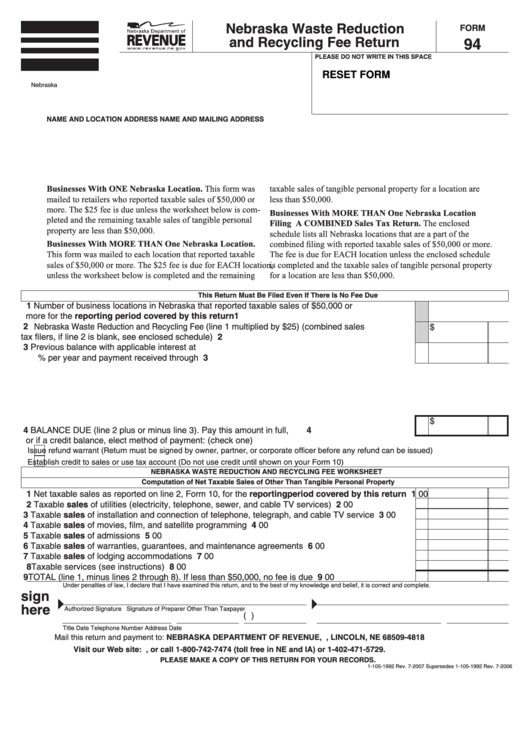

Nebraska Waste Reduction

FORM

and Recycling Fee Return

94

PLEASE DO NOT WRITE IN THIS SPACE

RESET FORM

Nebraska I.D. Number

Reporting Period Covered by Return

Due Date

NAME AND LOCATION ADDRESS

NAME AND MAILING ADDRESS

Businesses With ONE Nebraska Location. This form was

taxable sales of tangible personal property for a location are

mailed to retailers who reported taxable sales of $50,000 or

less than $50,000.

more. The $25 fee is due unless the worksheet below is com-

Businesses With MORE THAN One Nebraska Location

pleted and the remaining taxable sales of tangible personal

Filing A COMBINED Sales Tax Return. The enclosed

property are less than $50,000.

schedule lists all Nebraska locations that are a part of the

Businesses With MORE THAN One Nebraska Location.

combined filing with reported taxable sales of $50,000 or more.

This form was mailed to each location that reported taxable

The fee is due for EACH location unless the enclosed schedule

sales of $50,000 or more. The $25 fee is due for EACH location,

is completed and the taxable sales of tangible personal property

unless the worksheet below is completed and the remaining

for a location are less than $50,000.

This Return Must Be Filed Even If There Is No Fee Due

1 Number of business locations in Nebraska that reported taxable sales of $50,000 or

more for the reporting period covered by this return ....................................................................

1

2 Nebraska Waste Reduction and Recycling Fee (line 1 multiplied by $25) (combined sales

$

tax filers, if line 2 is blank, see enclosed schedule) ...........................................................................

2

3 Previous balance with applicable interest at

% per year and payment received through

3

$

4 BALANCE DUE (line 2 plus or minus line 3). Pay this amount in full, ..............................................

4

or if a credit balance, elect method of payment: (check one)

Issue refund warrant (Return must be signed by owner, partner, or corporate officer before any refund can be issued)

Establish credit to sales or use tax account (Do not use credit until shown on your Form 10)

NEBRASKA WASTE REDUCTION AND RECYCLING FEE WORKSHEET

Computation of Net Taxable Sales of Other Than Tangible Personal Property

1 Net taxable sales as reported on line 2, Form 10, for the reporting period covered by this return

1

00

2 Taxable sales of utilities (electricity, telephone, sewer, and cable TV services) ................................

2

00

3 Taxable sales of installation and connection of telephone, telegraph, and cable TV service ............

3

00

4 Taxable sales of movies, film, and satellite programming..................................................................

4

00

5 Taxable sales of admissions..............................................................................................................

5

00

6 Taxable sales of warranties, guarantees, and maintenance agreements ..........................................

6

00

7 Taxable sales of lodging accommodations ........................................................................................

7

00

8 Taxable services (see instructions) ....................................................................................................

8

00

9 TOTAL (line 1, minus lines 2 through 8). If less than $50,000, no fee is due .....................................

9

00

Under penalties of law, I declare that I have examined this return, and to the best of my knowledge and belief, it is correct and complete.

sign

here

Authorized Signature

Signature of Preparer Other Than Taxpayer

(

)

Title

Date

Telephone Number

Address

Date

Mail this return and payment to: NEBRASKA DEPARTMENT OF REVENUE, P.O. BOX 94818, LINCOLN, NE 68509-4818

Visit our Web site: , or call 1-800-742-7474 (toll free in NE and IA) or 1-402-471-5729.

PLEASE MAKE A COPY OF THIS RETURN FOR YOUR RECORDS.

1-105-1992 Rev. 7-2007 Supersedes 1-105-1992 Rev. 7-2006

1

1 2

2 3

3 4

4