Print and Reset Form

Reset Form

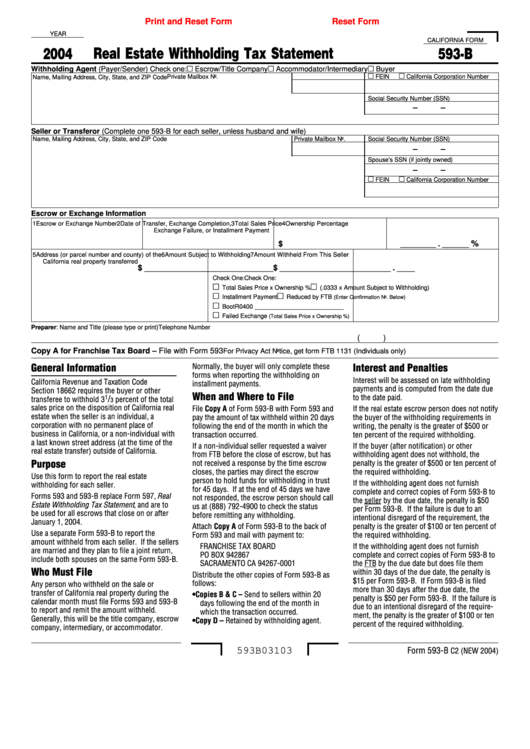

YEAR

CALIFORNIA FORM

2004

Real Estate Withholding Tax Statement

593-B

Withholding Agent (Payer/Sender) Check one:

Escrow/Title Company

Accommodator/Intermediary

Buyer

FEIN

California Corporation Number

Private Mailbox No.

Name, Mailing Address, City, State, and ZIP Code

Social Security Number (SSN)

Seller or Transferor (Complete one 593-B for each seller, unless husband and wife)

Name, Mailing Address, City, State, and ZIP Code

Private Mailbox No.

Social Security Number (SSN)

Spouse’s SSN (if jointly owned)

FEIN

California Corporation Number

Escrow or Exchange Information

1 Escrow or Exchange Number

2 Date of Transfer, Exchange Completion,

3 Total Sales Price

4 Ownership Percentage

Exchange Failure, or Installment Payment

%

$

________ . ______

5 Address (or parcel number and county) of the

6 Amount Subject to Withholding

7 Amount Withheld From This Seller

California real property transferred

$ _____________________________

$ _________________________ . ____

Check One:

Check One:

Total Sales Price x Ownership %

(.0333 x Amount Subject to Withholding)

Installment Payment

Reduced by FTB

(Enter Confirmation No. Below)

Boot

R0400 __________________________

Failed Exchange

(Total Sales Price x Ownership %)

Preparer: Name and Title (please type or print)

Telephone Number

(

)

Copy A for Franchise Tax Board – File with Form 593

For Privacy Act Notice, get form FTB 1131 (Individuals only)

Normally, the buyer will only complete these

General Information

Interest and Penalties

forms when reporting the withholding on

Interest will be assessed on late withholding

California Revenue and Taxation Code

installment payments.

payments and is computed from the date due

Section 18662 requires the buyer or other

When and Where to File

to the date paid.

1

/

transferee to withhold 3

percent of the total

3

sales price on the disposition of California real

File Copy A of Form 593-B with Form 593 and

If the real estate escrow person does not notify

estate when the seller is an individual, a

pay the amount of tax withheld within 20 days

the buyer of the withholding requirements in

corporation with no permanent place of

following the end of the month in which the

writing, the penalty is the greater of $500 or

business in California, or a non-individual with

transaction occurred.

ten percent of the required withholding.

a last known street address (at the time of the

If a non-individual seller requested a waiver

If the buyer (after notification) or other

real estate transfer) outside of California.

from FTB before the close of escrow, but has

withholding agent does not withhold, the

Purpose

not received a response by the time escrow

penalty is the greater of $500 or ten percent of

closes, the parties may direct the escrow

the required withholding.

Use this form to report the real estate

person to hold funds for withholding in trust

If the withholding agent does not furnish

withholding for each seller.

for 45 days. If at the end of 45 days we have

complete and correct copies of Form 593-B to

Forms 593 and 593-B replace Form 597, Real

not responded, the escrow person should call

the seller by the due date, the penalty is $50

Estate Withholding Tax Statement , and are to

us at (888) 792-4900 to check the status

per Form 593-B. If the failure is due to an

be used for all escrows that close on or after

before remitting any withholding.

intentional disregard of the requirement, the

January 1, 2004.

Attach Copy A of Form 593-B to the back of

penalty is the greater of $100 or ten percent of

Use a separate Form 593-B to report the

Form 593 and mail with payment to:

the required withholding.

amount withheld from each seller. If the sellers

FRANCHISE TAX BOARD

If the withholding agent does not furnish

are married and they plan to file a joint return,

PO BOX 942867

complete and correct copies of Form 593-B to

include both spouses on the same Form 593-B.

SACRAMENTO CA 94267-0001

the FTB by the due date but does file them

Who Must File

within 30 days of the due date, the penalty is

Distribute the other copies of Form 593-B as

$15 per Form 593-B. If Form 593-B is filed

follows:

Any person who withheld on the sale or

more than 30 days after the due date, the

transfer of California real property during the

• Copies B & C – Send to sellers within 20

penalty is $50 per Form 593-B. If the failure is

calendar month must file Forms 593 and 593-B

days following the end of the month in

due to an intentional disregard of the require-

to report and remit the amount withheld.

which the transaction occurred.

ment, the penalty is the greater of $100 or ten

Generally, this will be the title company, escrow

• Copy D – Retained by withholding agent.

percent of the required withholding.

company, intermediary, or accommodator.

593B03103

Form 593-B

C2 (NEW 2004)

1

1 2

2 3

3 4

4