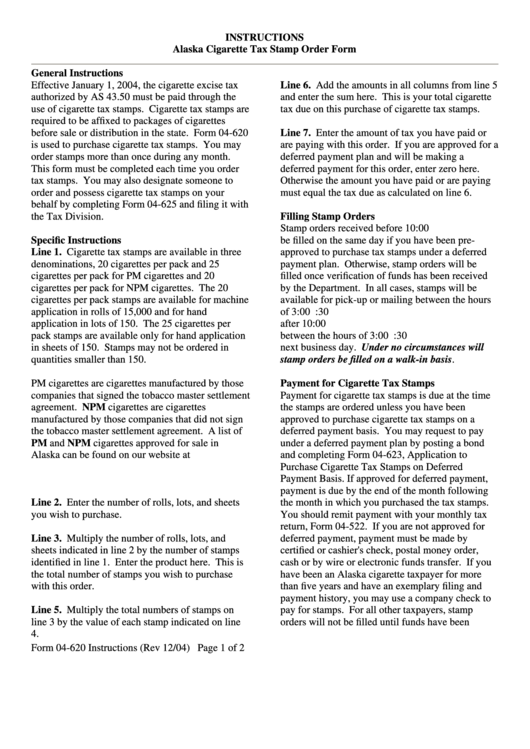

INSTRUCTIONS

Alaska Cigarette Tax Stamp Order Form

General Instructions

Effective January 1, 2004, the cigarette excise tax

Line 6. Add the amounts in all columns from line 5

authorized by AS 43.50 must be paid through the

and enter the sum here. This is your total cigarette

use of cigarette tax stamps. Cigarette tax stamps are

tax due on this purchase of cigarette tax stamps.

required to be affixed to packages of cigarettes

before sale or distribution in the state. Form 04-620

Line 7. Enter the amount of tax you have paid or

is used to purchase cigarette tax stamps. You may

are paying with this order. If you are approved for a

order stamps more than once during any month.

deferred payment plan and will be making a

This form must be completed each time you order

deferred payment for this order, enter zero here.

tax stamps. You may also designate someone to

Otherwise the amount you have paid or are paying

order and possess cigarette tax stamps on your

must equal the tax due as calculated on line 6.

behalf by completing Form 04-625 and filing it with

the Tax Division.

Filling Stamp Orders

Stamp orders received before 10:00 a.m. AST will

Specific Instructions

be filled on the same day if you have been pre-

Line 1. Cigarette tax stamps are available in three

approved to purchase tax stamps under a deferred

denominations, 20 cigarettes per pack and 25

payment plan. Otherwise, stamp orders will be

cigarettes per pack for PM cigarettes and 20

filled once verification of funds has been received

cigarettes per pack for NPM cigarettes. The 20

by the Department. In all cases, stamps will be

cigarettes per pack stamps are available for machine

available for pick-up or mailing between the hours

application in rolls of 15,000 and for hand

of 3:00 p.m. and 4:30 p.m. daily. Orders received

application in lots of 150. The 25 cigarettes per

after 10:00 a.m. will be available for pick-up

pack stamps are available only for hand application

between the hours of 3:00 p.m. and 4:30 p.m. the

in sheets of 150. Stamps may not be ordered in

next business day. Under no circumstances will

quantities smaller than 150.

stamp orders be filled on a walk-in basis.

PM cigarettes are cigarettes manufactured by those

Payment for Cigarette Tax Stamps

companies that signed the tobacco master settlement

Payment for cigarette tax stamps is due at the time

agreement. NPM cigarettes are cigarettes

the stamps are ordered unless you have been

manufactured by those companies that did not sign

approved to purchase cigarette tax stamps on a

the tobacco master settlement agreement. A list of

deferred payment basis. You may request to pay

PM and NPM cigarettes approved for sale in

under a deferred payment plan by posting a bond

Alaska can be found on our website at

and completing Form 04-623, Application to

Purchase Cigarette Tax Stamps on Deferred

pliantTPMBrandListings.pdf.

Payment Basis. If approved for deferred payment,

payment is due by the end of the month following

Line 2. Enter the number of rolls, lots, and sheets

the month in which you purchased the tax stamps.

you wish to purchase.

You should remit payment with your monthly tax

return, Form 04-522. If you are not approved for

Line 3. Multiply the number of rolls, lots, and

deferred payment, payment must be made by

sheets indicated in line 2 by the number of stamps

certified or cashier's check, postal money order,

identified in line 1. Enter the product here. This is

cash or by wire or electronic funds transfer. If you

the total number of stamps you wish to purchase

have been an Alaska cigarette taxpayer for more

with this order.

than five years and have an exemplary filing and

payment history, you may use a company check to

Line 5. Multiply the total numbers of stamps on

pay for stamps. For all other taxpayers, stamp

line 3 by the value of each stamp indicated on line

orders will not be filled until funds have been

4.

Form 04-620 Instructions (Rev 12/04)

Page 1 of 2

1

1 2

2 3

3