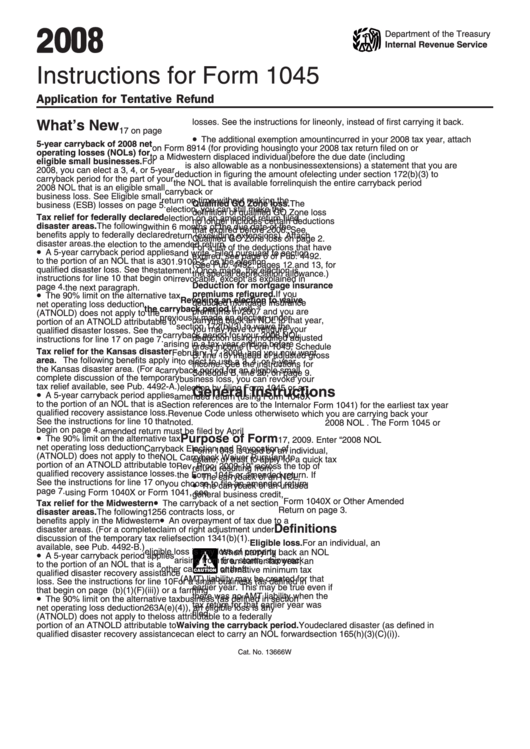

Instructions For Form 1045 - Application For Tentative Refund - 2008

ADVERTISEMENT

2 0 08

Department of the Treasury

Internal Revenue Service

Instructions for Form 1045

Application for Tentative Refund

losses. See the instructions for line

only, instead of first carrying it back.

What’s New

17 on page 7.

To make this election for an NOL

•

The additional exemption amount

incurred in your 2008 tax year, attach

5-year carryback of 2008 net

on Form 8914 (for providing housing

to your 2008 tax return filed on or

operating losses (NOLs) for

to a Midwestern displaced individual)

before the due date (including

eligible small businesses. For

is also allowable as a nonbusiness

extensions) a statement that you are

2008, you can elect a 3, 4, or 5-year

deduction in figuring the amount of

electing under section 172(b)(3) to

carryback period for the part of your

the NOL that is available for

relinquish the entire carryback period

2008 NOL that is an eligible small

carryback or carryforward.

for any 2008 NOL. If you filed your

business loss. See Eligible small

return on time without making the

Qualified GO Zone loss. The

business (ESB) losses on page 5.

election, you can still make the

definition of qualified GO Zone loss

Tax relief for federally declared

election on an amended return filed

no longer includes certain deductions

disaster areas. The following

within 6 months of the due date of the

that expired before 2008. See

benefits apply to federally declared

return (excluding extensions). Attach

Qualified GO Zone loss on page 2.

disaster areas.

the election to the amended return,

For a list of the deductions that have

•

A 5-year carryback period applies

and write “Filed pursuant to section

expired, see page 6 of Pub. 4492.

to the portion of an NOL that is a

301.9100-2” on the election

(See Pub. 4492, pages 12 and 13, for

qualified disaster loss. See the

statement. Once made, the election is

the special depreciation allowance.)

instructions for line 10 that begin on

irrevocable, except as explained in

Deduction for mortgage insurance

page 4.

the next paragraph.

•

premiums refigured. If you

The 90% limit on the alternative tax

Revoking an election to waive

deducted mortgage insurance

net operating loss deduction

the carryback period. If you

premiums in 2007 and you are

(ATNOLD) does not apply to the

previously made an election under

carrying back an NOL to that year,

portion of an ATNOLD attributable to

section 172(b)(3) to waive the

you may have to refigure your

qualified disaster losses. See the

carryback period for your 2008 NOL

deduction using modified adjusted

instructions for line 17 on page 7.

arising in a tax year ending before

gross income (Form 1045, Schedule

Tax relief for the Kansas disaster

February 17, 2009, and you now want

B, line 13) instead of adjusted gross

area. The following benefits apply in

to elect to use a 3, 4, or 5-year

income. See the instructions for

the Kansas disaster area. (For a

carryback period for an eligible small

Schedule B, line 20, on page 9.

complete discussion of the temporary

business loss, you can revoke your

tax relief available, see Pub. 4492-A.)

election by filing Form 1045 or an

General Instructions

•

A 5-year carryback period applies

amended return (using Form 1040X

to the portion of an NOL that is a

Section references are to the Internal

or Form 1041) for the earliest tax year

qualified recovery assistance loss.

Revenue Code unless otherwise

to which you are carrying back your

See the instructions for line 10 that

noted.

2008 NOL . The Form 1045 or

begin on page 4.

amended return must be filed by April

•

Purpose of Form

The 90% limit on the alternative tax

17, 2009. Enter “2008 NOL

net operating loss deduction

Carryback Election and Revocation of

Form 1045 is used by an individual,

(ATNOLD) does not apply to the

NOL Carryback Waiver Pursuant to

estate, or trust to apply for a quick tax

portion of an ATNOLD attributable to

Rev. Proc. 2009-19” across the top of

refund resulting from:

•

qualified recovery assistance losses.

the Form 1045 or amended return. If

The carryback of an NOL,

•

See the instructions for line 17 on

you choose to file an amended return

The carryback of an unused

page 7.

using Form 1040X or Form 1041, see

general business credit,

•

Form 1040X or Other Amended

Tax relief for the Midwestern

The carryback of a net section

Return on page 3.

disaster areas. The following

1256 contracts loss, or

•

benefits apply in the Midwestern

An overpayment of tax due to a

Definitions

disaster areas. (For a complete

claim of right adjustment under

discussion of the temporary tax relief

section 1341(b)(1).

Eligible loss. For an individual, an

available, see Pub. 4492-B.)

eligible loss is any loss of property

•

When carrying back an NOL

A 5-year carryback period applies

!

arising from fire, storm, shipwreck,

to an earlier tax year, an

to the portion of an NOL that is a

other casualty, or theft.

alternative minimum tax

CAUTION

qualified disaster recovery assistance

(AMT) liability may be created for that

loss. See the instructions for line 10

For a small business (as defined in

earlier year. This may be true even if

that begin on page 4.

section 172(b)(1)(F)(iii)) or a farming

•

there was no AMT liability when the

The 90% limit on the alternative tax

business (as defined in section

tax return for that earlier year was

net operating loss deduction

263A(e)(4)), an eligible loss is any

filed.

(ATNOLD) does not apply to the

loss attributable to a federally

portion of an ATNOLD attributable to

Waiving the carryback period. You

declared disaster (as defined in

qualified disaster recovery assistance

can elect to carry an NOL forward

section 165(h)(3)(C)(i)).

Cat. No. 13666W

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11