Form 44-101 - Withholding Monthly Deposit

ADVERTISEMENT

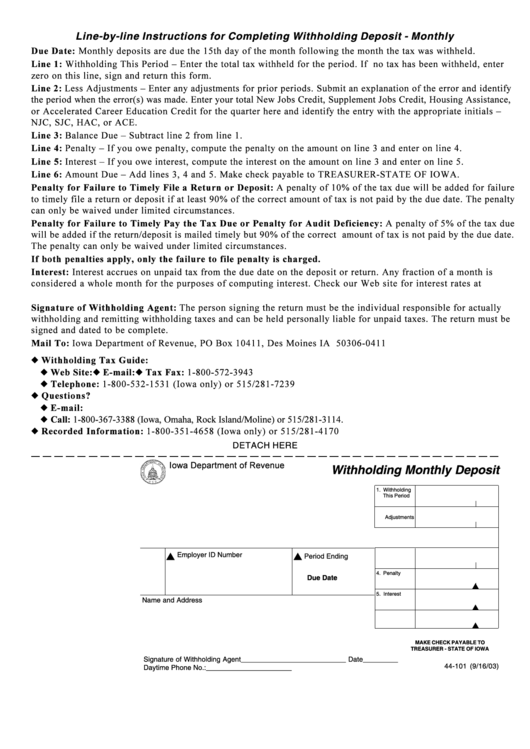

Line-by-line Instructions for Completing Withholding Deposit - Monthly

Due Date:

Line 1:

Line 2:

Line 3:

Line 4:

Line 5:

Line 6:

Penalty for Failure to Timely File a Return or Deposit:

Penalty for Failure to Timely Pay the Tax Due or Penalty for Audit Deficiency:

If both penalties apply, only the failure to file penalty is charged.

Interest:

Signature of Withholding Agent:

Mail To:

u Withholding Tax Guide:

u Web Site:

u E-mail:

u Tax Fax:

u Telephone:

u Questions?

u E-mail:

u Call:

u Recorded Information:

DETACH HERE

Iowa Department of Revenue

Withholding Monthly Deposit

1. Withholding

This Period

2. Less Credits/

Adjustments

3. Balance Due

s

s

Employer ID Number

Period Ending

4. Penalty

Due Date

s

5. Interest

Name and Address

s

6. Amount Due

s

MAKE CHECK PAYABLE TO

TREASURER - STATE OF IOWA

Signature of Withholding Agent ___________________________ Date _________

44-101 (9/16/03)

Daytime Phone No.: ______________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1