Form Pt-283a - Application And Questionnaire For Current Use Assessment Of Bona Fide Agricultural Property

ADVERTISEMENT

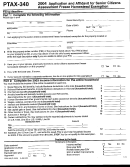

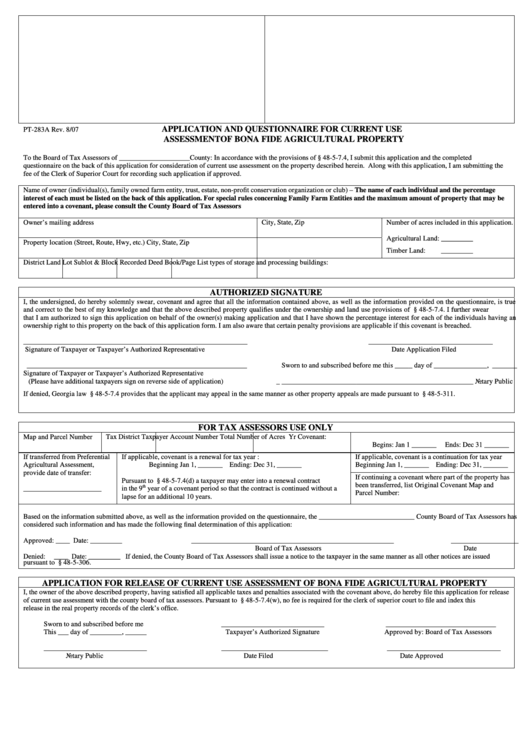

APPLICATION AND QUESTIONNAIRE FOR CURRENT USE

PT-283A Rev. 8/07

ASSESSMENT OF BONA FIDE AGRICULTURAL PROPERTY

To the Board of Tax Assessors of ____________________County: In accordance with the provisions of O.C.G.A. § 48-5-7.4, I submit this application and the completed

questionnaire on the back of this application for consideration of current use assessment on the property described herein. Along with this application, I am submitting the

fee of the Clerk of Superior Court for recording such application if approved.

Name of owner (individual(s), family owned farm entity, trust, estate, non-profit conservation organization or club) – The name of each individual and the percentage

interest of each must be listed on the back of this application. For special rules concerning Family Farm Entities and the maximum amount of property that may be

entered into a covenant, please consult the County Board of Tax Assessors

Owner’s mailing address

City, State, Zip

Number of acres included in this application.

Agricultural Land: _________

Property location (Street, Route, Hwy, etc.)

City, State, Zip

Timber Land:

_________

District

Land Lot

Sublot & Block

Recorded Deed Book/Page

List types of storage and processing buildings:

AUTHORIZED SIGNATURE

I, the undersigned, do hereby solemnly swear, covenant and agree that all the information contained above, as well as the information provided on the questionnaire, is true

and correct to the best of my knowledge and that the above described property qualifies under the ownership and land use provisions of O.C.G.A. § 48-5-7.4. I further swear

that I am authorized to sign this application on behalf of the owner(s) making application and that I have shown the percentage interest for each of the individuals having an

ownership right to this property on the back of this application form. I am also aware that certain penalty provisions are applicable if this covenant is breached.

_______________________________________________________________

___________________________________

Signature of Taxpayer or Taxpayer’s Authorized Representative

Date Application Filed

______________________________________________________________

Sworn to and subscribed before me this _____ day of _______________, _______

Signature of Taxpayer or Taxpayer’s Authorized Representative

(Please have additional taxpayers sign on reverse side of application)

_ ______________________________________________________ Notary Public

If denied, Georgia law O.C.G.A. § 48-5-7.4 provides that the applicant may appeal in the same manner as other property appeals are made pursuant to O.C.G.A. § 48-5-311.

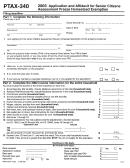

FOR TAX ASSESSORS USE ONLY

Map and Parcel Number

Tax District

Taxpayer Account Number

Total Number of Acres

Yr Covenant:

Begins: Jan 1 _______

Ends: Dec 31 _______

If transferred from Preferential

If applicable, covenant is a renewal for tax year :

If applicable, covenant is a continuation for tax year

Agricultural Assessment,

Beginning Jan 1, _______ Ending: Dec 31, _______

Beginning Jan 1, _______ Ending: Dec 31, _______

provide date of transfer:

If continuing a covenant where part of the property has

Pursuant to O.C.G.A.§ 48-5-7.4(d) a taxpayer may enter into a renewal contract

been transferred, list Original Covenant Map and

th

______________________

in the 9

year of a covenant period so that the contract is continued without a

Parcel Number:

lapse for an additional 10 years.

Based on the information submitted above, as well as the information provided on the questionnaire, the ___________________________ County Board of Tax Assessors has

considered such information and has made the following final determination of this application:

Approved: ____ Date: _________

_________________________________________________________

___________________

Board of Tax Assessors

Date

Denied:

____ Date: _________ If denied, the County Board of Tax Assessors shall issue a notice to the taxpayer in the same manner as all other notices are issued

pursuant to O.C.G.A. § 48-5-306.

APPLICATION FOR RELEASE OF CURRENT USE ASSESSMENT OF BONA FIDE AGRICULTURAL PROPERTY

I, the owner of the above described property, having satisfied all applicable taxes and penalties associated with the covenant above, do hereby file this application for release

of current use assessment with the county board of tax assessors. Pursuant to O.C.G.A. § 48-5-7.4(w), no fee is required for the clerk of superior court to file and index this

release in the real property records of the clerk’s office.

Sworn to and subscribed before me

_____________________________

_______________________________

This ___ day of _________, ______

Taxpayer’s Authorized Signature

Approved by: Board of Tax Assessors

_____________________________

______________________________

________________________________

Notary Public

Date Filed

Date Approved

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2