Schedule B - Jointly Owned Property - South Dakota Inheritance Tax Report And Information For Judicial Determination Of Inheritance Tax

ADVERTISEMENT

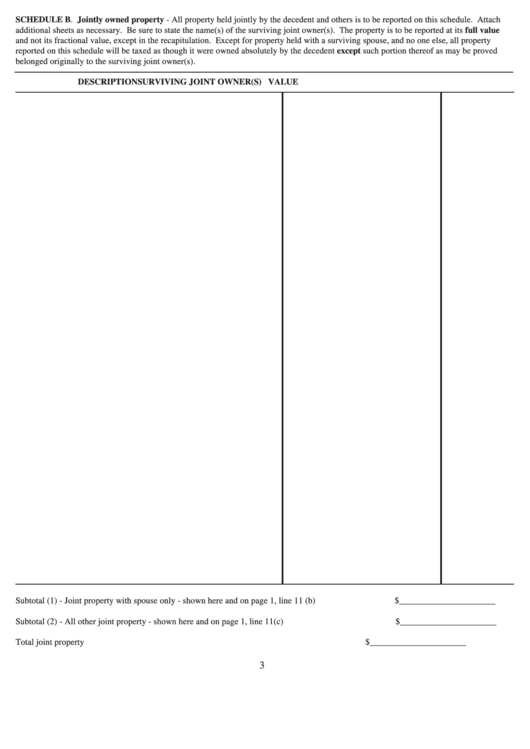

SCHEDULE B. Jointly owned property - All property held jointly by the decedent and others is to be reported on this schedule. Attach

additional sheets as necessary. Be sure to state the name(s) of the surviving joint owner(s). The property is to be reported at its full value

and not its fractional value, except in the recapitulation. Except for property held with a surviving spouse, and no one else, all property

reported on this schedule will be taxed as though it were owned absolutely by the decedent except such portion thereof as may be proved

belonged originally to the surviving joint owner(s).

DESCRIPTION

SURVIVING JOINT OWNER(S)

VALUE

Subtotal (1) - Joint property with spouse only - shown here and on page 1, line 11 (b)

$______________________

Subtotal (2) - All other joint property - shown here and on page 1, line 11(c)

$______________________

Total joint property

$______________________

3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1