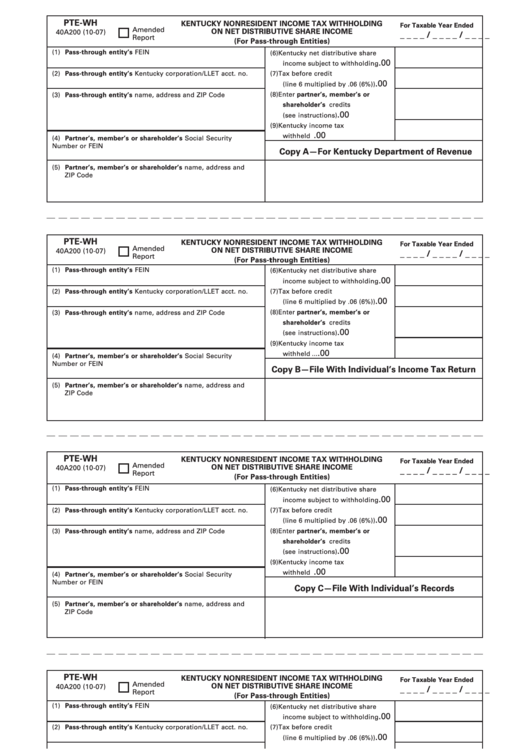

Form Pte-Wh - Kentucky Nonresident Income Tax Withholding On Net Distributive Share Income

ADVERTISEMENT

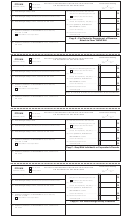

PTE-WH

KENTUCKY NONRESIDENT INCOME TAX WITHHOLDING

For Taxable Year Ended

Amended

ON NET DISTRIBUTIVE SHARE INCOME

40A200 (10-07)

__ __ / __ __ / __ __

Report

(For Pass-through Entities)

(1) Pass-through entity’s FEIN

(6) Kentucky net distributive share

.00

income subject to withholding .....

(2) Pass-through entity’s Kentucky corporation/LLET acct. no.

(7) Tax before credit

.00

(line 6 multiplied by .06 (6%)) .......

(8) Enter partner’s, member’s or

(3) Pass-through entity’s name, address and ZIP Code

shareholder’s credits

.00

(see instructions) ............................

(9) Kentucky income tax

.00

withheld ...........................................

(4) Partner’s, member’s or shareholder’s Social Security

Number or FEIN

Copy A—For Kentucky Department of Revenue

(5) Partner’s, member’s or shareholder’s name, address and

ZIP Code

PTE-WH

KENTUCKY NONRESIDENT INCOME TAX WITHHOLDING

For Taxable Year Ended

Amended

ON NET DISTRIBUTIVE SHARE INCOME

40A200 (10-07)

__ __ / __ __ / __ __

Report

(For Pass-through Entities)

t

(1) Pass-through entity’s FEIN

(6) Kentucky net distributive share

.00

income subject to withholding .....

(2) Pass-through entity’s Kentucky corporation/LLET acct. no.

(7) Tax before credit

.00

(line 6 multiplied by .06 (6%)) .......

(8) Enter partner’s, member’s or

(3) Pass-through entity’s name, address and ZIP Code

shareholder’s credits

.00

(see instructions) ............................

(9) Kentucky income tax

.00

withheld ...........................................

(4) Partner’s, member’s or shareholder’s Social Security

Number or FEIN

Copy B—File With Individual’s Income Tax Return

(5) Partner’s, member’s or shareholder’s name, address and

ZIP Code

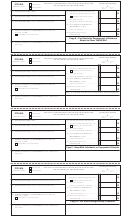

PTE-WH

KENTUCKY NONRESIDENT INCOME TAX WITHHOLDING

For Taxable Year Ended

Amended

ON NET DISTRIBUTIVE SHARE INCOME

40A200 (10-07)

__ __ / __ __ / __ __

Report

(For Pass-through Entities)

(1) Pass-through entity’s FEIN

(6) Kentucky net distributive share

.00

income subject to withholding .....

(2) Pass-through entity’s Kentucky corporation/LLET acct. no.

(7) Tax before credit

.00

(line 6 multiplied by .06 (6%)) .......

(8) Enter partner’s, member’s or

(3) Pass-through entity’s name, address and ZIP Code

shareholder’s credits

.00

(see instructions) ............................

(9) Kentucky income tax

.00

withheld ...........................................

(4) Partner’s, member’s or shareholder’s Social Security

Number or FEIN

Copy C—File With Individual’s Records

(5) Partner’s, member’s or shareholder’s name, address and

ZIP Code

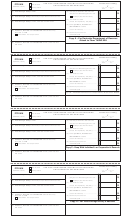

PTE-WH

KENTUCKY NONRESIDENT INCOME TAX WITHHOLDING

For Taxable Year Ended

Amended

ON NET DISTRIBUTIVE SHARE INCOME

40A200 (10-07)

__ __ / __ __ / __ __

Report

(For Pass-through Entities)

(1) Pass-through entity’s FEIN

(6) Kentucky net distributive share

.00

income subject to withholding .....

(2) Pass-through entity’s Kentucky corporation/LLET acct. no.

(7) Tax before credit

.00

(line 6 multiplied by .06 (6%)) .......

(8) Enter partner’s, member’s or

(3) Pass-through entity’s name, address and ZIP Code

shareholder’s credits

.00

(see instructions) ............................

(9) Kentucky income tax

.00

withheld ...........................................

(4) Partner’s, member’s or shareholder’s Social Security

Number or FEIN

Copy D—For Pass-through Entity’s Records

(5) Partner’s, member’s or shareholder’s name, address and

ZIP Code

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1