Self-Insured Workers' Compensation Corporation Gross Premium Tax Return Instructions - 2010

ADVERTISEMENT

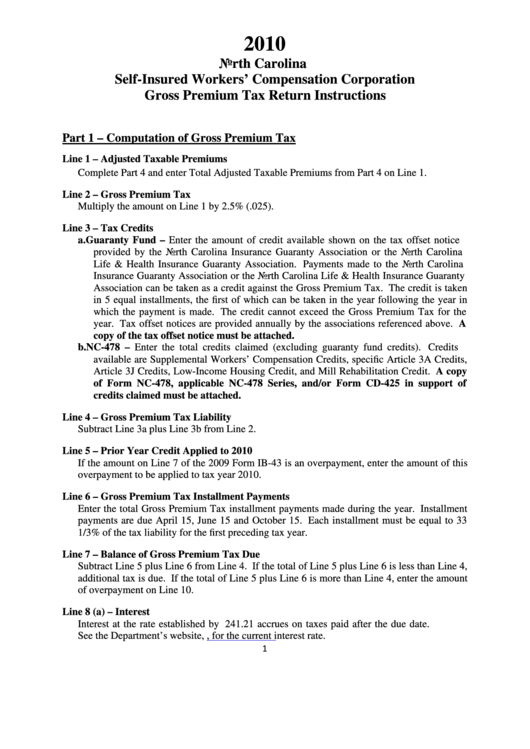

2010

North Carolina

Self-Insured Workers’ Compensation Corporation

Gross Premium Tax Return Instructions

Part 1 – Computation of Gross Premium Tax

Line 1 – Adjusted Taxable Premiums

Complete Part 4 and enter Total Adjusted Taxable Premiums from Part 4 on Line 1.

Line 2 – Gross Premium Tax

Multiply the amount on Line 1 by 2.5% (.025).

Line 3 – Tax Credits

a. Guaranty Fund – Enter the amount of credit available shown on the tax offset notice

provided by the North Carolina Insurance Guaranty Association or the North Carolina

Life & Health Insurance Guaranty Association. Payments made to the North Carolina

Insurance Guaranty Association or the North Carolina Life & Health Insurance Guaranty

Association can be taken as a credit against the Gross Premium Tax. The credit is taken

in 5 equal installments, the first of which can be taken in the year following the year in

which the payment is made. The credit cannot exceed the Gross Premium Tax for the

year. Tax offset notices are provided annually by the associations referenced above. A

copy of the tax offset notice must be attached.

b. NC-478 – Enter the total credits claimed (excluding guaranty fund credits). Credits

available are Supplemental Workers’ Compensation Credits, specific Article 3A Credits,

Article 3J Credits, Low-Income Housing Credit, and Mill Rehabilitation Credit. A copy

of Form NC-478, applicable NC-478 Series, and/or Form CD-425 in support of

credits claimed must be attached.

Line 4 – Gross Premium Tax Liability

Subtract Line 3a plus Line 3b from Line 2.

Line 5 – Prior Year Credit Applied to 2010

If the amount on Line 7 of the 2009 Form IB-43 is an overpayment, enter the amount of this

overpayment to be applied to tax year 2010.

Line 6 – Gross Premium Tax Installment Payments

Enter the total Gross Premium Tax installment payments made during the year. Installment

payments are due April 15, June 15 and October 15. Each installment must be equal to 33

1/3% of the tax liability for the first preceding tax year.

Line 7 – Balance of Gross Premium Tax Due

Subtract Line 5 plus Line 6 from Line 4. If the total of Line 5 plus Line 6 is less than Line 4,

additional tax is due. If the total of Line 5 plus Line 6 is more than Line 4, enter the amount

of overpayment on Line 10.

Line 8 (a) – Interest

Interest at the rate established by G.S. 105-241.21 accrues on taxes paid after the due date.

See the Department’s website, , for the current interest rate.

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4