Instructions For Form 5713 Schedule C - Tax Effect Of The International Boycott Provisions

ADVERTISEMENT

2

Schedule C (Form 5713) (Rev. 1-97)

Page

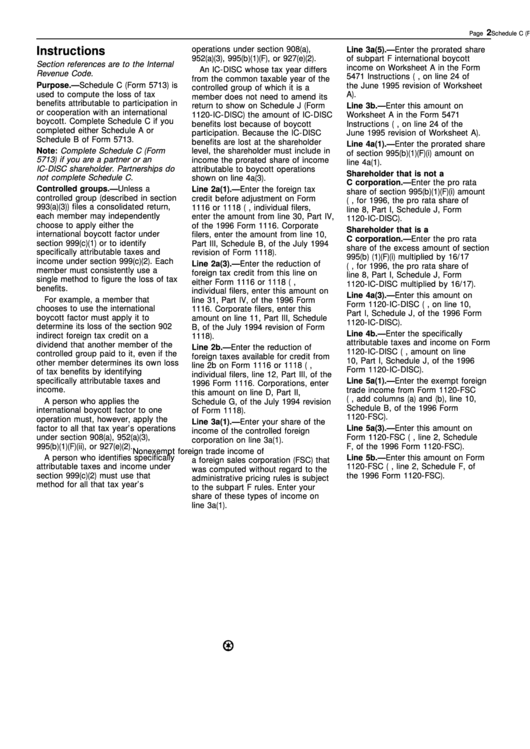

Instructions

operations under section 908(a),

Line 3a(5).—Enter the prorated share

952(a)(3), 995(b)(1)(F), or 927(e)(2).

of subpart F international boycott

Section references are to the Internal

income on Worksheet A in the Form

An IC-DISC whose tax year differs

Revenue Code.

5471 Instructions (e.g., on line 24 of

from the common taxable year of the

Purpose.—Schedule C (Form 5713) is

the June 1995 revision of Worksheet

controlled group of which it is a

used to compute the loss of tax

A).

member does not need to amend its

benefits attributable to participation in

return to show on Schedule J (Form

Line 3b.—Enter this amount on

or cooperation with an international

1120-IC-DISC) the amount of IC-DISC

Worksheet A in the Form 5471

boycott. Complete Schedule C if you

benefits lost because of boycott

Instructions (e.g., on line 24 of the

completed either Schedule A or

participation. Because the IC-DISC

June 1995 revision of Worksheet A).

Schedule B of Form 5713.

benefits are lost at the shareholder

Line 4a(1).—Enter the prorated share

Note: Complete Schedule C (Form

level, the shareholder must include in

of section 995(b)(1)(F)(i) amount on

5713) if you are a partner or an

income the prorated share of income

line 4a(1).

IC-DISC shareholder. Partnerships do

attributable to boycott operations

Shareholder that is not a

not complete Schedule C.

shown on line 4a(3).

C corporation.—Enter the pro rata

Controlled groups.—Unless a

Line 2a(1).—Enter the foreign tax

share of section 995(b)(1)(F)(i) amount

controlled group (described in section

credit before adjustment on Form

(e.g., for 1996, the pro rata share of

993(a)(3)) files a consolidated return,

1116 or 1118 (e.g., individual filers,

line 8, Part I, Schedule J, Form

each member may independently

enter the amount from line 30, Part IV,

1120-IC-DISC).

choose to apply either the

of the 1996 Form 1116. Corporate

Shareholder that is a

international boycott factor under

filers, enter the amount from line 10,

C corporation.—Enter the pro rata

section 999(c)(1) or to identify

Part III, Schedule B, of the July 1994

share of the excess amount of section

specifically attributable taxes and

revision of Form 1118).

995(b) (1)(F)(i) multiplied by 16/17

income under section 999(c)(2). Each

Line 2a(3).—Enter the reduction of

(e.g., for 1996, the pro rata share of

member must consistently use a

foreign tax credit from this line on

line 8, Part I, Schedule J, Form

single method to figure the loss of tax

either Form 1116 or 1118 (e.g.,

1120-IC-DISC multiplied by 16/17).

benefits.

individual filers, enter this amount on

Line 4a(3).—Enter this amount on

For example, a member that

line 31, Part IV, of the 1996 Form

Form 1120-IC-DISC (e.g., on line 10,

chooses to use the international

1116. Corporate filers, enter this

Part I, Schedule J, of the 1996 Form

boycott factor must apply it to

amount on line 11, Part III, Schedule

1120-IC-DISC).

determine its loss of the section 902

B, of the July 1994 revision of Form

Line 4b.—Enter the specifically

indirect foreign tax credit on a

1118).

attributable taxes and income on Form

dividend that another member of the

Line 2b.—Enter the reduction of

1120-IC-DISC (e.g., amount on line

controlled group paid to it, even if the

foreign taxes available for credit from

10, Part I, Schedule J, of the 1996

other member determines its own loss

line 2b on Form 1116 or 1118 (e.g.,

Form 1120-IC-DISC).

of tax benefits by identifying

individual filers, line 12, Part III, of the

specifically attributable taxes and

Line 5a(1).—Enter the exempt foreign

1996 Form 1116. Corporations, enter

income.

trade income from Form 1120-FSC

this amount on line D, Part II,

(e.g., add columns (a) and (b), line 10,

A person who applies the

Schedule G, of the July 1994 revision

Schedule B, of the 1996 Form

international boycott factor to one

of Form 1118).

1120-FSC).

operation must, however, apply the

Line 3a(1).—Enter your share of the

factor to all that tax year’s operations

Line 5a(3).—Enter this amount on

income of the controlled foreign

under section 908(a), 952(a)(3),

Form 1120-FSC (e.g., line 2, Schedule

corporation on line 3a(1).

995(b)(1)(F)(ii), or 927(e)(2).

F, of the 1996 Form 1120-FSC).

Nonexempt foreign trade income of

A person who identifies specifically

Line 5b.—Enter this amount on Form

a foreign sales corporation (FSC) that

attributable taxes and income under

1120-FSC (e.g., line 2, Schedule F, of

was computed without regard to the

section 999(c)(2) must use that

the 1996 Form 1120-FSC).

administrative pricing rules is subject

method for all that tax year’s

to the subpart F rules. Enter your

share of these types of income on

line 3a(1).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1