Instruction For Form Br - City Of Springdale Income Tax Return And Declaration - 2006

ADVERTISEMENT

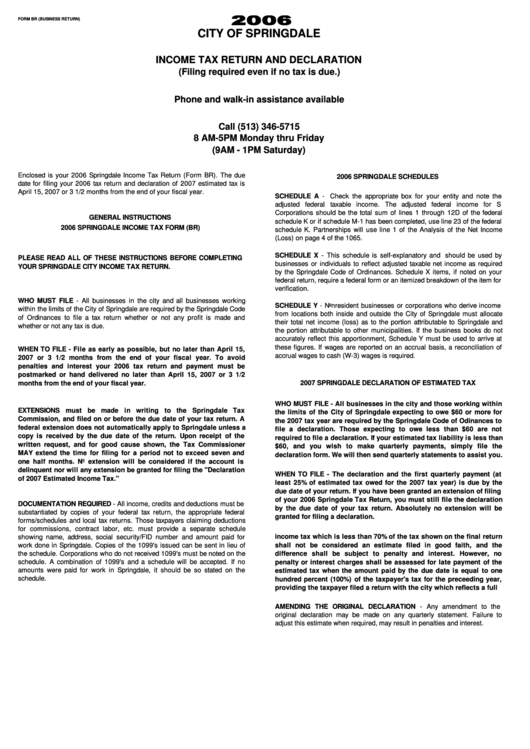

FORM BR (BUSINESS RETURN)

CITY OF SPRINGDALE

INCOME TAX RETURN AND DECLARATION

(Filing required even if no tax is due.)

Phone and walk-in assistance available

Call (513) 346-5715

8 AM-5PM Monday thru Friday

(9AM - 1PM Saturday)

Enclosed is your 2006 Springdale Income Tax Return (Form BR). The due

2006 SPRINGDALE SCHEDULES

date for filing your 2006 tax return and declaration of 2007 estimated tax is

April 15, 2007 or 3 1/2 months from the end of your fiscal year.

SCHEDULE A - Check the appropriate box for your entity and note the

adjusted federal taxable income. The adjusted federal income for S

Corporations should be the total sum of lines 1 through 12D of the federal

GENERAL INSTRUCTIONS

schedule K or if schedule M-1 has been completed, use line 23 of the federal

2006 SPRINGDALE INCOME TAX FORM (BR)

schedule K. Partnerships will use line 1 of the Analysis of the Net Income

(Loss) on page 4 of the 1065.

SCHEDULE X - This schedule is self-explanatory and should be used by

PLEASE READ ALL OF THESE INSTRUCTIONS BEFORE COMPLETING

businesses or individuals to reflect adjusted taxable net income as required

YOUR SPRINGDALE CITY INCOME TAX RETURN.

by the Springdale Code of Ordinances. Schedule X items, if noted on your

federal return, require a federal form or an itemized breakdown of the item for

verification.

WHO MUST FILE - All businesses in the city and all businesses working

SCHEDULE Y - Nonresident businesses or corporations who derive income

within the limits of the City of Springdale are required by the Springdale Code

from locations both inside and outside the City of Springdale must allocate

of Ordinances to file a tax return whether or not any profit is made and

their total net income (loss) as to the portion attributable to Springdale and

whether or not any tax is due.

the portion attributable to other municipalities. If the business books do not

accurately reflect this apportionment, Schedule Y must be used to arrive at

these figures. If wages are reported on an accrual basis, a reconciliation of

WHEN TO FILE - File as early as possible, but no later than April 15,

accrual wages to cash (W-3) wages is required.

2007 or 3 1/2 months from the end of your fiscal year. To avoid

penalties and interest your 2006 tax return and payment must be

postmarked or hand delivered no later than April 15, 2007 or 3 1/2

2007 SPRINGDALE DECLARATION OF ESTIMATED TAX

months from the end of your fiscal year.

WHO MUST FILE - All businesses in the city and those working within

EXTENSIONS must be made in writing to the Springdale Tax

the limits of the City of Springdale expecting to owe $60 or more for

Commission, and filed on or before the due date of your tax return. A

the 2007 tax year are required by the Springdale Code of Odinances to

federal extension does not automatically apply to Springdale unless a

file a declaration. Those expecting to owe less than $60 are not

copy is received by the due date of the return. Upon receipt of the

required to file a declaration. If your estimated tax liability is less than

written request, and for good cause shown, the Tax Commissioner

$60, and you wish to make quarterly payments, simply file the

MAY extend the time for filing for a period not to exceed seven and

declaration form. We will then send quarterly statements to assist you.

one half months. No extension will be considered if the account is

delinquent nor will any extension be granted for filing the "Declaration

WHEN TO FILE - The declaration and the first quarterly payment (at

of 2007 Estimated Income Tax."

least 25% of estimated tax owed for the 2007 tax year) is due by the

due date of your return. If you have been granted an extension of filing

of your 2006 Springdale Tax Return, you must still file the declaration

DOCUMENTATION REQUIRED - All income, credits and deductions must be

by the due date of your tax return. Absolutely no extension will be

substantiated by copies of your federal tax return, the appropriate federal

granted for filing a declaration.

forms/schedules and local tax returns. Those taxpayers claiming deductions

ESTIMATING YOUR 2007 TAX LIABILITY - A declaration of estimated

for commissions, contract labor, etc. must provide a separate schedule

income tax which is less than 70% of the tax shown on the final return

showing name, address, social security/FID number and amount paid for

shall not be considered an estimate filed in good faith, and the

work done in Springdale. Copies of the 1099's issued can be sent in lieu of

the schedule. Corporations who do not received 1099's must be noted on the

difference shall be subject to penalty and interest. However, no

schedule. A combination of 1099's and a schedule will be accepted. If no

penalty or interest charges shall be assessed for late payment of the

amounts were paid for work in Springdale, it should be so stated on the

estimated tax when the amount paid by the due date is equal to one

schedule.

hundred percent (100%) of the taxpayer's tax for the preceeding year,

providing the taxpayer filed a return with the city which reflects a full

AMENDING THE ORIGINAL DECLARATION - Any amendment to the

original declaration may be made on any quarterly statement. Failure to

adjust this estimate when required, may result in penalties and interest.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2