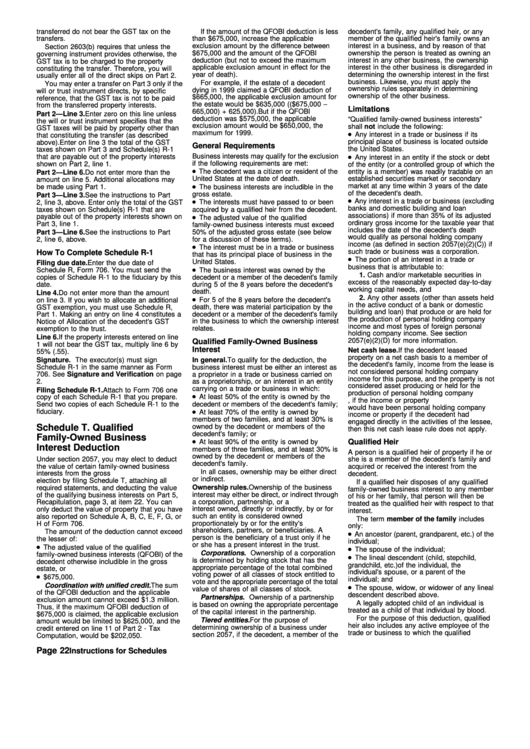

Instructions For Schedule T. Qualified Family-Owned Business Interest Deduction And Schedule U. Qualified Conservation Easement Exclusion

ADVERTISEMENT

transferred do not bear the GST tax on the

If the amount of the QFOBI deduction is less

decedent's family, any qualified heir, or any

transfers.

than $675,000, increase the applicable

member of the qualified heir's family owns an

exclusion amount by the difference between

interest in a business, and by reason of that

Section 2603(b) requires that unless the

$675,000 and the amount of the QFOBI

ownership the person is treated as owning an

governing instrument provides otherwise, the

deduction (but not to exceed the maximum

interest in any other business, the ownership

GST tax is to be charged to the property

applicable exclusion amount in effect for the

interest in the other business is disregarded in

constituting the transfer. Therefore, you will

year of death).

determining the ownership interest in the first

usually enter all of the direct skips on Part 2.

business. Likewise, you must apply the

For example, if the estate of a decedent

You may enter a transfer on Part 3 only if the

ownership rules separately in determining

dying in 1999 claimed a QFOBI deduction of

will or trust instrument directs, by specific

ownership of the other business.

$665,000, the applicable exclusion amount for

reference, that the GST tax is not to be paid

the estate would be $635,000 (($675,000 −

from the transferred property interests.

Limitations

665,000) + 625,000). But if the QFOBI

Part 2—Line 3. Enter zero on this line unless

deduction was $575,000, the applicable

“Qualified family-owned business interests”

the will or trust instrument specifies that the

exclusion amount would be $650,000, the

shall not include the following:

GST taxes will be paid by property other than

maximum for 1999.

Any interest in a trade or business if its

that constituting the transfer (as described

principal place of business is located outside

above). Enter on line 3 the total of the GST

General Requirements

the United States.

taxes shown on Part 3 and Schedule(s) R-1

Business interests may qualify for the exclusion

that are payable out of the property interests

Any interest in an entity if the stock or debt

if the following requirements are met:

shown on Part 2, line 1.

of the entity (or a controlled group of which the

The decedent was a citizen or resident of the

entity is a member) was readily tradable on an

Part 2—Line 6. Do not enter more than the

United States at the date of death.

established securities market or secondary

amount on line 5. Additional allocations may

market at any time within 3 years of the date

be made using Part 1.

The business interests are includible in the

of the decedent's death.

gross estate.

Part 3—Line 3. See the instructions to Part

Any interest in a trade or business (excluding

2, line 3, above. Enter only the total of the GST

The interests must have passed to or been

banks and domestic building and loan

taxes shown on Schedule(s) R-1 that are

acquired by a qualified heir from the decedent.

associations) if more than 35% of its adjusted

payable out of the property interests shown on

The adjusted value of the qualified

ordinary gross income for the taxable year that

Part 3, line 1.

family-owned business interests must exceed

includes the date of the decedent's death

50% of the adjusted gross estate (see below

Part 3—Line 6. See the instructions to Part

would qualify as personal holding company

2, line 6, above.

for a discussion of these terms).

income (as defined in section 2057(e)(2)(C)) if

The interest must be in a trade or business

such trade or business was a corporation.

How To Complete Schedule R-1

that has its principal place of business in the

The portion of an interest in a trade or

United States.

