Instructions For Form Ct-3-S-A/c - Report By An S Corporation Included In A Combined Franchise Tax Return - New York State Department Of Taxation And Finance - 2005

ADVERTISEMENT

CT-3-S-A/C (2005) (back)

Instructions

Short periods – Fixed dollar minimum tax and maintenance fee

New for 2005 —

Third-party designee - You can authorize

another person to discuss a tax return with the Tax Department by

Annualize the gross payroll and total receipts for tax periods of less

completing the Third-party designee section of the form. For more

than 12 months by dividing the amount of each by the number of

information, see Third-party designee below.

months in the short period and multiplying the result by 12.

—

The fixed dollar minimum tax and maintenance fee may be reduced

Filing requirements

Form CT-3-S-A/C is an individual

for short periods as follows:

certification that must be filed by each member of the New York State

combined group except a foreign corporation that is not taxable in

Period

Reduction

New York State. This form must be filed annually and attached to

Not more than 6 months ........................................................... 50%

the payer corporation’s Form CT-3-S-A, New York S Corporation

More than 6 months

Combined Franchise Tax Return.

but not more than 9 months ...................................................... 25%

You must complete Form CT-34-SH, New York S Corporation

More than 9 months .................................................................None

Shareholders’ Information Schedule, and attach it to this form.

—

Composition of prepayments

Complete this schedule

—

only if the corporation filing this Form CT-3-S-A/C made separate

Reporting period

Complete the beginning and ending tax

payments or has separate credits.

period boxes in the upper right corner on the front.

Lines 3 through 7 — If you need more space, write see attached

—

NAICS business code number

Enter the six-digit NAICS

in this section, and attach a separate sheet showing all relevant

business activity code number from your federal return.

prepayment information. Transfer the total shown on the attached

sheet to line 7.

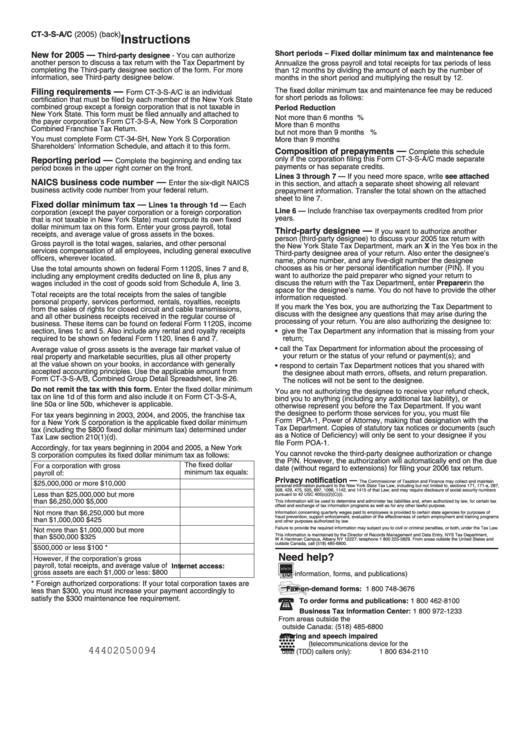

Fixed dollar minimum tax —

Lines 1a through 1d — Each

Line 6 — Include franchise tax overpayments credited from prior

corporation (except the payer corporation or a foreign corporation

years.

that is not taxable in New York State) must compute its own fixed

dollar minimum tax on this form. Enter your gross payroll, total

—

Third-party designee

If you want to authorize another

receipts, and average value of gross assets in the boxes.

person (third-party designee) to discuss your 2005 tax return with

Gross payroll is the total wages, salaries, and other personal

the New York State Tax Department, mark an X in the Yes box in the

services compensation of all employees, including general executive

Third-party designee area of your return. Also enter the designee’s

officers, wherever located.

name, phone number, and any five-digit number the designee

chooses as his or her personal identification number (PIN). If you

Use the total amounts shown on federal Form 1120S, lines 7 and 8,

want to authorize the paid preparer who signed your return to

including any employment credits deducted on line 8, plus any

discuss the return with the Tax Department, enter Preparer in the

wages included in the cost of goods sold from Schedule A, line 3.

