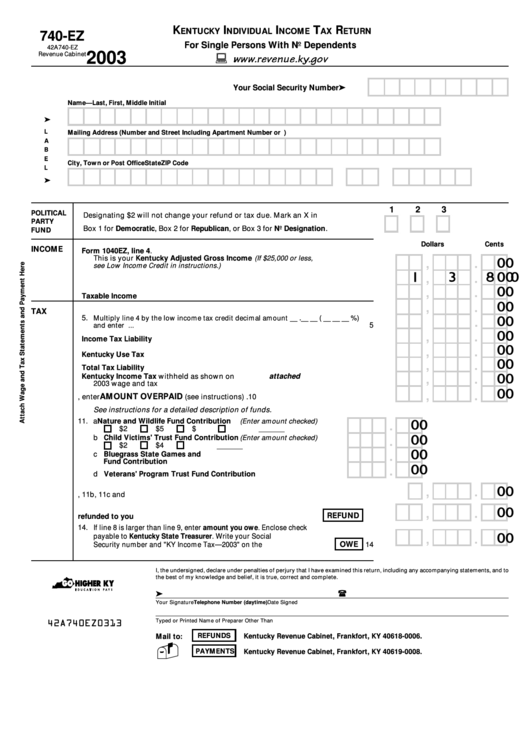

Form 740-Ez - Kentucky Individual Income Tax Return For Single Persons With No Dependents - 2003

ADVERTISEMENT

K

I

I

T

R

ENTUCKY

NDIVIDUAL

NCOME

AX

ETURN

740-EZ

For Single Persons With No Dependents

42A740-EZ

:

2003

Revenue Cabinet

Your Social Security Number ➤

Name—Last, First, Middle Initial

➤

L

Mailing Address (Number and Street Including Apartment Number or P.O. Box)

A

B

E

City, Town or Post Office

State

ZIP Code

L

➤

1

2

3

POLITICAL

Designating $2 will not change your refund or tax due. Mark an X in

PARTY

Box 1 for Democratic, Box 2 for Republican, or Box 3 for No Designation.

FUND

Dollars

Cents

INCOME

1. Enter federal Adjusted Gross Income from Form 1040EZ, line 4.

0

0

This is your Kentucky Adjusted Gross Income (If $25,000 or less,

,

.

see Low Income Credit in instructions.) ...................................................................... 1

1

8

3

0

0

0

,

.

2. Standard deduction ................................................................................................... 2

0

0

,

.

3. Subtract line 2 from line 1. This is your Taxable Income ...................................... 3

0

0

,

.

4. Enter tax from Tax Table or Tax Computation for amount on line 3 ...................... 4

TAX

0

0

5.

__ . __ __

__ __ __

Multiply line 4 by the low income tax credit decimal amount

(

%)

.

5

and enter here ....................................................................................................................

0

0

,

.

6. Subtract line 5 from line 4. This is your Income Tax Liability ............................... 6

0

0

,

.

7. Enter Kentucky Use Tax ............................................................................................ 7

0

0

,

.

8. Add lines 6 and 7. This is your Total Tax Liability ................................................. 8

0

0

9. Enter Kentucky Income Tax withheld as shown on attached

,

.

2003 wage and tax statements ................................................................................. 9

0

0

,

.

AMOUNT OVERPAID

10. If line 9 is greater than line 8, enter

(see instructions) . 10

See instructions for a detailed description of funds.

0

0

11. a Nature and Wildlife Fund Contribution (Enter amount checked)

.

$2

$5

$10

Other

................

0

0

b Child Victims' Trust Fund Contribution (Enter amount checked)

.

$2

$4

Other

......................................

0

0

c Bluegrass State Games and U.S. Olympic Committee

.

Fund Contribution .............................................................................

0

0

.

d Veterans' Program Trust Fund Contribution ..................................

0

0

,

.

12. Add amounts contributed on lines 11a, 11b, 11c and 11d ..................................... 12

0

0

,

.

REFUND

13. Subtract line 12 from line 10. Amount to be refunded to you .......

13

14. If line 8 is larger than line 9, enter amount you owe. Enclose check

0

0

payable to Kentucky State Treasurer. Write your Social

,

.

Security number and "KY Income Tax—2003" on the check ......................

OWE

14

I, the undersigned, declare under penalties of perjury that I have examined this return, including any accompanying statements, and to

the best of my knowledge and belief, it is true, correct and complete.

(

➤

Your Signature

Telephone Number (daytime)

Date Signed

42A740EZ0313

Typed or Printed Name of Preparer Other Than Taxpayer

I.D. Number of Preparer

Date

REFUNDS

Kentucky Revenue Cabinet, Frankfort, KY 40618-0006.

Mail to:

-

PAYMENTS

Kentucky Revenue Cabinet, Frankfort, KY 40619-0008.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1