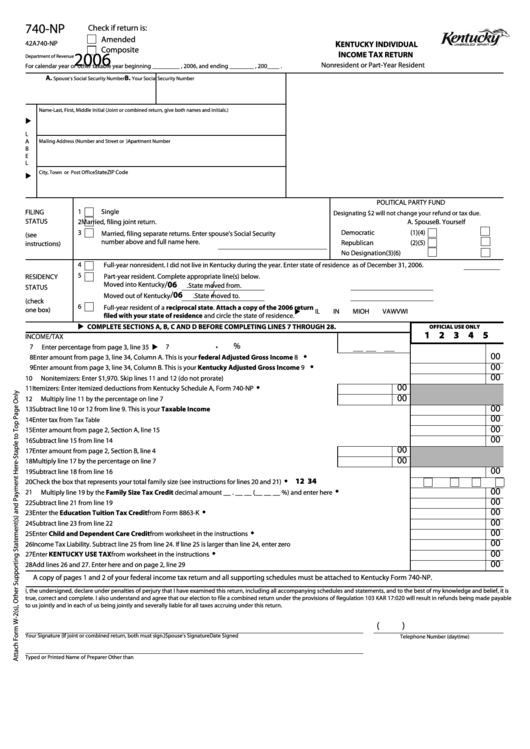

740-NP

Check if return is:

Amended

K

42A740-NP

I

ENTUCKY

NDIVIDUAL

Composite

2006

I

T

NCOME

AX R ETURN

Department of Revenue

Nonresident or Part-Year Resident

For calendar year or other taxable year beginning _________ , 2006, and ending ________ , 200____ .

A.

B.

Spouse's Social Security Number

Your Social Security Number

Name-Last, First, Middle Initial (Joint or combined return, give both names and initials.)

L

A

Mailing Address (Number and Street or P.O. Box)

Apartment Number

B

E

L

State

ZIP Code

City, Town or Post Office

POLITICAL PARTY FUND

1

Single

FILING

Designating $2 will not change your refund or tax due.

STATUS

2

Married, filing joint return.

A. Spouse

B. Yourself

3

Democratic

(1)

(4)

Married, filing separate returns. Enter spouse's Social Security

(see

number above and full name here.

Republican

(2)

(5)

instructions)

No Designation

(3)

(6)

4

Full-year nonresident. I did not live in Kentucky during the year. Enter state of residence as of December 31, 2006

.

5

Part-year resident. Complete appropriate line(s) below.

RESIDENCY

/

/ 06

Moved into Kentucky

.

State moved from

.

STATUS

/

/ 06

Moved out of Kentucky

.

State moved to

.

(check

6

Full-year resident of a reciprocal state. Attach a copy of the 2006 return

one box)

IL

IN

MI

OH

VA

WV

WI

filed with your state of residence and circle the state of residence.

COMPLETE SECTIONS A, B, C AND D BEFORE COMPLETING LINES 7 THROUGH 28.

OFFICIAL USE ONLY

1 2 3 4 5

INCOME/TAX

.

%

Enter percentage from page 3, line 35 .................................................................................................................

7

7

•

00

8

Enter amount from page 3, line 34, Column A. This is your federal Adjusted Gross Income ............................................................ 8

•

00

9

Enter amount from page 3, line 34, Column B. This is your Kentucky Adjusted Gross Income ....................................................... 9

00

10

Nonitemizers: Enter $1,970. Skip lines 11 and 12 (do not prorate) ................................................................................................................

10

•

00

11

Itemizers: Enter itemized deductions from Kentucky Schedule A, Form 740-NP .................................... 11

00

12

Multiply line 11 by the percentage on line 7 ......................................................................................................... 12

00

13

Subtract line 10 or 12 from line 9. This is your Taxable Income ..................................................................................................................... 13

00

14

Enter tax from

.................................................................................................................................................................................................. 14

Tax Table

00

15

Enter amount from page 2, Section A, line 15 ........................................................................................................................................................ 15

00

16

Subtract line 15 from line 14 ......................................................................................................................................................................................... 16

00

17

Enter amount from page 2, Section B, line 4 ....................................................................................................... 17

00

18

Multiply line 17 by the percentage on line 7 ....................................................................................................... 18

00

19

Subtract line 18 from line 16 ......................................................................................................................................................................................... 19

•

1

2

3

4

20

Check the box that represents your total family size (see instructions for lines 20 and 21) .................................................................. 20

•

00

21

__ . __ __

__ __ __

Multiply line 19 by the Family Size Tax Credit decimal amount

(

%) and enter here ...................................... 21

00

22

Subtract line 21 from line 19 .......................................................................................................................................................................................... 22

•

00

23

Enter the Education Tuition Tax Credit from Form 8863-K ............................................................................................................................ 23

00

24

Subtract line 23 from line 22 ......................................................................................................................................................................................... 24

•

00

25

Enter Child and Dependent Care Credit from worksheet in the instructions .......................................................................................... 25

00

26

Income Tax Liability. Subtract line 25 from line 24. If line 25 is larger than line 24, enter zero ............................................................. 26

•

00

Enter KENTUCKY USE TAX from worksheet in the instructions ...................................................................................................................... 27

27

00

28

Add lines 26 and 27. Enter here and on page 2, line 29 ....................................................................................................................................... 28

A copy of pages 1 and 2 of your federal income tax return and all supporting schedules must be attached to Kentucky Form 740-NP.

I, the undersigned, declare under penalties of perjury that I have examined this return, including all accompanying schedules and statements, and to the best of my knowledge and belief, it is

true, correct and complete. I also understand and agree that our election to file a combined return under the provisions of Regulation 103 KAR 17:020 will result in refunds being made payable

to us jointly and in each of us being jointly and severally liable for all taxes accruing under this return.

(

)

Your Signature (If joint or combined return, both must sign.)

Spouse's Signature

Date Signed

Telephone Number (daytime)

Typed or Printed Name of Preparer Other than Taxpayer

I.D. Number of Preparer

Date

1

1 2

2 3

3