Jobs And Investment Tax Credit Worksheet For Tax Year 2008

ADVERTISEMENT

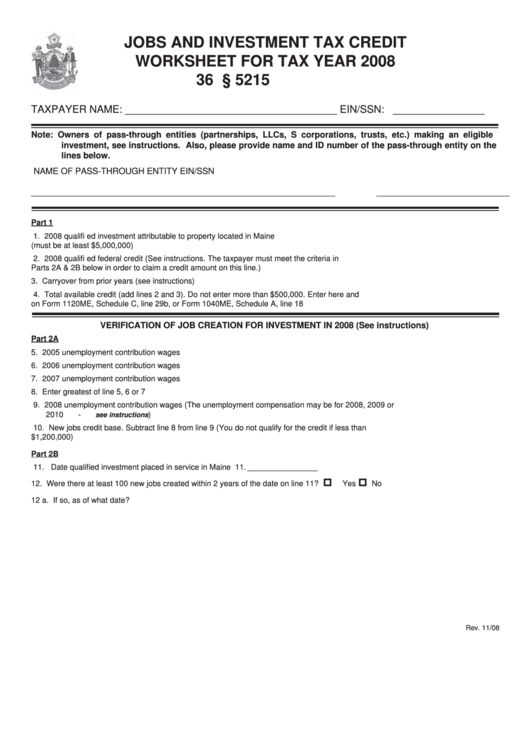

JOBS AND INVESTMENT TAX CREDIT

WORKSHEET FOR TAX YEAR 2008

36 M.R.S.A. § 5215

TAXPAYER NAME: _____________________________________ EIN/SSN: ________________

Note: Owners of pass-through entities (partnerships, LLCs, S corporations, trusts, etc.) making an eligible

investment, see instructions. Also, please provide name and ID number of the pass-through entity on the

lines below.

NAME OF PASS-THROUGH ENTITY

EIN/SSN

________________________________________________________________

____________________________

Part 1

1. 2008 qualifi ed investment attributable to property located in Maine

(must be at least $5,000,000) ........................................................................................................................... 1. ________________

2. 2008 qualifi ed federal credit (See instructions. The taxpayer must meet the criteria in

Parts 2A & 2B below in order to claim a credit amount on this line.) ................................................................ 2. ________________

3. Carryover from prior years (see instructions) ................................................................................................... 3. ________________

4. Total available credit (add lines 2 and 3). Do not enter more than $500,000. Enter here and

on Form 1120ME, Schedule C, line 29b, or Form 1040ME, Schedule A, line 18 ............................................. 4. ________________

VERIFICATION OF JOB CREATION FOR INVESTMENT IN 2008 (See instructions)

Part 2A

5. 2005 unemployment contribution wages .......................................................................................................... 5. ________________

6. 2006 unemployment contribution wages .......................................................................................................... 6. ________________

7. 2007 unemployment contribution wages ......................................................................................................... 7. ________________

8. Enter greatest of line 5, 6 or 7 .......................................................................................................................... 8. ________________

9. 2008 unemployment contribution wages (The unemployment compensation may be for 2008, 2009 or

2010 -

) ..................................................................................................................................... 9. ________________

see instructions

10. New jobs credit base. Subtract line 8 from line 9 (You do not qualify for the credit if less than

$1,200,000)...................................................................................................................................................... 10. ________________

Part 2B

11. Date qualifi ed investment placed in service in Maine ..................................................................................... 11. ________________

12. Were there at least 100 new jobs created within 2 years of the date on line 11? ............................................ 12.

Yes

No

12 a. If so, as of what date?........................................................................................................................ 12 a. ________________

Rev. 11/08

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1