Form C2 - Michigan Supplemental Tobacco Tax Return

ADVERTISEMENT

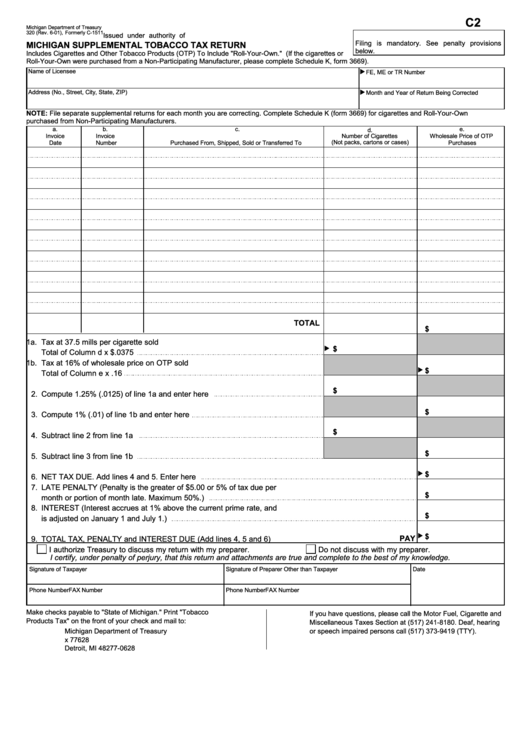

C2

Michigan Department of Treasury

320 (Rev. 6-01), Formerly C-1511

Issued under authority of P.A. 327 of 1993.

Filing is mandatory. See penalty provisions

MICHIGAN SUPPLEMENTAL TOBACCO TAX RETURN

below.

Includes Cigarettes and Other Tobacco Products (OTP) To Include "Roll-Your-Own." (If the cigarettes or

Roll-Your-Own were purchased from a Non-Participating Manufacturer, please complete Schedule K, form 3669).

.

Name of Licensee

FE, ME or TR Number

.

Address (No., Street, City, State, ZIP)

Month and Year of Return Being Corrected

NOTE: File separate supplemental returns for each month you are correcting. Complete Schedule K (form 3669) for cigarettes and Roll-Your-Own

purchased from Non-Participating Manufacturers.

a.

b.

c.

e.

d.

Invoice

Invoice

Number of Cigarettes

Wholesale Price of OTP

(Not packs, cartons or cases)

Date

Number

Purchased From, Shipped, Sold or Transferred To

Purchases

TOTAL

$

1a.

Tax at 37.5 mills per cigarette sold

.

$

Total of Column d x $.0375

1b.

Tax at 16% of wholesale price on OTP sold

.

$

Total of Column e x .16

$

2.

Compute 1.25% (.0125) of line 1a and enter here

$

3.

Compute 1% (.01) of line 1b and enter here

$

4.

Subtract line 2 from line 1a

$

5.

Subtract line 3 from line 1b

.

$

6.

NET TAX DUE. Add lines 4 and 5. Enter here

7.

LATE PENALTY (Penalty is the greater of $5.00 or 5% of tax due per

$

month or portion of month late. Maximum 50%.)

8.

INTEREST (Interest accrues at 1% above the current prime rate, and

$

is adjusted on January 1 and July 1.)

.

$

PAY

9.

TOTAL TAX, PENALTY and INTEREST DUE (Add lines 4, 5 and 6)

I authorize Treasury to discuss my return with my preparer.

Do not discuss with my preparer.

I certify, under penalty of perjury, that this return and attachments are true and complete to the best of my knowledge.

Signature of Taxpayer

Signature of Preparer Other than Taxpayer

Date

Phone Number

FAX Number

Phone Number

FAX Number

Make checks payable to "State of Michigan." Print "Tobacco

If you have questions, please call the Motor Fuel, Cigarette and

Products Tax" on the front of your check and mail to:

Miscellaneous Taxes Section at (517) 241-8180. Deaf, hearing

Michigan Department of Treasury

or speech impaired persons call (517) 373-9419 (TTY).

P.O. Box 77628

Detroit, MI 48277-0628

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1