Department of Insurance

Reset

State of Arizona

Financial Affairs Division – Tax unit

RETALIATORY TAXES

2910 North 44th Street, Suite 210

AND FEES WORKSHEET

Phoenix, AZ 85018-7269

Telephone: (602) 364-3998

Facsimile: (602) 364-3989

COMPANY NAME:

State Of Incorporation:

NAIC#:

YEAR:

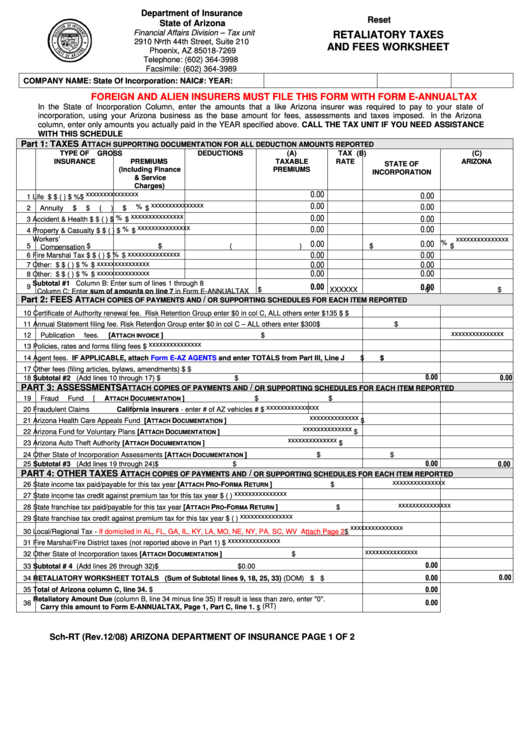

FOREIGN AND ALIEN INSURERS MUST FILE THIS FORM WITH FORM E-ANNUALTAX

In the State of Incorporation Column, enter the amounts that a like Arizona insurer was required to pay to your state of

incorporation, using your Arizona business as the base amount for fees, assessments and taxes imposed. In the Arizona

column, enter only amounts you actually paid in the YEAR specified above. CALL THE TAX UNIT IF YOU NEED ASSISTANCE

WITH THIS SCHEDULE

Part 1: TAXES

A

TTACH SUPPORTING DOCUMENTATION FOR ALL DEDUCTION AMOUNTS REPORTED

TYPE OF

GROSS

DEDUCTIONS

(A)

TAX

(B)

(C)

INSURANCE

PREMIUMS

TAXABLE

RATE

ARIZONA

STATE OF

(Including Finance

PREMIUMS

INCORPORATION

& Service

Charges)

0.00

0.00

xxxxxxxxxxxxxxx

1

Life

$

$ (

)

$

% $

0.00

0.00

xxxxxxxxxxxxxxx

% $

2

Annuity

$

$ (

)

$

0.00

0.00

xxxxxxxxxxxxxxx

% $

3

Accident & Health

$

$ (

)

$

0.00

0.00

xxxxxxxxxxxxxxx

% $

4

Property & Casualty

$

$ (

)

$

Workers’

xxxxxxxxxxxxxxx

0.00

0.00

% $

5

$

$ (

)

$

Compensation

0.00

0.00

xxxxxxxxxxxxxxx

% $

6

Fire Marshal Tax

$

$ (

)

$

0.00

0.00

xxxxxxxxxxxxxxx

% $

7

Other:

$

$ (

)

$

0.00

0.00

xxxxxxxxxxxxxxx

% $

8

Other:

$

$ (

)

$

0.00

9 Subtotal #1 Column B: Enter sum of lines 1 through 8

0.00

$

XXXXXX $

$

Column C: Enter sum of amounts on line 7 in Form E-ANNUALTAX

Part 2: FEES

A

/

TTACH COPIES OF PAYMENTS AND

OR SUPPORTING SCHEDULES FOR EACH ITEM REPORTED

10

Certificate of Authority renewal fee. Risk Retention Group enter $0 in col C, ALL others enter $135

$

$

11

Annual Statement filing fee.

Risk Retention Group enter $0 in col C – ALL others enter $300 $

$

xxxxxxxxxxxxxxx

12

Publication fees.

[ A

]

$

TTACH INVOICE

xxxxxxxxxxxxxxx

13

Policies, rates and forms filing fees

$

14

Agent fees. IF APPLICABLE, attach

Form E-AZ AGENTS

and enter TOTALS from Part III, Line J

$

$

17

Other fees (filing articles, bylaws, amendments)

$

$

0.00

0.00

18

Subtotal #2 (Add lines 10 through 17)

$

$

PART 3: ASSESSMENTSA

/

TTACH COPIES OF PAYMENTS AND

OR SUPPORTING SCHEDULES FOR EACH ITEM REPORTED

19

Fraud Fund

[ A

D

]

$

$

TTACH

OCUMENTATION

xxxxxxxxxxxxxxx

20

Fraudulent Claims

California insurers - enter # of AZ vehicles

#

$

xxxxxxxxxxxxxx

21

Arizona Health Care Appeals Fund

[ A

D

]

$

TTACH

OCUMENTATION

xxxxxxxxxxxxxx

22

Arizona Fund for Voluntary Plans

[ A

D

]

$

TTACH

OCUMENTATION

xxxxxxxxxxxxxx

23

Arizona Auto Theft Authority

[ A

D

]

$

TTACH

OCUMENTATION

24

Other State of Incorporation Assessments

[ A

D

]

$

$

TTACH

OCUMENTATION

0.00

0.00

25

Subtotal #3 (Add lines 19 through 24)

$

$

PART 4: OTHER TAXES A

/

TTACH COPIES OF PAYMENTS AND

OR SUPPORTING SCHEDULES FOR EACH ITEM REPORTED

xxxxxxxxxxxxxxx

26

State income tax paid/payable for this tax year

[ A

P

-F

R

]

$

TTACH

RO

ORMA

ETURN

xxxxxxxxxxxxxxx

27

State income tax credit against premium tax for this tax year

$ (

)

xxxxxxxxxxxxxxx

28

State franchise tax paid/payable for this tax year

[ A

P

-F

R

]

$

TTACH

RO

ORMA

ETURN

xxxxxxxxxxxxxxx

29

State franchise tax credit against premium tax for this tax year

$ (

)

xxxxxxxxxxxxxxx

30

Local/Regional Tax -

If domiciled in AL, FL, GA, IL, KY, LA, MO, NE, NY, PA, SC, WV Attach Page 2

$

xxxxxxxxxxxxxxx

31

Fire Marshal/Fire District taxes (not reported above in Part 1)

$

xxxxxxxxxxxxxxx

32

Other State of Incorporation taxes

[ A

D

]

$

TTACH

OCUMENTATION

0.00

33

Subtotal # 4 (Add lines 26 through 32)

$

$0.00

0.00

0.00

34

RETALIATORY WORKSHEET TOTALS (Sum of Subtotal lines 9, 18, 25, 33)

(DOM) $

$

0.00

35

Total of Arizona column C, line 34.

$

Retaliatory Amount Due (column B, line 34 minus line 35) If result is less than zero, enter "0".

0.00

36

(RT)

Carry this amount to Form E-ANNUALTAX, Page 1, Part C, line 1.

$

Sch-RT (Rev.12/08)

ARIZONA DEPARTMENT OF INSURANCE

PAGE 1 OF 2

1

1 2

2