Form Es-40 - Estimated Tax Payment Form - 2009

ADVERTISEMENT

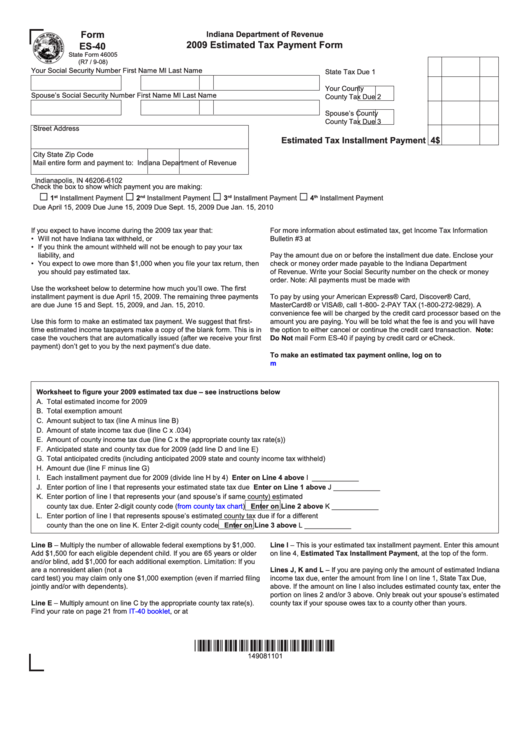

Form

Indiana Department of Revenue

2009 Estimated Tax Payment Form

ES-40

State Form 46005

(R7 / 9-08)

Your Social Security Number

First Name

MI

Last Name

State Tax Due

1

Your

County

Spouse’s Social Security Number

First Name

MI

Last Name

County

Tax Due

2

Spouse’s

County

County

Tax Due

3

Street Address

Estimated Tax Installment Payment 4$

City

State

Zip Code

Mail entire form and payment to: Indiana Department of Revenue

P.O. Box 6102

Indianapolis, IN 46206-6102

Check the box to show which payment you are making:

□

□

□

□

1

2

3

4

Installment Payment

Installment Payment

Installment Payment

Installment Payment

st

nd

rd

th

Due April 15, 2009

Due June 15, 2009

Due Sept. 15, 2009

Due Jan. 15, 2010

If you expect to have income during the 2009 tax year that:

For more information about estimated tax, get Income Tax Information

•

Will not have Indiana tax withheld, or

Bulletin #3 at

•

If you think the amount withheld will not be enough to pay your tax

liability, and

Pay the amount due on or before the installment due date. Enclose your

•

You expect to owe more than $1,000 when you file your tax return, then

check or money order made payable to the Indiana Department

you should pay estimated tax.

of Revenue. Write your Social Security number on the check or money

order. Note: All payments must be made with U.S. funds.

Use the worksheet below to determine how much you’ll owe. The first

installment payment is due April 15, 2009. The remaining three payments

To pay by using your American Express® Card, Discover® Card,

are due June 15 and Sept. 15, 2009, and Jan. 15, 2010.

MasterCard® or VISA®, call 1-800- 2-PAY TAX (1-800-272-9829). A

convenience fee will be charged by the credit card processor based on the

Use this form to make an estimated tax payment. We suggest that first-

amount you are paying. You will be told what the fee is and you will have

time estimated income taxpayers make a copy of the blank form. This is in

the option to either cancel or continue the credit card transaction. Note:

case the vouchers that are automatically issued (after we receive your first

Do Not mail Form ES-40 if paying by credit card or eCheck.

payment) don’t get to you by the next payment’s due date.

To make an estimated tax payment online, log on to

Worksheet to figure your 2009 estimated tax due – see instructions below

A.

Total estimated income for 2009 ..................................................................................................................................................... A ____________

B.

Total exemption amount .................................................................................................................................................................. B ____________

C.

Amount subject to tax (line A minus line B) ..................................................................................................................................... C ____________

D.

Amount of state income tax due (line C x .034) .............................................................................................................................. D ____________

E.

Amount of county income tax due (line C x the appropriate county tax rate(s)) .............................................................................. E ____________

F.

Anticipated state and county tax due for 2009 (add line D and line E) ............................................................................................. F ____________

G.

Total anticipated credits (including anticipated 2009 state and county income tax withheld) .......................................................... G ____________

H.

Amount due (line F minus line G) .................................................................................................................................................... H ____________

I.

Each installment payment due for 2009 (divide line H by 4) ..................................................................... Enter on Line 4 above

I ____________

J.

Enter portion of line I that represents your estimated state tax due .......................................................... Enter on Line 1 above

J ____________

K.

Enter portion of line I that represents your (and spouse’s if same county) estimated

county tax due. Enter 2-digit county code

(from county tax

chart)

........................................ Enter on Line 2 above

K ____________

L.

Enter portion of line I that represents spouse’s estimated county tax due if for a different

...................................................... Enter on Line 3 above

county than the one on line K. Enter 2-digit county code

L ____________

Line B – Multiply the number of allowable federal exemptions by $1,000.

Line I – This is your estimated tax installment payment. Enter this amount

Add $1,500 for each eligible dependent child. If you are 65 years or older

on line 4, Estimated Tax Installment Payment, at the top of the form.

and/or blind, add $1,000 for each additional exemption. Limitation: If you

are a nonresident alien (not a U.S. citizen and does not meet the green

Lines J, K and L – If you are paying only the amount of estimated Indiana

card test) you may claim only one $1,000 exemption (even if married filing

income tax due, enter the amount from line I on line 1, State Tax Due,

jointly and/or with dependents).

above. If the amount on line I also includes estimated county tax, enter the

portion on lines 2 and/or 3 above. Only break out your spouse’s estimated

Line E – Multiply amount on line C by the appropriate county tax rate(s).

county tax if your spouse owes tax to a county other than yours.

Find your rate on page 21 from

IT-40

booklet, or at

*149081101*

149081101

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1