Tax Form Instructions - Earned Income Tax - City Of Louisville

ADVERTISEMENT

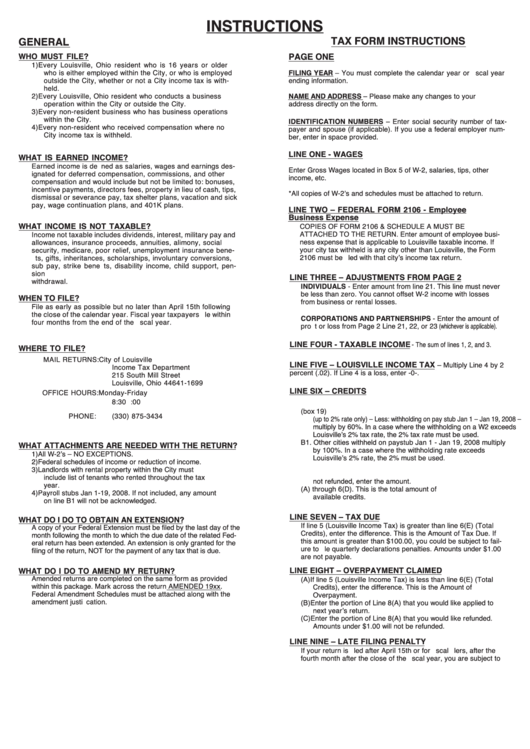

INSTRUCTIONS

TAX FORM INSTRUCTIONS

GENERAL

WHO MUST FILE?

PAGE ONE

1) Every Louisville, Ohio resident who is 16 years or older

who is either employed within the City, or who is employed

FILING YEAR – You must complete the calendar year or fiscal year

outside the City, whether or not a City income tax is with-

ending information.

held.

2) Every Louisville, Ohio resident who conducts a business

NAME AND ADDRESS – Please make any changes to your

operation within the City or outside the City.

address directly on the form.

3) Every non-resident business who has business operations

within the City.

IDENTIFICATION NUMBERS – Enter social security number of tax-

4) Every non-resident who received compensation where no

payer and spouse (if applicable). If you use a federal employer num-

City income tax is withheld.

ber, enter in space provided.

LINE ONE - WAGES

WHAT IS EARNED INCOME?

Earned income is defined as salaries, wages and earnings des-

Enter Gross Wages located in Box 5 of W-2, salaries, tips, other

ignated for deferred compensation, commissions, and other

income, etc.

compensation and would include but not be limited to: bonuses,

incentive payments, directors fees, property in lieu of cash, tips,

*All copies of W-2’s and schedules must be attached to return.

dismissal or severance pay, tax shelter plans, vacation and sick

pay, wage continuation plans, and 401K plans.

LINE TWO – FEDERAL FORM 2106 - Employee

Business Expense

WHAT INCOME IS NOT TAXABLE?

COPIES OF FORM 2106 & SCHEDULE A MUST BE

ATTACHED TO THE RETURN. Enter amount of employee busi-

Income not taxable includes dividends, interest, military pay and

ness expense that is applicable to Louisville taxable income. If

allowances, insurance proceeds, annuities, alimony, social

your city tax withheld is any city other than Louisville, the Form

security, medicare, poor relief, unemployment insurance bene-

2106 must be filed with that city’s income tax return.

fits, gifts, inheritances, scholarships, involuntary conversions,

sub pay, strike benefits, disability income, child support, pen-

sion

LINE THREE – ADJUSTMENTS FROM PAGE 2

withdrawal.

INDIVIDUALS - Enter amount from line 21. This line must never

be less than zero. You cannot offset W-2 income with losses

WHEN TO FILE?

from business or rental losses.

File as early as possible but no later than April 15th following

the close of the calendar year. Fiscal year taxpayers file within

CORPORATIONS AND PARTNERSHIPS - Enter the amount of

four months from the end of the fiscal year.

profit or loss from Page 2 Line 21, 22, or 23 (whichever is applicable).

LINE FOUR - TAXABLE INCOME -

The sum of lines 1, 2, and 3.

WHERE TO FILE?

MAIL RETURNS:

City of Louisville

LINE FIVE – LOUISVILLE INCOME TAX

– Multiply Line 4 by 2

Income Tax Department

percent (.02). If Line 4 is a loss, enter -0-.

215 South Mill Street

Louisville, Ohio 44641-1699

LINE SIX – CREDITS

OFFICE HOURS:

Monday-Friday

8:30 a.m. - 5:00 p.m.

A. Enter the amount of City of Louisville income tax withheld.

B. Enter withholding tax withheld by other municipalities on W2 (box 19)

PHONE:

(330) 875-3434

(up to 2% rate only) – Less: withholding on pay stub Jan 1 – Jan 19, 2008 –

multiply by 60%. In a case where the withholding on a W2 exceeds

Louisville’s 2% tax rate, the 2% tax rate must be used.

B1. Other cities withheld on paystub Jan 1 - Jan 19, 2008 multiply

WHAT ATTACHMENTS ARE NEEDED WITH THE RETURN?

by 100%. In a case where the withholding rate exceeds

1) All W-2’s – NO EXCEPTIONS.

Louisville’s 2% rate, the 2% must be used.

2) Federal schedules of income or reduction of income.

C. Enter the amount of Estimate Declaration paid for the tax year.

3) Landlords with rental property within the City must

D. If you had an overpayment on a prior year tax return that was

include list of tenants who rented throughout the tax

not refunded, enter the amount.

year.

E. Total lines 6(A) through 6(D). This is the total amount of

4) Payroll stubs Jan 1-19, 2008. If not included, any amount

available credits.

on line B1 will not be acknowledged.

LINE SEVEN – TAX DUE

WHAT DO I DO TO OBTAIN AN EXTENSION?

If line 5 (Louisville Income Tax) is greater than line 6(E) (Total

A copy of your Federal Extension must be filed by the last day of the

Credits), enter the difference. This is the Amount of Tax Due. If

month following the month to which the due date of the related Fed-

this amount is greater than $100.00, you could be subject to fail-

eral return has been extended. An extension is only granted for the

ure to file quarterly declarations penalties. Amounts under $1.00

filing of the return, NOT for the payment of any tax that is due.

are not payable.

LINE EIGHT – OVERPAYMENT CLAIMED

WHAT DO I DO TO AMEND MY RETURN?

Amended returns are completed on the same form as provided

(A) If line 5 (Louisville Income Tax) is less than line 6(E) (Total

within this package. Mark across the return AMENDED 19xx.

Credits), enter the difference. This is the Amount of

Federal Amendment Schedules must be attached along with the

Overpayment.

amendment justification.

(B) Enter the portion of Line 8(A) that you would like applied to

next year’s return.

(C) Enter the portion of Line 8(A) that you would like refunded.

Amounts under $1.00 will not be refunded.

LINE NINE – LATE FILING PENALTY

If your return is filed after April 15th or for fiscal filers, after the

fourth month after the close of the fiscal year, you are subject to

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2