space for the designee’s name. You do not have to provide the other

Total receipts are the total receipts from the sales of tangible

information requested.

personal property, services performed, rentals, royalties, receipts

If you mark the Yes box, you are authorizing the Tax Department to

from the sales of rights for closed circuit and cable transmissions,

discuss with the designee any questions that may arise during the

and all other business receipts received in the regular course of

processing of your return. You are also authorizing the designee to:

business. These items can be found on federal Form 1120S, income

section, lines 1c and 5. Also include any rental and royalty receipts

• give the Tax Department any information that is missing from your

required to be shown on federal Form 1120, lines 6 and 7.

return;

• call the Tax Department for information about the processing of

Average value of gross assets is the average fair market value of

your return or the status of your refund or payment(s); and

real property and marketable securities, plus all other property

at the value shown on your books, in accordance with generally

• respond to certain Tax Department notices that you shared with

accepted accounting principles. Use the applicable amount from

the designee about math errors, offsets, and return preparation.

Form CT-3-S-A/B, Combined Group Detail Spreadsheet, line 26.

The notices will not be sent to the designee.

Do not remit the tax with this form. Enter the fixed dollar minimum

You are not authorizing the designee to receive your refund check,

tax on line 1d of this form and also include it on Form CT-3-S-A,

bind you to anything (including any additional tax liability), or

line 50a or line 50b, whichever is applicable.

otherwise represent you before the Tax Department. If you want

the designee to perform those services for you, you must file

For tax years beginning in 2003, 2004, and 2005, the franchise tax

Form POA-1, Power of Attorney, making that designation with the

for a New York S corporation is the applicable fixed dollar minimum

Tax Department. Copies of statutory tax notices or documents (such

tax (including the $800 fixed dollar minimum tax) determined under

as a Notice of Deficiency) will only be sent to your designee if you

Tax Law section 210(1)(d).

file Form POA-1.

Accordingly, for tax years beginning in 2004 and 2005, a New York

You cannot revoke the third-party designee authorization or change

S corporation computes its fixed dollar minimum tax as follows:

the PIN. However, the authorization will automatically end on the due

The fixed dollar

For a corporation with gross

date (without regard to extensions) for filing your 2006 tax return.

minimum tax equals:

payroll of:

Privacy notification —

The Commissioner of Taxation and Finance may collect and maintain

$25,000,000 or more

$10,000

personal information pursuant to the New York State Tax Law, including but not limited to, sections 171, 171-a, 287,

308, 429, 475, 505, 697, 1096, 1142, and 1415 of that Law; and may require disclosure of social security numbers

Less than $25,000,000 but more

pursuant to 42 USC 405(c)(2)(C)(i).

than $6,250,000

$5,000

This information will be used to determine and administer tax liabilities and, when authorized by law, for certain tax

offset and exchange of tax information programs as well as for any other lawful purpose.

Not more than $6,250,000 but more

Information concerning quarterly wages paid to employees is provided to certain state agencies for purposes of

fraud prevention, support enforcement, evaluation of the effectiveness of certain employment and training programs

than $1,000,000

$425

and other purposes authorized by law.

Failure to provide the required information may subject you to civil or criminal penalties, or both, under the Tax Law.

Not more than $1,000,000 but more

This information is maintained by the Director of Records Management and Data Entry, NYS Tax Department,

than $500,000

$325

W A Harriman Campus, Albany NY 12227; telephone 1 800 225-5829. From areas outside the United States and

outside Canada, call (518) 485-6800.

$500,000 or less

$100*

Need help?

However, if the corporation’s gross

payroll, total receipts, and average value of

Internet access:

gross assets are each $1,000 or less:

$800

(for information, forms, and publications)

* Foreign authorized corporations: If your total corporation taxes are

Fax-on-demand forms:

1 800 748-3676

less than $300, you must increase your payment accordingly to

satisfy the $300 maintenance fee requirement.

To order forms and publications:

1 800 462-8100

Business Tax Information Center:

1 800 972-1233

From areas outside the U.S. and

outside Canada:

(518) 485-6800

Hearing and speech impaired

(telecommunications device for the

44402050094

deaf (TDD) callers only):

1 800 634-2110

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1