Instructions For 1040 Ez Form - Internal Revenue Service - 2005 Page 10

ADVERTISEMENT

•

•

You do not claim any adjustments to income. Use TeleTax

DHL Express (DHL): DHL Same Day Service, DHL Next

topics 451-453 and 455-458 (see page 6).

Day 10:30 am, DHL Next Day 12:00 pm, DHL Next Day 3:00 pm,

•

and DHL 2nd Day Service.

The only tax credit you can claim is the earned income credit.

•

Use TeleTax topics 601-608 and 610 (see page 6).

Federal Express (FedEx): FedEx Priority Overnight, FedEx

•

Standard Overnight, FedEx 2Day, FedEx International Priority, and

You (and your spouse if filing a joint return) were under age

FedEx International First.

65 and not blind at the end of 2005. If you were born on January 1,

•

1941, you are considered to be age 65 at the end of 2005 and cannot

United Parcel Service (UPS): UPS Next Day Air, UPS Next

use Form 1040EZ.

Day Air Saver, UPS 2nd Day Air, UPS 2nd Day Air A.M., UPS

•

Worldwide Express Plus, and UPS Worldwide Express.

Your taxable income (line 6 of Form 1040EZ) is less than

$100,000.

•

The private delivery service can tell you how to get written proof

You had only wages, salaries, tips, taxable scholarship or fel-

of the mailing date.

lowship grants, unemployment compensation, or Alaska Permanent

Fund dividends, and your taxable interest was not over $1,500.

•

You did not receive any advance earned income credit pay-

Who Can Use Form 1040EZ?

ments.

•

You can use Form 1040EZ if all of the following apply.

You do not owe any household employment taxes on wages

•

you paid to a household employee. To find out who owes these

Your filing status is single or married filing jointly (see page

taxes, use TeleTax topic 756 (see page 6).

11). If you were a nonresident alien at any time in 2005, see Nonres-

ident aliens on page 11.

•

You do not claim any dependents.

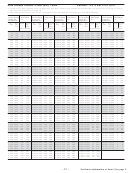

Where To Report Certain Items From 2005 Forms W-2, 1098, and 1099

IRS e-file takes the guesswork out of preparing your return. You may also be eligible to use free online commercial tax preparation software to file

your federal income tax return. Visit for details.

If any federal income tax withheld is shown on these forms, include the tax withheld on Form 1040EZ, line 7.

Form

Item and Box in Which It Should Appear

Where To Report on Form 1040EZ

W-2

Wages, tips, other compensation (box 1)

Line 1

Allocated tips (box 8)

See Tip income on page 12

}

Advance EIC payment (box 9)

Dependent care benefits (box 10)

Must file Form 1040A or 1040

Adoption benefits (box 12, code T)

Employer contributions to an Archer MSA

Must file Form 1040

(box 12, code R)

Employer contributions to a health savings account

Must file Form 1040 if required to file Form 8889 (see the instructions for

(box 12, code W)

Form 8889)

Income from nonqualified deferred compensation plan

Must file Form 1040

(box 12, code Z)

W-2G

Gambling winnings (box 1)

Must file Form 1040

1098-E

Student loan interest (box 1)

Must file Form 1040A or 1040 to deduct

1098-T

Qualified tuition and related expenses (box 1)

Must file Form 1040A or 1040 to deduct or take a credit for the tuition and

related expenses

1099-C

Canceled debt (box 2)

Must file Form 1040 if taxable (see the instructions on Form 1099-C)

1099-DIV

Dividends and distributions

Must file Form 1040A or 1040

1099-G

Unemployment compensation (box 1)

Line 3. But if you repaid any unemployment compensation in 2005, see the

instructions for line 3 on page 13

1099-INT

Interest income (box 1)

Line 2

Interest on U.S. savings bonds and Treasury obligations

See the instructions for line 2 on page 13

(box 3)

Early withdrawal penalty (box 2)

Must file Form 1040 to deduct

Foreign tax paid (box 6)

Must file Form 1040 to deduct or take a credit for the tax

1099-LTC

Long-term care and accelerated death benefits

Must file Form 1040 if required to file Form 8853 (see the instructions for

Form 8853)

1099-MISC

Miscellaneous income

Must file Form 1040

}

1099-OID

Original issue discount (box 1)

See the instructions on Form 1099-OID

Other periodic interest (box 2)

Early withdrawal penalty (box 3)

Must file Form 1040 to deduct

1099-Q

Qualified education program payments

Must file Form 1040

1099-R

Distributions from pensions, annuities, IRAs, etc.

Must file Form 1040A or 1040

1099-SA

Distributions from HSAs and MSAs*

Must file Form 1040

*This includes distributions from Archer and Medicare Advantage MSAs.

- 10 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37