Maximum Levy Worksheet School District General Fund

ADVERTISEMENT

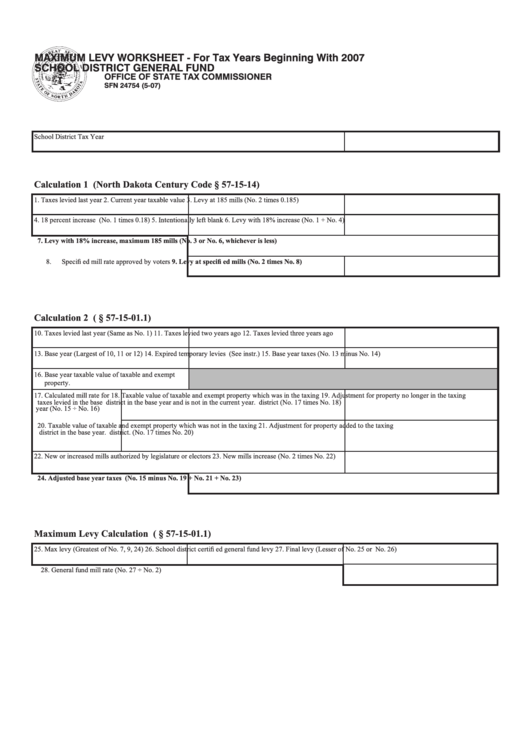

MAXIMUM LEVY WORKSHEET - For Tax Years Beginning With 2007

SCHOOL DISTRICT GENERAL FUND

OFFICE OF STATE TAX COMMISSIONER

SFN 24754 (5-07)

School District

Tax Year

Calculation 1 (North Dakota Century Code § 57-15-14)

1. Taxes levied last year

2. Current year taxable value

3. Levy at 185 mills (No. 2 times 0.185)

4. 18 percent increase (No. 1 times 0.18)

5. Intentionally left blank

6. Levy with 18% increase (No. 1 + No. 4)

7. Levy with 18% increase, maximum 185 mills (No. 3 or No. 6, whichever is less)

8. Specifi ed mill rate approved by voters

9. Levy at specifi ed mills (No. 2 times No. 8)

Calculation 2 (N.D.C.C. § 57-15-01.1)

10. Taxes levied last year (Same as No. 1)

11. Taxes levied two years ago

12. Taxes levied three years ago

13. Base year (Largest of 10, 11 or 12)

14. Expired temporary levies (See instr.)

15. Base year taxes (No. 13 minus No. 14)

16. Base year taxable value of taxable and exempt

property.

17. Calculated mill rate for

18. Taxable value of taxable and exempt property which was in the taxing

19. Adjustment for property no longer in the taxing

taxes levied in the base

district in the base year and is not in the current year.

district (No. 17 times No. 18)

year (No. 15 ÷ No. 16)

20. Taxable value of taxable and exempt property which was not in the taxing

21. Adjustment for property added to the taxing

district in the base year.

district. (No. 17 times No. 20)

22. New or increased mills authorized by legislature or electors

23. New mills increase (No. 2 times No. 22)

24. Adjusted base year taxes (No. 15 minus No. 19 + No. 21 + No. 23)

Maximum Levy Calculation (N.D.C.C. § 57-15-01.1)

25. Max levy (Greatest of No. 7, 9, 24)

26. School district certifi ed general fund levy

27. Final levy (Lesser of No. 25 or No. 26)

28. General fund mill rate (No. 27 ÷ No. 2)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3