Form 520 - Oklahoma Agricultural Producer Credit - 2004

ADVERTISEMENT

520

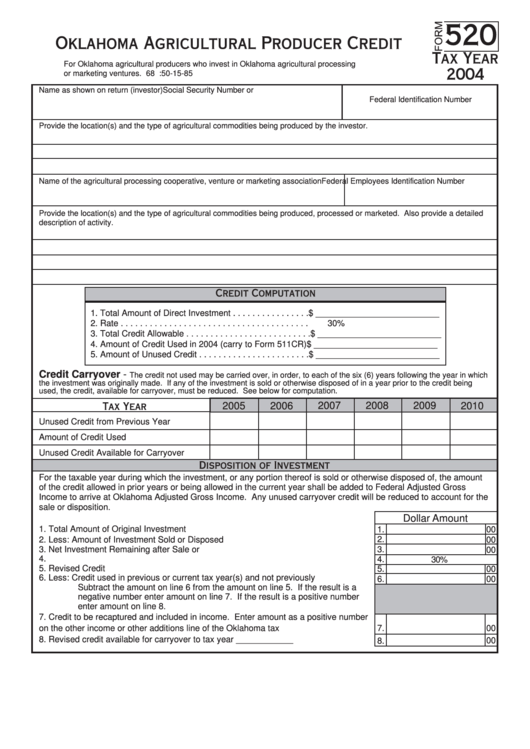

Oklahoma Agricultural Producer Credit

Tax Year

For Oklahoma agricultural producers who invest in Oklahoma agricultural processing

2004

or marketing ventures. 68 O.S. Section 2357.25 and Rule 710:50-15-85

Social Security Number or

Name as shown on return (investor)

Federal Identification Number

Provide the location(s) and the type of agricultural commodities being produced by the investor.

Name of the agricultural processing cooperative, venture or marketing association

Federal Employees Identification Number

Provide the location(s) and the type of agricultural commodities being produced, processed or marketed. Also provide a detailed

description of activity.

Credit Computation

1. Total Amount of Direct Investment . . . . . . . . . . . . . . . . $ __________________________

2. Rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

30%

3. Total Credit Allowable . . . . . . . . . . . . . . . . . . . . . . . . . .$ __________________________

4. Amount of Credit Used in 2004 (carry to Form 511CR) $ __________________________

5. Amount of Unused Credit . . . . . . . . . . . . . . . . . . . . . . . $ __________________________

Credit Carryover -

The credit not used may be carried over, in order, to each of the six (6) years following the year in which

the investment was originally made. If any of the investment is sold or otherwise disposed of in a year prior to the credit being

used, the credit, available for carryover, must be reduced. See below for computation.

2007

2008

2009

2005

2006

2010

Tax Year

Unused Credit from Previous Year

Amount of Credit Used

Unused Credit Available for Carryover

Disposition of Investment

For the taxable year during which the investment, or any portion thereof is sold or otherwise disposed of, the amount

of the credit allowed in prior years or being allowed in the current year shall be added to Federal Adjusted Gross

Income to arrive at Oklahoma Adjusted Gross Income. Any unused carryover credit will be reduced to account for the

sale or disposition.

Dollar Amount

1. Total Amount of Original Investment 2004 ..................................................................

1.

00

2.

2. Less: Amount of Investment Sold or Disposed of .......................................................

00

3. Net Investment Remaining after Sale or Disposition ...................................................

3.

00

4. Rate .............................................................................................................................

4.

30%

5. Revised Credit Allowable ............................................................................................

5.

00

6. Less: Credit used in previous or current tax year(s) and not previously recaptured ...

6.

00

Subtract the amount on line 6 from the amount on line 5. If the result is a

negative number enter amount on line 7. If the result is a positive number

enter amount on line 8.

7. Credit to be recaptured and included in income. Enter amount as a positive number

on the other income or other additions line of the Oklahoma tax return .....................

7.

00

8. Revised credit available for carryover to tax year ____________ ..............................

00

8.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1