Filing due date. Enter the due date of

business that is attributable to:

Schedule R, Form 706. You must send the

The business interest was owned by the

1. Cash and/or marketable securities in

copies of Schedule R-1 to the fiduciary by this

decedent or a member of the decedent's family

excess of the reasonably expected day-to-day

date.

during 5 of the 8 years before the decedent's

working capital needs, and

death.

Line 4. Do not enter more than the amount

2. Any other assets (other than assets held

For 5 of the 8 years before the decedent's

on line 3. If you wish to allocate an additional

in the active conduct of a bank or domestic

GST exemption, you must use Schedule R,

death, there was material participation by the

building and loan) that produce or are held for

Part 1. Making an entry on line 4 constitutes a

decedent or a member of the decedent's family

the production of personal holding company

in the business to which the ownership interest

Notice of Allocation of the decedent's GST

income and most types of foreign personal

relates.

exemption to the trust.

holding company income. See section

Line 6. If the property interests entered on line

2057(e)(2)(D) for more information.

Qualified Family-Owned Business

1 will not bear the GST tax, multiply line 6 by

Interest

Net cash lease. If the decedent leased

55% (.55).

property on a net cash basis to a member of

Signature. The executor(s) must sign

In general. To qualify for the deduction, the

the decedent's family, income from the lease is

Schedule R-1 in the same manner as Form

business interest must be either an interest as

not considered personal holding company

706. See Signature and Verification on page

a proprietor in a trade or business carried on

income for this purpose, and the property is not

2.

as a proprietorship, or an interest in an entity

considered asset producing or held for the

carrying on a trade or business in which:

Filing Schedule R-1. Attach to Form 706 one

production of personal holding company

copy of each Schedule R-1 that you prepare.

At least 50% of the entity is owned by the

income. However, if the income or property

decedent or members of the decedent's family;

Send two copies of each Schedule R-1 to the

would have been personal holding company

fiduciary.

At least 70% of the entity is owned by

income or property if the decedent had

members of two families, and at least 30% is

engaged directly in the activities of the lessee,

Schedule T. Qualified

owned by the decedent or members of the

then this net cash lease rule does not apply.

decedent's family; or

Family-Owned Business

Qualified Heir

At least 90% of the entity is owned by

Interest Deduction

members of three families, and at least 30% is

A person is a qualified heir of property if he or

owned by the decedent or members of the

Under section 2057, you may elect to deduct

she is a member of the decedent's family and

decedent's family.

the value of certain family-owned business

acquired or received the interest from the

In all cases, ownership may be either direct

interests from the gross estate. You make the

decedent.

or indirect.

election by filing Schedule T, attaching all

If a qualified heir disposes of any qualified

required statements, and deducting the value

Ownership rules. Ownership of the business

family-owned business interest to any member

interest may either be direct, or indirect through

of the qualifying business interests on Part 5,

of his or her family, that person will then be

a corporation, partnership, or a trust. An

Recapitulation, page 3, at item 22. You can

treated as the qualified heir with respect to that

only deduct the value of property that you have

interest owned, directly or indirectly, by or for

interest.

such an entity is considered owned

also reported on Schedule A, B, C, E, F, G, or

The term member of the family includes

proportionately by or for the entity's

H of Form 706.

only:

shareholders, partners, or beneficiaries. A

The amount of the deduction cannot exceed

An ancestor (parent, grandparent, etc.) of the

person is the beneficiary of a trust only if he

the lesser of:

individual;

or she has a present interest in the trust.

The adjusted value of the qualified

The spouse of the individual;

Corporations. Ownership of a corporation

family-owned business interests (QFOBI) of the

The lineal descendent (child, stepchild,

is determined by holding stock that has the

decedent otherwise includible in the gross

grandchild, etc.) of the individual, the

appropriate percentage of the total combined

estate, or

individual's spouse, or a parent of the

voting power of all classes of stock entitled to

$675,000.

individual; and

vote and the appropriate percentage of the total

Coordination with unified credit. The sum

The spouse, widow, or widower of any lineal

value of shares of all classes of stock.

of the QFOBI deduction and the applicable

descendent described above.

Partnerships. Ownership of a partnership

exclusion amount cannot exceed $1.3 million.

A legally adopted child of an individual is

is based on owning the appropriate percentage

Thus, if the maximum QFOBI deduction of

treated as a child of that individual by blood.

of the capital interest in the partnership.

$675,000 is claimed, the applicable exclusion

For the purpose of this deduction, qualified

Tiered entities. For the purpose of

amount would be limited to $625,000, and the

heir also includes any active employee of the

determining ownership of a business under

credit entered on line 11 of Part 2 - Tax

trade or business to which the qualified

section 2057, if the decedent, a member of the

Computation, would be $202,050.

Page 22

Instructions for Schedules

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2