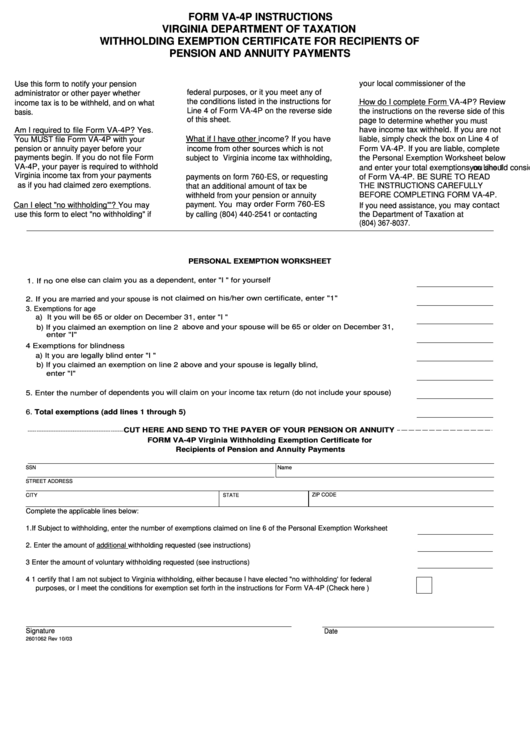

FORM VA-4P INSTRUCTIONS

VIRGINIA DEPARTMENT OF TAXATION

WITHHOLDING EXEMPTION CERTIFICATE FOR RECIPIENTS OF

PENSION AND ANNUITY PAYMENTS

you have made a similar election for

your local commissioner of the revenue.

Use this form to notify your pension

federal purposes, or it you meet any of

administrator or other payer whether

the conditions listed in the instructions for

How do I complete Form VA-4P? Review

income tax is to be withheld, and on what

Line 4 of Form VA-4P on the reverse side

the instructions on the reverse side of this

basis.

of this sheet.

page to determine whether you must

file Form VA-4P? Yes.

have income tax withheld. If you are not

Am I required to

What if I have other income? If you have

liable, simply check the box on Line 4 of

You MUST file Form VA-4P with your

pension or annuity payer before your

income from other sources which is not

Form VA-4P. If you are liable, complete

payments begin. If you do not file Form

Virginia income tax withholding,

the Personal Exemption Worksheet below

subject to

VA-4P, your payer is required to withhold

you should consider making estimated tax

and enter your total exemptions

on Line 1

Virginia income tax from your payments

payments on form 760-ES, or requesting

of Form VA-4P. BE SURE TO READ

as if you had claimed zero exemptions.

THE INSTRUCTIONS CAREFULLY

that an additional amount of tax be

BEFORE COMPLETING FORM VA-4P.

withheld from your pension or annuity

may order Form 760-ES

Can I elect "no withholding"'? You may

payment. You

may contact

If you need assistance, you

by calling (804) 440-2541 or contacting

the Department of Taxation at

use this form to elect "no withholding" if

(804) 367-8037.

PERSONAL EXEMPTION WORKSHEET

one else can claim you as a dependent, enter "I " for yourself

1. If no

is not claimed on his/her own certificate, enter "1"

2. If you

are married and your spouse

3. Exemptions for age

a) It you will be 65 or older on December 31, enter "I "

above and your spouse will be 65 or older on December 31,

b) If you claimed an exemption on line 2

enter "I"

4 Exemptions for blindness

a) It you are legally blind enter "I "

b) If you claimed an exemption on line 2 above and your spouse is legally blind,

enter "I"

of dependents you will claim on your income tax return (do not include your spouse)

5. Enter the number

6. Total exemptions (add lines 1 through 5)

CUT HERE AND SEND TO THE PAYER OF YOUR PENSION OR ANNUITY

FORM VA-4P Virginia Withholding Exemption Certificate for

Recipients of Pension and Annuity Payments

SSN

Name

STREET ADDRESS

ZIP CODE

CITY

STATE

Complete the applicable lines below:

1. If Subject to withholding, enter the number of exemptions claimed on line 6 of the Personal Exemption Worksheet

2. Enter the amount of additional withholding requested (see instructions)

3 Enter the amount of voluntary withholding requested (see instructions)

4 1 certify that I am not subject to Virginia withholding, either because I have elected "no withholding' for federal

purposes, or I meet the conditions for exemption set forth in the instructions for Form VA-4P (Check here )

Signature

Date

2601062 Rev 10/03

1

1