Instructions For Completion Of Form Uc-2x And Uc-2ax

ADVERTISEMENT

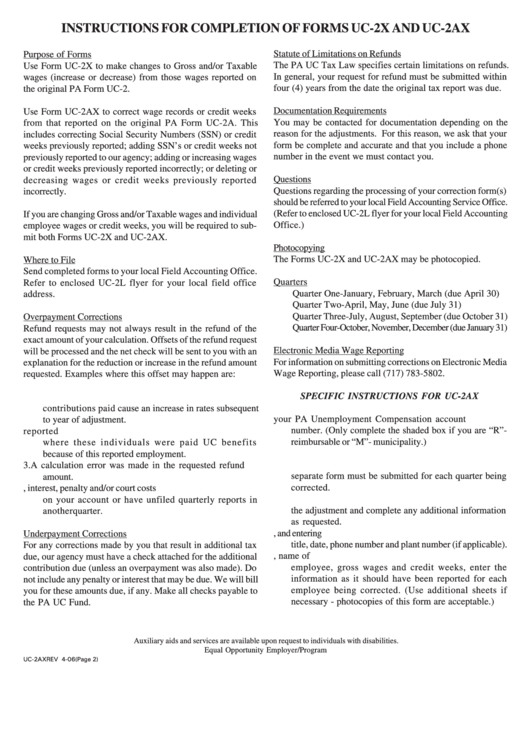

INSTRUCTIONS FOR COMPLETION OF FORMS UC-2X AND UC-2AX

Statute of Limitations on Refunds

Purpose of Forms

The PA UC Tax Law specifies certain limitations on refunds.

Use Form UC-2X to make changes to Gross and/or Taxable

In general, your request for refund must be submitted within

wages (increase or decrease) from those wages reported on

four (4) years from the date the original tax report was due.

the original PA Form UC-2.

Documentation Requirements

Use Form UC-2AX to correct wage records or credit weeks

You may be contacted for documentation depending on the

from that reported on the original PA Form UC-2A. This

reason for the adjustments. For this reason, we ask that your

includes correcting Social Security Numbers (SSN) or credit

form be complete and accurate and that you include a phone

weeks previously reported; adding SSN’s or credit weeks not

number in the event we must contact you.

previously reported to our agency; adding or increasing wages

or credit weeks previously reported incorrectly; or deleting or

Questions

decreasing wages or credit weeks previously reported

Questions regarding the processing of your correction form(s)

incorrectly.

should be referred to your local Field Accounting Service Office.

(Refer to enclosed UC-2L flyer for your local Field Accounting

If you are changing Gross and/or Taxable wages and individual

Office.)

employee wages or credit weeks, you will be required to sub-

mit both Forms UC-2X and UC-2AX.

Photocopying

The Forms UC-2X and UC-2AX may be photocopied.

Where to File

Send completed forms to your local Field Accounting Office.

Quarters

Refer to enclosed UC-2L flyer for your local field office

Quarter One-January, February, March (due April 30)

address.

Quarter Two-April, May, June (due July 31)

Quarter Three-July, August, September (due October 31)

Overpayment Corrections

Quarter Four-October, November, December (due January 31)

Refund requests may not always result in the refund of the

exact amount of your calculation. Offsets of the refund request

Electronic Media Wage Reporting

will be processed and the net check will be sent to you with an

For information on submitting corrections on Electronic Media

explanation for the reduction or increase in the refund amount

Wage Reporting, please call (717) 783-5802.

requested. Examples where this offset may happen are:

SPECIFIC INSTRUCTIONS FOR UC-2AX

1.

Taxable wage reductions along with reduction in the

contributions paid cause an increase in rates subsequent

1.

Enter your PA Unemployment Compensation account

to year of adjustment.

number. (Only complete the shaded box if you are “R”-

2.

Correction of exempt employment previously reported

reimbursable or “M”- municipality.)

where these individuals were paid UC benefits

2.

Complete your business name and address.

because of this reported employment.

3.

Complete the quarter and year using four digits. A

3.

A calculation error was made in the requested refund

separate form must be submitted for each quarter being

amount.

corrected.

4.

You owe contribution, interest, penalty and/or court costs

4.

Check the appropriate box to indicate the reason for

on your account or have unfiled quarterly reports in

the adjustment and complete any additional information

anotherquarter.

as requested.

5.

Complete the employer certification by signing, and entering

Underpayment Corrections

title, date, phone number and plant number (if applicable).

For any corrections made by you that result in additional tax

6.

Following the format of employees SS number, name of

due, our agency must have a check attached for the additional

employee, gross wages and credit weeks, enter the

contribution due (unless an overpayment was also made). Do

information as it should have been reported for each

not include any penalty or interest that may be due. We will bill

employee being corrected. (Use additional sheets if

you for these amounts due, if any. Make all checks payable to

necessary - photocopies of this form are acceptable.)

the PA UC Fund.

Auxiliary aids and services are available upon request to individuals with disabilities.

Equal Opportunity Employer/Program

UC-2AX REV 4-06 (Page 2)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1