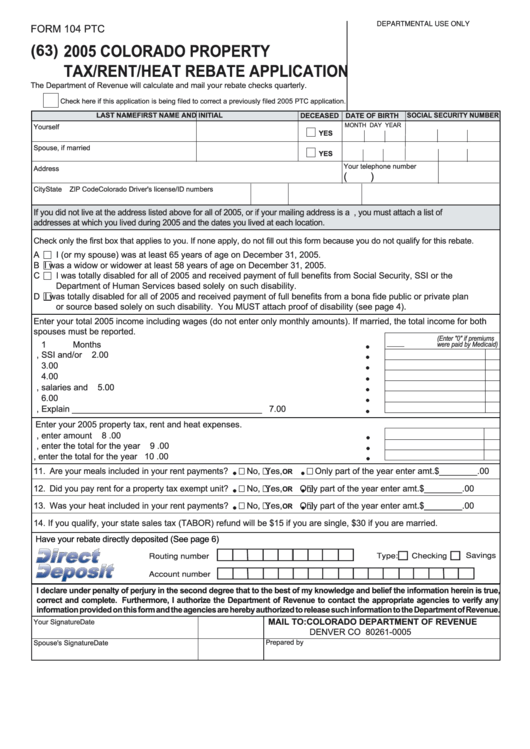

DEPARTMENTAL USE ONLY

FORM 104 PTC

(63)

2005 COLORADO PROPERTY

TAX/RENT/HEAT REBATE APPLICATION

The Department of Revenue will calculate and mail your rebate checks quarterly.

Check here if this application is being filed to correct a previously filed 2005 PTC application.

LAST NAME

FIRST NAME AND INITIAL

DATE OF BIRTH

SOCIAL SECURITY NUMBER

DECEASED

MONTH DAY YEAR

Yourself

YES

Spouse, if married

YES

Your telephone number

Address

(

)

City

State

ZIP Code

Colorado Driver's license/ID numbers

If you did not live at the address listed above for all of 2005, or if your mailing address is a P.O. Box, you must attach a list of

addresses at which you lived during 2005 and the dates you lived at each location.

Check only the first box that applies to you. If none apply, do not fill out this form because you do not qualify for this rebate.

A

I (or my spouse) was at least 65 years of age on December 31, 2005.

B

I was a widow or widower at least 58 years of age on December 31, 2005.

C

I was totally disabled for all of 2005 and received payment of full benefits from Social Security, SSI or the

Department of Human Services based solely on such disability.

D

I was totally disabled for all of 2005 and received payment of full benefits from a bona fide public or private plan

or source based solely on such disability. You MUST attach proof of disability (see page 4).

Enter your total 2005 income including wages (do not enter only monthly amounts). If married, the total income for both

spouses must be reported.

(Enter "0" if premiums

1. Enter number of months you received Medicare during 2005 .................................

1

Months

were paid by Medicaid)

2. Social Security, SSI and/or A.N.D. benefits received in 2005 .................................

2

.00

3. Colorado Old Age Pension payments received in 2005 ..........................................

3

.00

4. Private or VA pension payments received in 2005 ..................................................

4

.00

5. Wages, salaries and tips ..........................................................................................

5

.00

6. Interest and dividends ..............................................................................................

6

.00

7. Other income, Explain ________________________________________ ............

7

.00

Enter your 2005 property tax, rent and heat expenses.

8. If you paid 2004 property tax in 2005, enter amount here .......................................

8

.00

9. If you paid rent in 2005, enter the total for the year here .........................................

9

.00

10. If you paid heat or fuel expenses in 2005, enter the total for the year here ............

10

.00

11. Are your meals included in your rent payments?

No,

Yes,

Only part of the year enter amt.$ ________ .00

OR

12. Did you pay rent for a property tax exempt unit?

No,

Yes,

Only part of the year enter amt.$ ________ .00

OR

13. Was your heat included in your rent payments?

No,

Yes,

Only part of the year enter amt.$ ________ .00

OR

14. If you qualify, your state sales tax (TABOR) refund will be $15 if you are single, $30 if you are married.

Have your rebate directly deposited (See page 6)

Type:

Checking

Savings

Routing number

Account number

I declare under penalty of perjury in the second degree that to the best of my knowledge and belief the information herein is true,

correct and complete. Furthermore, I authorize the Department of Revenue to contact the appropriate agencies to verify any

information provided on this form and the agencies are hereby authorized to release such information to the Department of Revenue.

MAIL TO: COLORADO DEPARTMENT OF REVENUE

Your Signature

Date

DENVER CO 80261-0005

Prepared by

Spouse's Signature

Date

1

1