Form Dr-100000 - Tax Amnesty Agreement Effective July 1 To October 31, 2003

ADVERTISEMENT

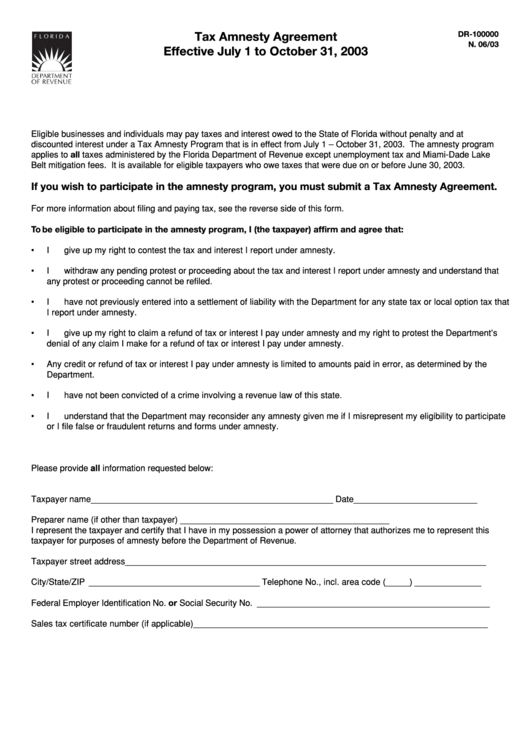

DR-100000

Tax Amnesty Agreement

N. 06/03

Effective July 1 to October 31, 2003

Eligible businesses and individuals may pay taxes and interest owed to the State of Florida without penalty and at

discounted interest under a Tax Amnesty Program that is in effect from July 1 – October 31, 2003. The amnesty program

applies to all taxes administered by the Florida Department of Revenue except unemployment tax and Miami-Dade Lake

Belt mitigation fees. It is available for eligible taxpayers who owe taxes that were due on or before June 30, 2003.

If you wish to participate in the amnesty program, you must submit a Tax Amnesty Agreement.

For more information about filing and paying tax, see the reverse side of this form.

To be eligible to participate in the amnesty program, I (the taxpayer) affirm and agree that:

•

I give up my right to contest the tax and interest I report under amnesty.

•

I withdraw any pending protest or proceeding about the tax and interest I report under amnesty and understand that

any protest or proceeding cannot be refiled.

•

I have not previously entered into a settlement of liability with the Department for any state tax or local option tax that

I report under amnesty.

•

I give up my right to claim a refund of tax or interest I pay under amnesty and my right to protest the Department’s

denial of any claim I make for a refund of tax or interest I pay under amnesty.

•

Any credit or refund of tax or interest I pay under amnesty is limited to amounts paid in error, as determined by the

Department.

•

I have not been convicted of a crime involving a revenue law of this state.

•

I understand that the Department may reconsider any amnesty given me if I misrepresent my eligibility to participate

or I file false or fraudulent returns and forms under amnesty.

Please provide all information requested below:

Taxpayer name ___________________________________________________ Date __________________________

Preparer name (if other than taxpayer) ____________________________________________

I represent the taxpayer and certify that I have in my possession a power of attorney that authorizes me to represent this

taxpayer for purposes of amnesty before the Department of Revenue.

Taxpayer street address ____________________________________________________________________________

City/State/ZIP ____________________________________ Telephone No., incl. area code ( _____ ) ______________

Federal Employer Identification No. or Social Security No. _________________________________________________

Sales tax certificate number (if applicable) ______________________________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1