Schedule C - Other Property Transfers - South Dakota Inheritance Tax Report And Information For Judicial Determination Of Inheritance Tax

ADVERTISEMENT

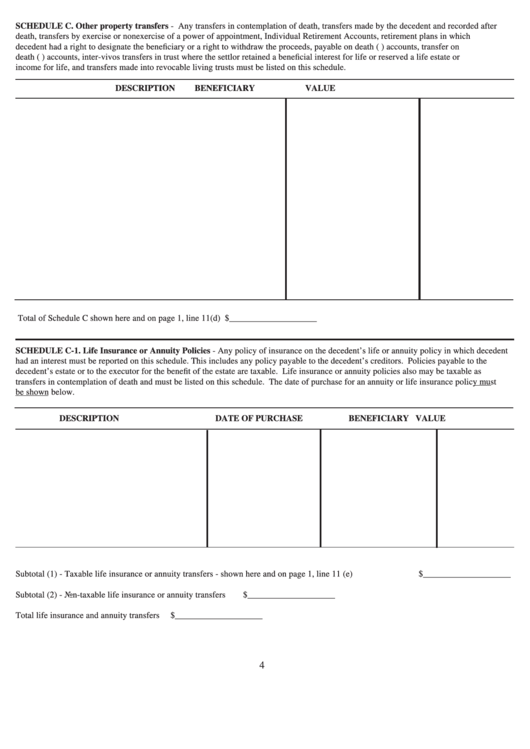

SCHEDULE C. Other property transfers - Any transfers in contemplation of death, transfers made by the decedent and recorded after

death, transfers by exercise or nonexercise of a power of appointment, Individual Retirement Accounts, retirement plans in which

decedent had a right to designate the beneficiary or a right to withdraw the proceeds, payable on death (P.O.D.) accounts, transfer on

death (T.O.D.) accounts, inter-vivos transfers in trust where the settlor retained a beneficial interest for life or reserved a life estate or

income for life, and transfers made into revocable living trusts must be listed on this schedule.

DESCRIPTION

BENEFICIARY

VALUE

Total of Schedule C shown here and on page 1, line 11(d)

$____________________

SCHEDULE C-1. Life Insurance or Annuity Policies - Any policy of insurance on the decedent’s life or annuity policy in which decedent

had an interest must be reported on this schedule. This includes any policy payable to the decedent’s creditors. Policies payable to the

decedent’s estate or to the executor for the benefit of the estate are taxable. Life insurance or annuity policies also may be taxable as

transfers in contemplation of death and must be listed on this schedule. The date of purchase for an annuity or life insurance policy must

be shown below.

DESCRIPTION

DATE OF PURCHASE

BENEFICIARY

VALUE

Subtotal (1) - Taxable life insurance or annuity transfers - shown here and on page 1, line 11 (e)

$____________________

Subtotal (2) - Non-taxable life insurance or annuity transfers

$____________________

Total life insurance and annuity transfers

$____________________

4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1