24

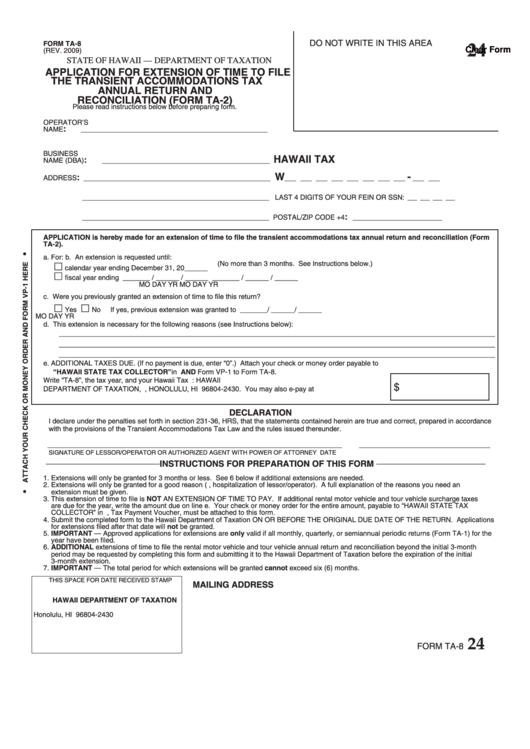

FORM TA-8

DO NOT WRITE IN THIS AREA

Clear Form

(REV. 2009)

STATE OF HAWAII — DEPARTMENT OF TAXATION

APPLICATION FOR EXTENSION OF TIME TO FILE

THE TRANSIENT ACCOMMODATIONS TAX

ANNUAL RETURN AND

RECONCILIATION (FORM TA-2)

Please read instructions below before preparing form.

OPERATOR’S

:

NAME

________________________________________________

BUSINESS

HAWAII TAX I.D. NO.

:

NAME (DBA)

___________________________________________

W

-

:

ADDRESS

________________________________________________

___ ___ ___ ___ ___ ___ ___ ___

___ ___

LAST 4 DIGITS OF YOUR FEIN OR SSN: ___ ___ ___ ___

________________________________________________

:

________________________________________________ POSTAL/ZIP CODE +4

_______________________

APPLICATION is hereby made for an extension of time to file the transient accommodations tax annual return and reconciliation (Form

TA-2).

a. For:

b. An extension is requested until:

(No more than 3 months. See Instructions below.)

calendar year ending December 31, 20______

fiscal year ending

_______ / ______ / ______

_______ / ______ / ______

MO

DAY

YR

MO

DAY

YR

c. Were you previously granted an extension of time to file this return?

Yes

No

If yes, previous extension was granted to

_______ / ______ / ______

MO

DAY

YR

d. This extension is necessary for the following reasons (see Instructions below):

________________________________________________________________________________________________________________

________________________________________________________________________________________________________________

________________________________________________________________________________________________________________

e. ADDITIONAL TAXES DUE. (If no payment is due, enter “0”.) Attach your check or money order payable to

“HAWAII STATE TAX COLLECTOR” in U.S. dollars drawn on any U.S. Bank AND Form VP-1 to Form TA-8.

Write “TA-8”, the tax year, and your Hawaii Tax I.D. No. on your check or money order. Mail to: HAWAII

$

DEPARTMENT OF TAXATION, P.O. BOX 2430, HONOLULU, HI 96804-2430. You may also e-pay at

.......................................................................................................................................

DECLARATION

I declare under the penalties set forth in section 231-36, HRS, that the statements contained herein are true and correct, prepared in accordance

with the provisions of the Transient Accommodations Tax Law and the rules issued thereunder.

SIGNATURE OF LESSOR/OPERATOR OR AUTHORIZED AGENT WITH POWER OF ATTORNEY

DATE

________________________ INSTRUCTIONS FOR PREPARATION OF THIS FORM _______________________

1. Extensions will only be granted for 3 months or less. See 6 below if additional extensions are needed.

2. Extensions will only be granted for a good reason (e.g., hospitalization of lessor/operator). A full explanation of the reasons you need an

extension must be given.

3. This extension of time to file is NOT AN EXTENSION OF TIME TO PAY. If additional rental motor vehicle and tour vehicle surcharge taxes

are due for the year, write the amount due on line e. Your check or money order for the entire amount, payable to “HAWAII STATE TAX

COLLECTOR” in U.S. dollars drawn on any U.S. bank and Form VP-1, Tax Payment Voucher, must be attached to this form.

4. Submit the completed form to the Hawaii Department of Taxation ON OR BEFORE THE ORIGINAL DUE DATE OF THE RETURN. Applications

for extensions filed after that date will not be granted.

5. IMPORTANT — Approved applications for extensions are only valid if all monthly, quarterly, or semiannual periodic returns (Form TA-1) for the

year have been filed.

6. ADDITIONAL extensions of time to file the rental motor vehicle and tour vehicle annual return and reconciliation beyond the initial 3-month

period may be requested by completing this form and submitting it to the Hawaii Department of Taxation before the expiration of the initial

3-month extension.

7. IMPORTANT — The total period for which extensions will be granted cannot exceed six (6) months.

THIS SPACE FOR DATE RECEIVED STAMP

MAILING ADDRESS

HAWAII DEPARTMENT OF TAXATION

P.O. Box 2430

Honolulu, HI 96804-2430

24

FORM TA-8

1

1