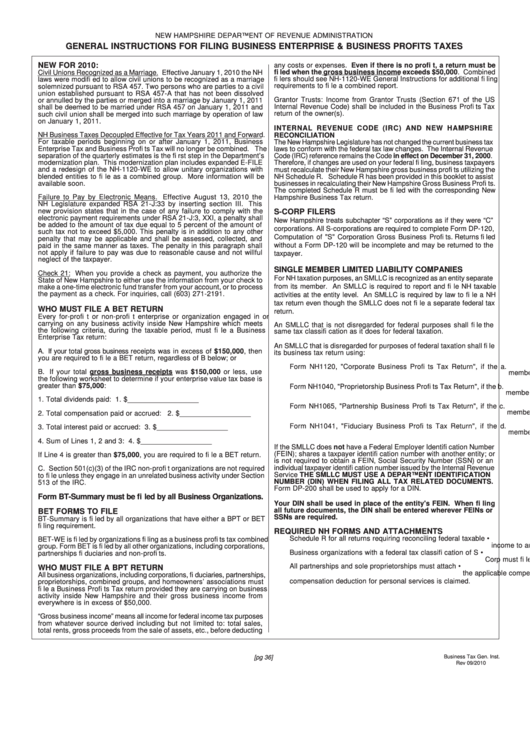

General Instructions For Filing Business Enterprise & Business Profits Taxes Form

ADVERTISEMENT

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

GENERAL INSTRUCTIONS FOR FILING BUSINESS ENTERPRISE & BUSINESS PROFITS TAXES

NEW FOR 2010:

any costs or expenses. Even if there is no profi t, a return must be

fi led when the gross business income exceeds $50,000. Combined

Civil Unions Recognized as a Marriage. Effective January 1, 2010 the NH

fi lers should see NH-1120-WE General Instructions for additional fi ling

laws were modifi ed to allow civil unions to be recognized as a marriage

requirements to fi le a combined report.

solemnized pursuant to RSA 457. Two persons who are parties to a civil

union established pursuant to RSA 457-A that has not been dissolved

Grantor Trusts: Income from Grantor Trusts (Section 671 of the US

or annulled by the parties or merged into a marriage by January 1, 2011

Internal Revenue Code) shall be included in the Business Profi ts Tax

shall be deemed to be married under RSA 457 on January 1, 2011 and

return of the owner(s).

such civil union shall be merged into such marriage by operation of law

on January 1, 2011.

INTERNAL REVENUE CODE (IRC) AND NEW HAMPSHIRE

NH Business Taxes Decoupled Effective for Tax Years 2011 and Forward.

RECONCILIATION

For taxable periods beginning on or after January 1, 2011, Business

The New Hampshire Legislature has not changed the current business tax

Enterprise Tax and Business Profi ts Tax will no longer be combined. The

laws to conform with the federal tax law changes. The Internal Revenue

separation of the quarterly estimates is the fi rst step in the Department’s

Code (IRC) reference remains the Code in effect on December 31, 2000.

modernization plan. This modernization plan includes expanded E-FILE

Therefore, if changes are used on your federal fi ling, business taxpayers

and a redesign of the NH-1120-WE to allow unitary organizations with

must recalculate their New Hampshire gross business profi ts utilizing the

blended entities to fi le as a combined group. More information will be

NH Schedule R. Schedule R has been provided in this booklet to assist

available soon.

businesses in recalculating their New Hampshire Gross Business Profi ts.

The completed Schedule R must be fi led with the corresponding New

Failure to Pay by Electronic Means. Effective August 13, 2010 the

Hampshire Business Tax return.

NH Legislature expanded RSA 21-J:33 by inserting section III. This

new provision states that in the case of any failure to comply with the

S-CORP FILERS

electronic payment requirements under RSA 21-J:3, XXI, a penalty shall

New Hampshire treats subchapter “S” corporations as if they were “C”

be added to the amount of tax due equal to 5 percent of the amount of

corporations. All S-corporations are required to complete Form DP-120,

such tax not to exceed $5,000. This penalty is in addition to any other

Computation of "S" Corporation Gross Business Profi ts. Returns fi led

penalty that may be applicable and shall be assessed, collected, and

paid in the same manner as taxes. The penalty in this paragraph shall

without a Form DP-120 will be incomplete and may be returned to the

not apply if failure to pay was due to reasonable cause and not willful

taxpayer.

neglect of the taxpayer.

