Sales,use & Rental Tax Report Form - Municipality Of Helena

ADVERTISEMENT

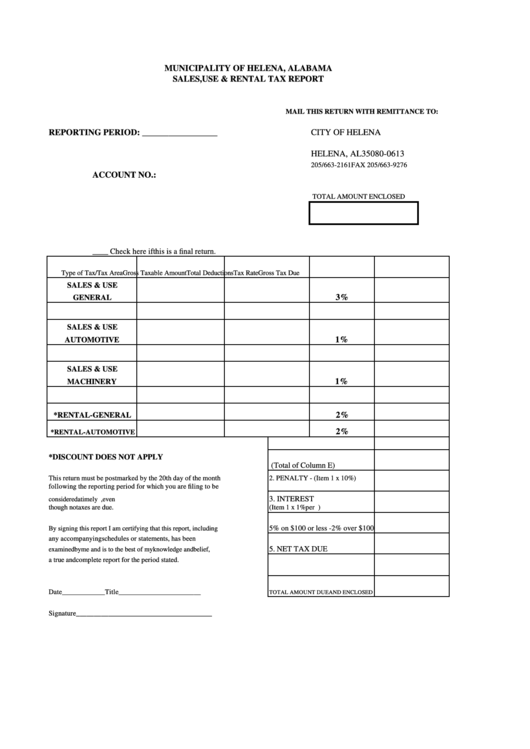

MUNICIPALITY OF HELENA, ALABAMA

SALES,USE & RENTAL TAX REPORT

MAIL THIS RETURN WITH REMITTANCE TO:

REPORTING PERIOD: _________________

CITY OF HELENA

P.O. BOX 613

HELENA, AL 35080-0613

205/663-2161 FAX 205/663-9276

ACCOUNT NO.:

TOTAL AMOUNT ENCLOSED

____ Check here if this is a final return.

Type of Tax/Tax Area

Gross Taxable Amount

Total Deductions

Tax Rate

Gross Tax Due

SALES & USE

3%

GENERAL

SALES & USE

1%

AUTOMOTIVE

SALES & USE

1%

MACHINERY

2%

*RENTAL-GENERAL

2%

*RENTAL-AUTOMOTIVE

*DISCOUNT DOES NOT APPLY

1. TOTAL TAX DUE

(Total of Column E)

This return must be postmarked by the 20th day of the month

2. PENALTY - (Item 1 x 10%)

following the reporting period for which you are filing to be

3. INTEREST

considered a timely return. Seller must file timely returns, even

though no taxes are due.

(Item 1 x 1% per mo.delinquent)

4. DISCOUNT-if filed by 20th

By signing this report I am certifying that this report, including

5% on $100 or less -2% over $100

any accompanying schedules or statements, has been

5. NET TAX DUE

examined by me and is to the best of my knowledge and belief,

a true and complete report for the period stated.

Date____________Title_______________________

TOTAL AMOUNT DUE AND ENCLOSED

Signature______________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2