Instructions For Form Os-3710 Is On Page 18 Of The 2003 Instructions For Forms W-2cm And Os-3710

ADVERTISEMENT

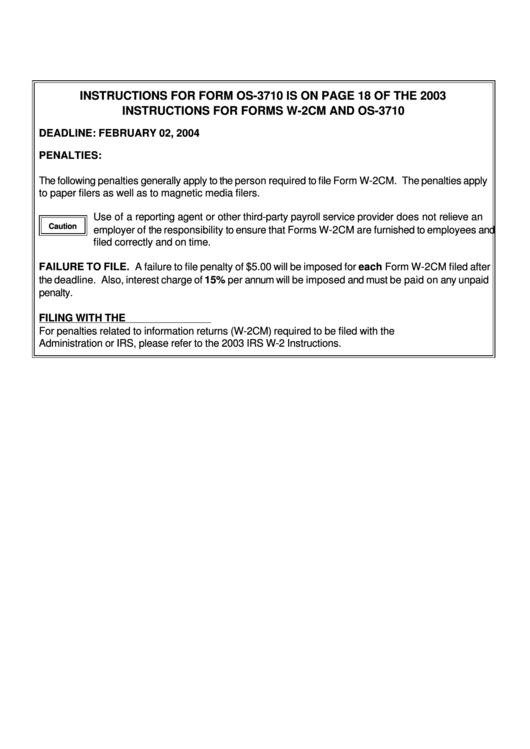

INSTRUCTIONS FOR FORM OS-3710 IS ON PAGE 18 OF THE 2003

INSTRUCTIONS FOR FORMS W-2CM AND OS-3710

DEADLINE: FEBRUARY 02, 2004

PENALTIES:

The following penalties generally apply to the person required to file Form W-2CM. The penalties apply

to paper filers as well as to magnetic media filers.

Use of a reporting agent or other third-party payroll service provider does not relieve an

Caution

employer of the responsibility to ensure that Forms W-2CM are furnished to employees and

filed correctly and on time.

FAILURE TO FILE. A failure to file penalty of $5.00 will be imposed for each Form W-2CM filed after

the deadline. Also, interest charge of 15% per annum will be imposed and must be paid on any unpaid

penalty.

FILING WITH THE U.S. SSA OR IRS

For penalties related to information returns (W-2CM) required to be filed with the U.S. Social Security

Administration or IRS, please refer to the 2003 IRS W-2 Instructions.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1