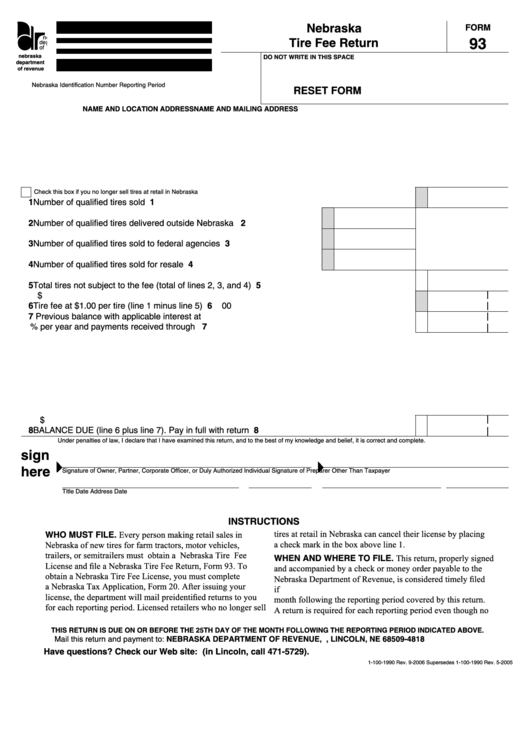

Nebraska

FORM

n e

93

Tire Fee Return

de p

of

nebraska

DO NOT WRITE IN THIS SPACE

department

of revenue

Nebraska Identification Number

Reporting Period

RESET FORM

NAME AND LOCATION ADDRESS

NAME AND MAILING ADDRESS

Check this box if you no longer sell tires at retail in Nebraska

1 Number of qualified tires sold.............................................................................................................

1

2 Number of qualified tires delivered outside Nebraska.................................. 2

3 Number of qualified tires sold to federal agencies ....................................... 3

4 Number of qualified tires sold for resale....................................................... 4

5 Total tires not subject to the fee (total of lines 2, 3, and 4) .................................................................

5

$

6 Tire fee at $1.00 per tire (line 1 minus line 5).....................................................................................

6

00

7 Previous balance with applicable interest at

% per year and payments received through

7

$

8 BALANCE DUE (line 6 plus line 7). Pay in full with return..................................................................

8

Under penalties of law, I declare that I have examined this return, and to the best of my knowledge and belief, it is correct and complete.

sign

here

Signature of Owner, Partner, Corporate Officer, or Duly Authorized Individual

Signature of Preparer Other Than Taxpayer

Title

Date

Address

Date

INSTRUCTIONS

tires at retail in Nebraska can cancel their license by placing

WHO MUST FILE. Every person making retail sales in

a check mark in the box above line 1.

Nebraska of new tires for farm tractors, motor vehicles,

trailers, or semitrailers must obtain a Nebraska Tire Fee

WHEN AND WHERETO FILE. This return, properly signed

License and file a Nebraska Tire Fee Return, Form 93. To

and accompanied by a check or money order payable to the

obtain a Nebraska Tire Fee License, you must complete

Nebraska Department of Revenue, is considered timely filed

a Nebraska Tax Application, Form 20. After issuing your

if U.S. postmarked on or before the twenty-fifth day of the

license, the department will mail preidentified returns to you

month following the reporting period covered by this return.

for each reporting period. Licensed retailers who no longer sell

A return is required for each reporting period even though no

THIS RETURN IS DUE ON OR BEFORE THE 25TH DAY OF THE MONTH FOLLOWING THE REPORTING PERIOD INDICATED ABOVE.

Mail this return and payment to: NEBRASKA DEPARTMENT OF REVENUE, P.O. BOX 94818, LINCOLN, NE 68509-4818

Have questions? Check our Web site: or call 1-800-742-7474 (in Lincoln, call 471-5729).

1-100-1990 Rev. 9-2006 Supersedes 1-100-1990 Rev. 5-2005

1

1 2

2