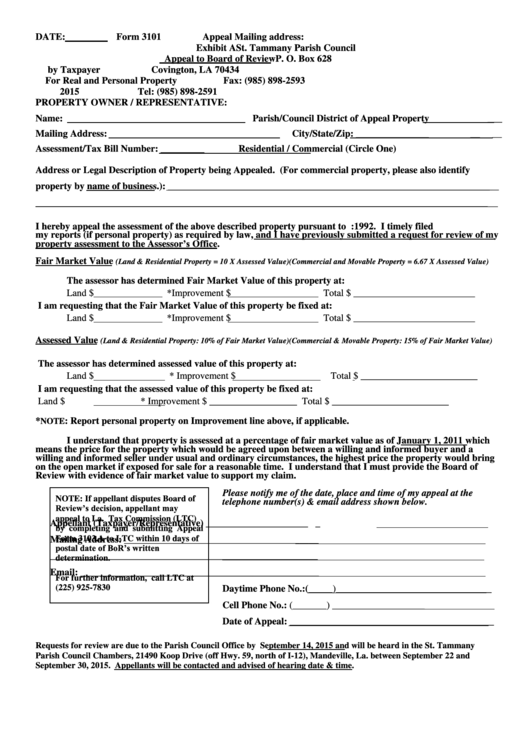

Form 3101 - Exhibit A - Appeal To Board Of Review By Taxpayer For Real And Personal Property - 2015

ADVERTISEMENT

DATE:

Form 3101

Appeal Mailing address:

Exhibit A

St. Tammany Parish Council

Appeal to Board of Review

P. O. Box 628

by Taxpayer

Covington, LA 70434

For Real and Personal Property

Fax: (985) 898-2593

2015

Tel: (985) 898-2591

PROPERTY OWNER / REPRESENTATIVE:

Name:

Parish/Council District of Appeal Property

___

Mailing Address:

City/State/Zip: _______________

__

__

Assessment/Tax Bill Number: _________

Residential / Commercial (Circle One)

Address or Legal Description of Property being Appealed. (For commercial property, please also identify

property by name of business.): ____________________________________________________________________

_______________________________________________________________________________________________

I hereby appeal the assessment of the above described property pursuant to L.R.S. 47:1992. I timely filed

my reports (if personal property) as required by law, and I have previously submitted a request for review of my

property assessment to the Assessor’s Office.

Fair Market Value

(Land & Residential Property = 10 X Assessed Value)(Commercial and Movable Property = 6.67 X Assessed Value)

The assessor has determined Fair Market Value of this property at:

Land $

*Improvement $

Total $ _________________________

I am requesting that the Fair Market Value of this property be fixed at:

Land $

*Improvement $

Total $ _________________________

Assessed Value

(Land & Residential Property: 10% of Fair Market Value)(Commercial & Movable Property: 15% of Fair Market Value)

The assessor has determined assessed value of this property at:

Land $

* Improvement $

Total $ ________________________

I am requesting that the assessed value of this property be fixed at:

Land $

* Improvement $ __________________ Total $ ________________________

*

: Report personal property on Improvement line above, if applicable.

NOTE

I understand that property is assessed at a percentage of fair market value as of January 1, 2011 which

means the price for the property which would be agreed upon between a willing and informed buyer and a

willing and informed seller under usual and ordinary circumstances, the highest price the property would bring

on the open market if exposed for sale for a reasonable time. I understand that I must provide the Board of

Review with evidence of fair market value to support my claim.

Please notify me of the date, place and time of my appeal at the

NOTE: If appellant disputes Board of

telephone number(s) & email address shown below.

Review’s

decision,

appellant

may

appeal to La. Tax Commission (LTC)

Appellant (Taxpayer/Representative) _____________________ _

by completing and submitting Appeal

Form 3103.A to LTC within 10 days of

Mailing Address: ________________________________________

date

of

BoR’s

written

postal

_______________________________________________________

determination.

Email: _________________________________________________

For further information, call LTC at

(225) 925-7830

Daytime Phone No.:(_____)________________________________

Cell

Phone

No.:

(_______)

___________________

Date of Appeal: __________________________________________

Requests for review are due to the Parish Council Office by September 14, 2015 and will be heard in the St. Tammany

Parish Council Chambers, 21490 Koop Drive (off Hwy. 59, north of I-12), Mandeville, La. between September 22 and

September 30, 2015. Appellants will be contacted and advised of hearing date & time.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1