Form 4a - Standard Deduction Adjustment - 2008

ADVERTISEMENT

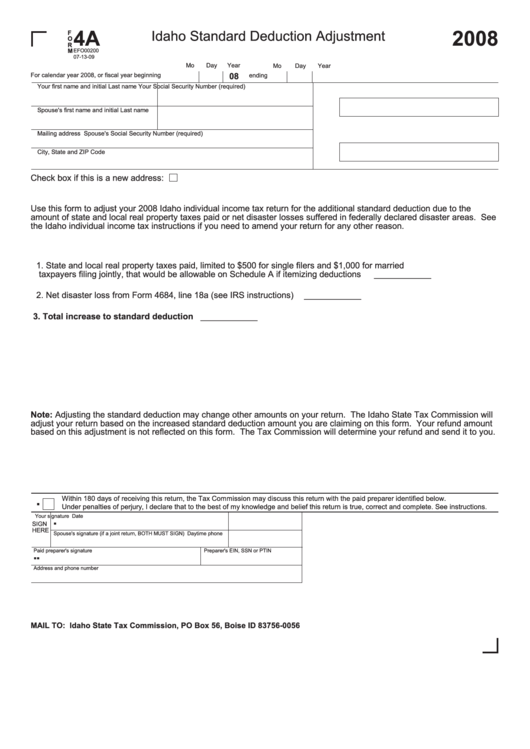

4A

2008

Idaho Standard Deduction Adjustment

F

O

R

M

EFO00200

07-13-09

Mo Day Year

Mo Day Year

08

For calendar year 2008, or fiscal year beginning

ending

Your first name and initial

Last name

Your Social Security Number (required)

Spouse's first name and initial

Last name

Mailing address

Spouse's Social Security Number (required)

City, State and ZIP Code

Check box if this is a new address:

Use this form to adjust your 2008 Idaho individual income tax return for the additional standard deduction due to the

amount of state and local real property taxes paid or net disaster losses suffered in federally declared disaster areas. See

the Idaho individual income tax instructions if you need to amend your return for any other reason.

1. State and local real property taxes paid, limited to $500 for single filers and $1,000 for married

taxpayers filing jointly, that would be allowable on Schedule A if itemizing deductions .....................

____________

2. Net disaster loss from Form 4684, line 18a (see IRS instructions) . ...................................................

____________

3. Total increase to standard deduction ............................................................................................

____________

Note: Adjusting the standard deduction may change other amounts on your return. The Idaho State Tax Commission will

adjust your return based on the increased standard deduction amount you are claiming on this form. Your refund amount

based on this adjustment is not reflected on this form. The Tax Commission will determine your refund and send it to you.

.

Within 180 days of receiving this return, the Tax Commission may discuss this return with the paid preparer identified below.

Under penalties of perjury, I declare that to the best of my knowledge and belief this return is true, correct and complete. See instructions.

Your signature

Date

▪

SIGN

HERE

Spouse's signature (if a joint return, BOTH MUST SIGN)

Daytime phone

Paid preparer's signature

Preparer's EIN, SSN or PTIN

▪

▪

Address and phone number

MAIL TO: Idaho State Tax Commission, PO Box 56, Boise ID 83756-0056

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1