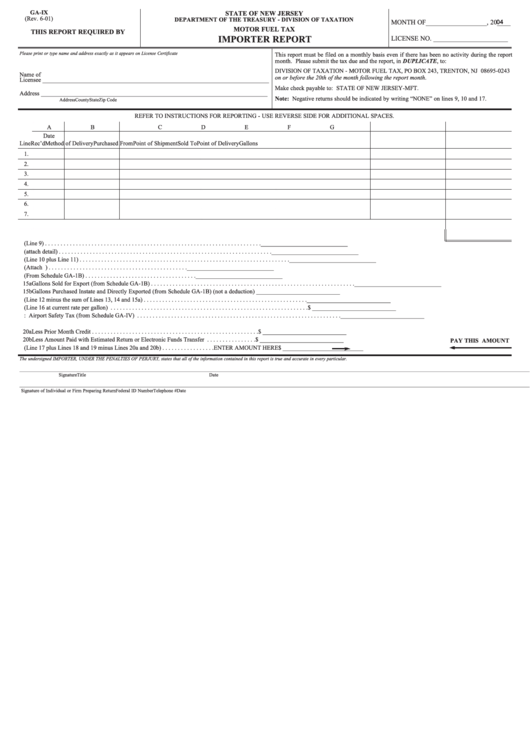

GA-IX

STATE OF NEW JERSEY

(Rev. 6-01)

DEPARTMENT OF THE TREASURY - DIVISION OF TAXATION

MONTH OF__________________, 20____

04

MOTOR FUEL TAX

THIS REPORT REQUIRED BY

LICENSE NO. ______________________

IMPORTER REPORT

N.J. MOTOR FUEL TAX LAW

Please print or type name and address exactly as it appears on License Certificate

This report must be filed on a monthly basis even if there has been no activity during the report

month. Please submit the tax due and the report, in DUPLICATE, to:

F.I.D. NO. ____________________________________________

DIVISION OF TAXATION - MOTOR FUEL TAX, PO BOX 243, TRENTON, NJ 08695-0243

Name of

on or before the 20th of the month following the report month.

Licensee _________________________________________________________________________

Make check payable to: STATE OF NEW JERSEY-MFT.

Address _________________________________________________________________________

Note: Negative returns should be indicated by writing “NONE” on lines 9, 10 and 17.

Address

County

State

Zip Code

REFER TO INSTRUCTIONS FOR REPORTING - USE REVERSE SIDE FOR ADDITIONAL SPACES.

A

B

C

D

E

F

G

Date

Line

Rec’d

Method of Delivery

Purchased From

Point of Shipment

Sold To

Point of Delivery

Gallons

1.

2.

3.

4.

5.

6.

7.

8.

Sub-total transferred from line 36 on reverse side . . . . . . . . . . . . . . . . . . . .

9. Total Gallons Imported - Gasoline . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10. Total Gallons Imported - Gasoline (Line 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .____________________________

11. Previously Unreported Gallons (attach detail) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .____________________________

12. Total Gallons Imported (Line 10 plus Line 11) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .____________________________

13. Gallons Sold to Government Agencies (Attach U.S. 1094 and C-6060-MF) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .____________________________

14. Gallons Sold to Licensed Distributors and Gasoline Jobbers (From Schedule GA-1B) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .____________________________

15a Gallons Sold for Export (from Schedule GA-1B) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .____________________________

15b Gallons Purchased Instate and Directly Exported (from Schedule GA-1B) (not a deduction) ___________________________

16. Gallons Taxable (Line 12 minus the sum of Lines 13, 14 and 15a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .___________________________

17. Gross Tax Due (Line 16 at current rate per gallon) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$ ___________________________

18. Add: Airport Safety Tax (from Schedule GA-IV) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .___________________________

19. Add Penalty and Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .___________________________

20a Less Prior Month Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$ ___________________________

20b Less Amount Paid with Estimated Return or Electronic Funds Transfer . . . . . . . . . . . . . . . .$ ___________________________

PAY THIS AMOUNT

21. Net Tax Due (Line 17 plus Lines 18 and 19 minus Lines 20a and 20b) . . . . . . . . . . . . . . . . .ENTER AMOUNT HERE

$ __________________________

The undersigned IMPORTER, UNDER THE PENALTIES OF PERJURY, states that all of the information contained in this report is true and accurate in every particular.

_________________________________________________________________________________________________________________________________________________________________________________________________________________

Signature

Title

Date

_________________________________________________________________________________________________________________________________________________________________________________________________________________

Signature of Individual or Firm Preparing Return

Federal ID Number

Telephone #

Date

1

1 2

2