SINGLE MEMBER LIMITED LIABILITY COMPANIES

Check 21: When you provide a check as payment, you authorize the

For NH taxation purposes, an SMLLC is recognized as an entity separate

State of New Hampshire to either use the information from your check to

from its member. An SMLLC is required to report and fi le NH taxable

make a one-time electronic fund transfer from your account, or to process

the payment as a check. For inquiries, call (603) 271-2191.

activities at the entity level. An SMLLC is required by law to fi le a NH

tax return even though the SMLLC does not fi le a separate federal tax

WHO MUST FILE A BET RETURN

return.

Every for-profi t or non-profi t enterprise or organization engaged in or

carrying on any business activity inside New Hampshire which meets

An SMLLC that is not disregarded for federal purposes shall fi le the

the following criteria, during the taxable period, must fi le a Business

same tax classifi cation as it does for federal taxation.

Enterprise Tax return:

An SMLLC that is disregarded for purposes of federal taxation shall fi le

A. If your total gross business receipts was in excess of $150,000, then

its business tax return using:

you are required to fi le a BET return, regardless of B below; or

a.

Form NH1120, "Corporate Business Profi ts Tax Return", if the

B. If your total gross business receipts was $150,000 or less, use

member is a corporation;

the following worksheet to determine if your enterprise value tax base is

greater than $75,000:

b.

Form NH1040, "Proprietorship Business Profi ts Tax Return", if the

member is an individual;

1. Total dividends paid:

1. $__________________

c.

Form NH1065, "Partnership Business Profi ts Tax Return", if the

member is a partnership; and

2. Total compensation paid or accrued:

2. $__________________

d.

Form NH1041, "Fiduciary Business Profi ts Tax Return", if the

3. Total interest paid or accrued:

3. $__________________

member is a trust.

4. Sum of Lines 1, 2 and 3:

4. $__________________

If the SMLLC does not have a Federal Employer Identifi cation Number

(FEIN); shares a taxpayer identifi cation number with another entity; or

If Line 4 is greater than $75,000, you are required to fi le a BET return.

is not required to obtain a FEIN, Social Security Number (SSN) or an

individual taxpayer identifi cation number issued by the Internal Revenue

C. Section 501(c)(3) of the IRC non-profi t organizations are not required

Service THE SMLLC MUST USE A DEPARTMENT IDENTIFICATION

to fi le unless they engage in an unrelated business activity under Section

NUMBER (DIN) WHEN FILING ALL TAX RELATED DOCUMENTS.

513 of the IRC.

Form DP-200 shall be used to apply for a DIN.

Form BT-Summary must be fi led by all Business Organizations.

Your DIN shall be used in place of the entity's FEIN. When fi ling

all future documents, the DIN shall be entered wherever FEINs or

BET FORMS TO FILE

SSNs are required.

BT-Summary is fi led by all organizations that have either a BPT or BET

fi ling requirement.

REQUIRED NH FORMS AND ATTACHMENTS

•

Schedule R for all returns requiring reconciling federal taxable

BET-WE is fi led by organizations fi ling as a business profi ts tax combined

income to arrive at NH gross business profi ts.

group. Form BET is fi led by all other organizations, including corporations,

•

Business organizations with a federal tax classifi cation of S

partnerships fi duciaries and non-profi ts.

Corp must fi le a NH Form DP-120.

•

All partnerships and sole proprietorships must attach

WHO MUST FILE A BPT RETURN

the applicable compensation deduction work sheet if a

All business organizations, including corporations, fi duciaries, partnerships,

compensation deduction for personal services is claimed.

proprietorships, combined groups, and homeowners’ associations must

fi le a Business Profi ts Tax return provided they are carrying on business

activity inside New Hampshire and their gross business income from

everywhere is in excess of $50,000.

“Gross business income” means all income for federal income tax purposes

from whatever source derived including but not limited to: total sales,

total rents, gross proceeds from the sale of assets, etc., before deducting

Business Tax Gen. Inst.

[pg 36]

Rev 09/2010

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2