Clear form

Print Form

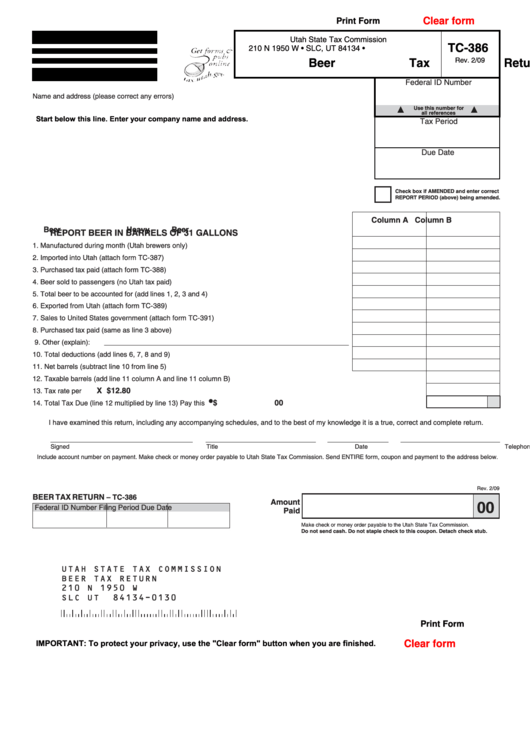

Utah State Tax Commission

TC-386

210 N 1950 W • SLC, UT 84134 •

Rev. 2/09

Beer Tax Return

Federal ID Number

Name and address (please correct any errors)

Use this number for

all references

Start below this line. Enter your company name and address.

Tax Period

Due Date

Check box if AMENDED and enter correct

REPORT PERIOD (above) being amended.

Column A

Column B

Beer

Heavy Beer

REPORT BEER IN BARRELS OF 31 GALLONS

1. Manufactured during month (Utah brewers only).............................................................................

2. Imported into Utah (attach form TC-387) .........................................................................................

3. Purchased tax paid (attach form TC-388)........................................................................................

4. Beer sold to passengers (no Utah tax paid).....................................................................................

5. Total beer to be accounted for (add lines 1, 2, 3 and 4) ..................................................................

6. Exported from Utah (attach form TC-389) .......................................................................................

7. Sales to United States government (attach form TC-391) ...............................................................

8. Purchased tax paid (same as line 3 above).....................................................................................

9. Other (explain): _ _ _ _ _ _ _ _ __ _ _ _ __ _ _ _ __ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _

10. Total deductions (add lines 6, 7, 8 and 9)........................................................................................

11. Net barrels (subtract line 10 from line 5)..........................................................................................

12. Taxable barrels (add line 11 column A and line 11 column B).............................................................................................

X $12.80

13. Tax rate per barrel ...............................................................................................................................................................

•

$

00

14. Total Tax Due (line 12 multiplied by line 13) Pay this amount .............................................................................................

I have examined this return, including any accompanying schedules, and to the best of my knowledge it is a true, correct and complete return.

Signed

Title

Date

Telephone

Include account number on payment. Make check or money order payable to Utah State Tax Commission. Send ENTIRE form, coupon and payment to the address below.

Rev. 2/09

BEER TAX RETURN

– TC-386

Amount

00

Federal ID Number

Filing Period

Due Date

Paid

Make check or money order payable to the Utah State Tax Commission.

Do not send cash. Do not staple check to this coupon. Detach check stub.

UTAH STATE TAX COMMISSION

BEER TAX RETURN

210 N 1950 W

SLC UT

84134-0130

Print Form

IMPORTANT: To protect your privacy, use the "Clear form" button when you are finished.

Clear form

1

1 2

2