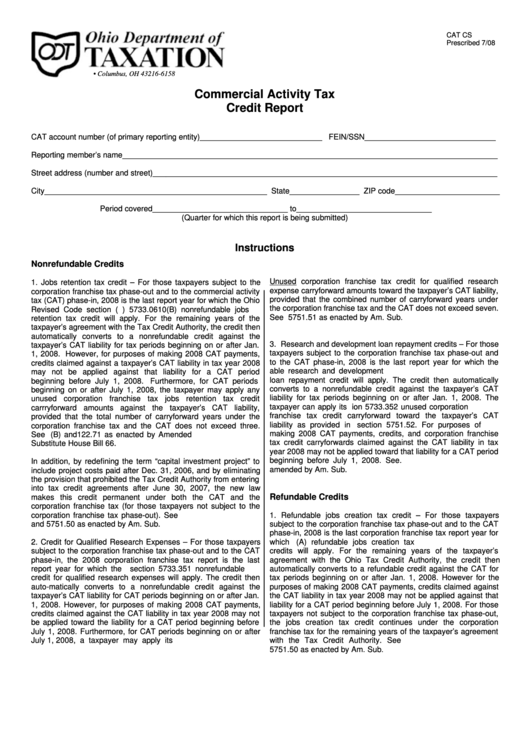

Form Cat Cs - Commercial Activity Tax Credit Report

ADVERTISEMENT

CAT CS

Prescribed 7/08

P.O. Box 16158 • Columbus, OH 43216-6158

Commercial Activity Tax

Credit Report

CAT account number (of primary reporting entity)____________________________ FEIN/SSN______________________________

Reporting member’s name______________________________________________________________________________________

Street address (number and street)_______________________________________________________________________________

City___________________________________________________ State________________ ZIP code________________________

Period covered_______________________________ to_______________________________

(Quarter for which this report is being submitted)

Instructions

Nonrefundable Credits

Unused corporation franchise tax credit for qualified research

1. Jobs retention tax credit – For those taxpayers subject to the

expense carryforward amounts toward the taxpayer’s CAT liability,

corporation franchise tax phase-out and to the commercial activity

provided that the combined number of carryforward years under

tax (CAT) phase-in, 2008 is the last report year for which the Ohio

the corporation franchise tax and the CAT does not exceed seven.

Revised Code section (R.C.) 5733.0610(B) nonrefundable jobs

See R.C. sections 5733.351 and 5751.51 as enacted by Am. Sub.

retention tax credit will apply. For the remaining years of the

H.B. 66.

taxpayer’s agreement with the Tax Credit Authority, the credit then

automatically converts to a nonrefundable credit against the

3. Research and development loan repayment credits – For those

taxpayer’s CAT liability for tax periods beginning on or after Jan.

taxpayers subject to the corporation franchise tax phase-out and

1, 2008. However, for purposes of making 2008 CAT payments,

to the CAT phase-in, 2008 is the last report year for which the

credits claimed against a taxpayer’s CAT liability in tax year 2008

R.C. section 733.352 nonrefundable research and development

may not be applied against that liability for a CAT period

loan repayment credit will apply. The credit then automatically

beginning before July 1, 2008.

Furthermore, for CAT periods

converts to a nonrefundable credit against the taxpayer’s CAT

beginning on or after July 1, 2008, the taxpayer may apply any

liability for tax periods beginning on or after Jan. 1, 2008. The

unused corporation franchise tax jobs retention tax credit

taxpayer can apply its R.C. section 5733.352 unused corporation

carrryforward amounts against the taxpayer’s CAT liability,

franchise tax credit carryforward toward the taxpayer’s CAT

provided that the total number of carryforward years under the

liability as provided in R.C. section 5751.52. For purposes of

corporation franchise tax and the CAT does not exceed three.

making 2008 CAT payments, credits, and corporation franchise

See R.C. sections 5751(B) and 122.71 as enacted by Amended

tax credit carryforwards claimed against the CAT liability in tax

Substitute House Bill 66.

year 2008 may not be applied toward that liability for a CAT period

beginning before July 1, 2008. See. R.C. section 5733.352 as

In addition, by redefining the term “capital investment project” to

amended by Am. Sub. H.B. 66.

include project costs paid after Dec. 31, 2006, and by eliminating

the provision that prohibited the Tax Credit Authority from entering

into tax credit agreements after June 30, 2007, the new law

Refundable Credits

makes this credit permanent under both the CAT and the

corporation franchise tax (for those taxpayers not subject to the

corporation franchise tax phase-out). See R.C. sections 122.171

1. Refundable jobs creation tax credit – For those taxpayers

and 5751.50 as enacted by Am. Sub. H.B. 66.

subject to the corporation franchise tax phase-out and to the CAT

phase-in, 2008 is the last corporation franchise tax report year for

2. Credit for Qualified Research Expenses – For those taxpayers

which R.C. section 5733.0610(A) refundable jobs creation tax

subject to the corporation franchise tax phase-out and to the CAT

credits will apply. For the remaining years of the taxpayer’s

phase-in, the 2008 corporation franchise tax report is the last

agreement with the Ohio Tax Credit Authority, the credit then

report year for which the R.C. section 5733.351 nonrefundable

automatically converts to a refundable credit against the CAT for

credit for qualified research expenses will apply. The credit then

tax periods beginning on or after Jan. 1, 2008. However for the

auto-matically converts to a nonrefundable credit against the

purposes of making 2008 CAT payments, credits claimed against

taxpayer’s CAT liability for CAT periods beginning on or after Jan.

the CAT liability in tax year 2008 may not be applied against that

1, 2008. However, for purposes of making 2008 CAT payments,

liability for a CAT period beginning before July 1, 2008. For those

credits claimed against the CAT liability in tax year 2008 may not

taxpayers not subject to the corporation franchise tax phase-out,

be applied toward the liability for a CAT period beginning before

the jobs creation tax credit continues under the corporation

July 1, 2008. Furthermore, for CAT periods beginning on or after

franchise tax for the remaining years of the taxpayer’s agreement

July 1, 2008, a taxpayer may apply its R.C. section 5733.351

with the Tax Credit Authority. See R.C. section 122.17 and

5751.50 as enacted by Am. Sub. H.B. 66.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2