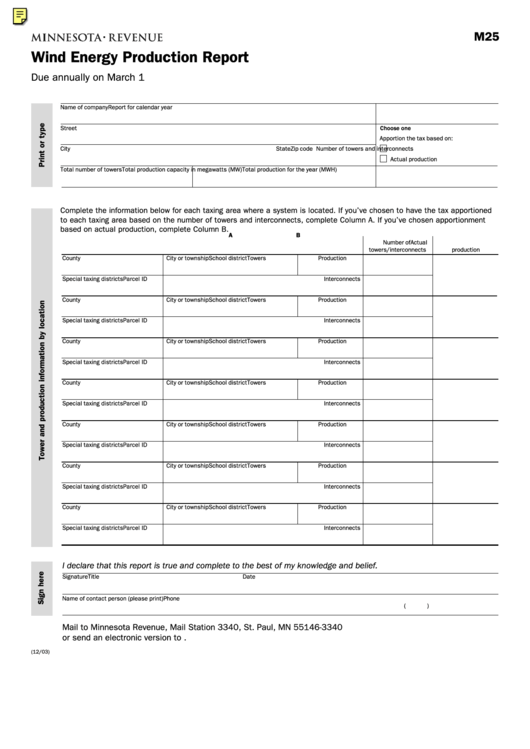

Form M25 - Wind Energy Production Repor

ADVERTISEMENT

M25

Wind Energy Production Report

Due annually on March 1

Name of company

Report for calendar year

Street

Choose one

Apportion the tax based on:

City

State

Zip code

Number of towers and interconnects

Actual production

Total number of towers

Total production capacity in megawatts (MW)

Total production for the year (MWH)

Complete the information below for each taxing area where a system is located. If you’ve chosen to have the tax apportioned

to each taxing area based on the number of towers and interconnects, complete Column A. If you’ve chosen apportionment

based on actual production, complete Column B.

A

B

Number of

Actual

towers/interconnects

production

County

City or township

School district

Towers

Production

Special taxing districts

Parcel ID

Interconnects

County

City or township

School district

Towers

Production

Special taxing districts

Parcel ID

Interconnects

County

City or township

School district

Towers

Production

Special taxing districts

Parcel ID

Interconnects

County

City or township

School district

Towers

Production

Special taxing districts

Parcel ID

Interconnects

County

City or township

School district

Towers

Production

Special taxing districts

Parcel ID

Interconnects

County

City or township

School district

Towers

Production

Special taxing districts

Parcel ID

Interconnects

County

City or township

School district

Towers

Production

Special taxing districts

Parcel ID

Interconnects

I declare that this report is true and complete to the best of my knowledge and belief.

Signature

Title

Date

Name of contact person (please print)

Phone

(

)

Mail to Minnesota Revenue, Mail Station 3340, St. Paul, MN 55146-3340

or send an electronic version to sa.property@state.mn.us.

(12/03)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2