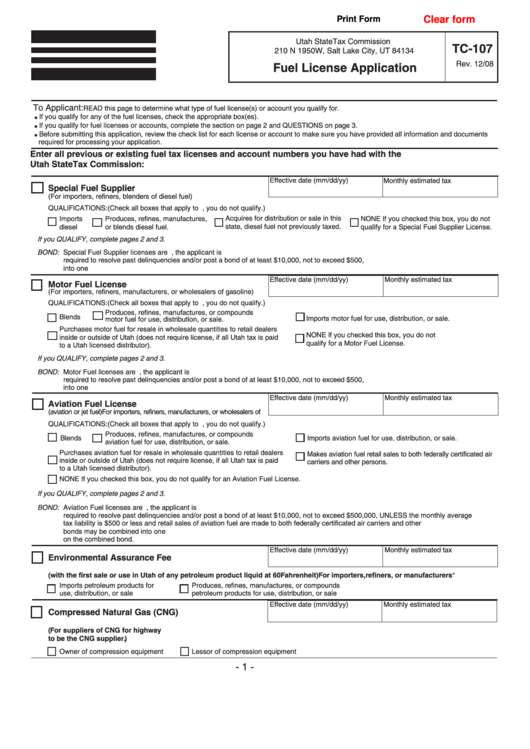

Clear form

Print Form

Utah State Tax Commission

TC-107

210 N 1950 W, Salt Lake City, UT 84134

Rev. 12/08

Fuel License Application

To Applicant:

READ this page to determine what type of fuel license(s) or account you qualify for.

If you qualify for any of the fuel licenses, check the appropriate box(es).

●

If you qualify for fuel licenses or accounts, complete the section on page 2 and QUESTIONS on page 3.

●

Before submitting this application, review the check list for each license or account to make sure you have provided all information and documents

●

required for processing your application.

Enter all previous or existing fuel tax licenses and account numbers you have had with the

Utah State Tax Commission:

Effective date (mm/dd/yy)

Monthly estimated tax

Special Fuel Supplier

(For importers, refiners, blenders of diesel fuel)

QUALIFICATIONS: (Check all boxes that apply to you. If none, you do not qualify.)

Acquires for distribution or sale in this

Imports

Produces, refines, manufactures,

NONE If you checked this box, you do not

state, diesel fuel not previously taxed.

diesel

or blends diesel fuel.

qualify for a Special Fuel Supplier License.

If you QUALIFY, complete pages 2 and 3.

BOND:

Special Fuel Supplier licenses are conditional. If an applicant or a fiduciary of the applicant has a history of filing or paying late, the applicant is

required to resolve past delinquencies and/or post a bond of at least $10,000, not to exceed $500,000. Fuel tax bonds may be combined

into one bond. The amount of the combined bond is the sum of the bond amounts required for each fuel tax type on the combined bond.

Effective date (mm/dd/yy)

Monthly estimated tax

Motor Fuel License

(For importers, refiners, manufacturers, or wholesalers of gasoline)

QUALIFICATIONS: (Check all boxes that apply to you. If none, you do not qualify.)

Produces, refines, manufactures, or compounds

Blends

Imports motor fuel for use, distribution, or sale.

motor fuel for use, distribution, or sale.

Purchases motor fuel for resale in wholesale quantities to retail dealers

NONE If you checked this box, you do not

inside or outside of Utah (does not require license, if all Utah tax is paid

qualify for a Motor Fuel License.

to a Utah licensed distributor).

If you QUALIFY, complete pages 2 and 3.

BOND:

Motor Fuel licenses are conditional. If an applicant or a fiduciary of the applicant has a history of filing or paying late, the applicant is

required to resolve past delinquencies and/or post a bond of at least $10,000, not to exceed $500,000. Fuel tax bonds may be combined

into one bond. The amount of the combined bond is the sum of the bond amounts required for each fuel tax type on the combined bond.

Effective date (mm/dd/yy)

Monthly estimated tax

Aviation Fuel License

(

For importers, refiners, manufacturers, or wholesalers of

aviation or jet fuel)

QUALIFICATIONS: (Check all boxes that apply to you. If none, you do not qualify.)

Produces, refines, manufactures, or compounds

Blends

Imports aviation fuel for use, distribution, or sale.

aviation fuel for use, distribution, or sale.

Purchases aviation fuel for resale in wholesale quantities to retail dealers

Makes aviation fuel retail sales to both federally certificated air

inside or outside of Utah (does not require license, if all Utah tax is paid

carriers and other persons.

to a Utah licensed distributor).

NONE If you checked this box, you do not qualify for an Aviation Fuel License.

If you QUALIFY, complete pages 2 and 3.

BOND: Aviation Fuel licenses are conditional. If an applicant or a fiduciary of the applicant has a history of filing or paying late, the applicant is

required to resolve past delinquencies and/or post a bond of at least $10,000, not to exceed $500,000, UNLESS the monthly average

tax liability is $500 or less and retail sales of aviation fuel are made to both federally certificated air carriers and other persons. Fuel tax

bonds may be combined into one bond. The amount of the combined bond is the sum of the bond amounts required for each fuel tax type

on the combined bond.

Effective date (mm/dd/yy)

Monthly estimated tax

Environmental Assurance Fee

(

For importers, refiners, or manufacturers

with the first sale or use in Utah of any petroleum product liquid at 60 Fahrenheit)

°

Imports petroleum products for

Produces, refines, manufactures, or compounds

use, distribution, or sale

petroleum products for use, distribution, or sale

Effective date (mm/dd/yy)

Monthly estimated tax

Compressed Natural Gas (CNG)

(

For suppliers of CNG for highway use. The owner or lessor of equipment used to compress natural gas for highway use is considered

to be the CNG supplier.

)

Owner of compression equipment

Lessor of compression equipment

- 1 -

1

1 2

2 3

3