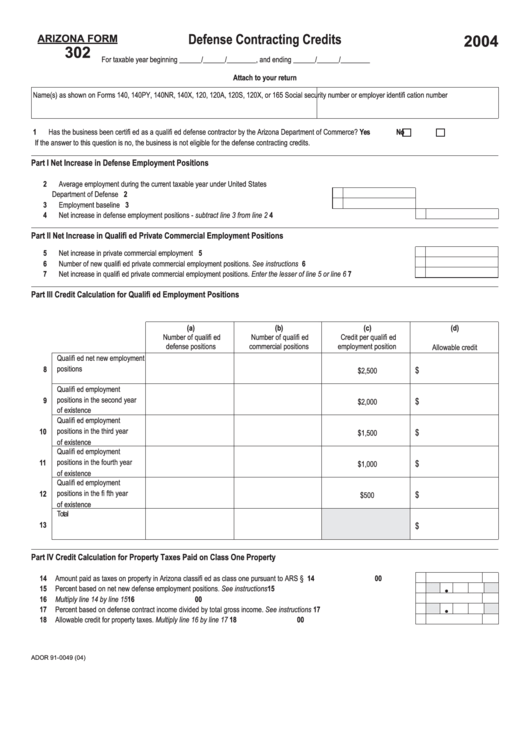

Arizona Form 302 - Defense Contracting Credits - 2004

ADVERTISEMENT

2004

ARIZONA FORM

Defense Contracting Credits

302

For taxable year beginning ______/______/________, and ending ______/______/________

Attach to your return

Name(s) as shown on Forms 140, 140PY, 140NR, 140X, 120, 120A, 120S, 120X, or 165

Social security number or employer identifi cation number

1 Has the business been certifi ed as a qualifi ed defense contractor by the Arizona Department of Commerce?

Yes

No

If the answer to this question is no, the business is not eligible for the defense contracting credits.

Part I

Net Increase in Defense Employment Positions

2 Average employment during the current taxable year under United States

Department of Defense contracts .....................................................................................................

2

3 Employment baseline .......................................................................................................................

3

4 Net increase in defense employment positions - subtract line 3 from line 2....................................................................................

4

Part II

Net Increase in Qualifi ed Private Commercial Employment Positions

5 Net increase in private commercial employment positions..............................................................................................................

5

6 Number of new qualifi ed private commercial employment positions. See instructions ...................................................................

6

7 Net increase in qualifi ed private commercial employment positions. Enter the lesser of line 5 or line 6.........................................

7

Part III

Credit Calculation for Qualifi ed Employment Positions

(a)

(b)

(c)

(d)

Number of qualifi ed

Number of qualifi ed

Credit per qualifi ed

defense positions

commercial positions

employment position

Allowable credit

Qualifi ed net new employment

positions

8

$

$2,500

Qualifi ed employment

positions in the second year

9

$

$2,000

of existence

Qualifi ed employment

positions in the third year

10

$

$1,500

of existence

Qualifi ed employment

positions in the fourth year

11

$

$1,000

of existence

Qualifi ed employment

positions in the fi fth year

12

$

$500

of existence

Total

13

$

Part IV Credit Calculation for Property Taxes Paid on Class One Property

14 Amount paid as taxes on property in Arizona classifi ed as class one pursuant to ARS § 42-12001 ...............................................

14

00

15 Percent based on net new defense employment positions. See instructions..................................................................................

15

•

16 Multiply line 14 by line 15.................................................................................................................................................................

16

00

•

17 Percent based on defense contract income divided by total gross income. See instructions .........................................................

17

18 Allowable credit for property taxes. Multiply line 16 by line 17 ........................................................................................................

18

00

ADOR 91-0049 (04)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2