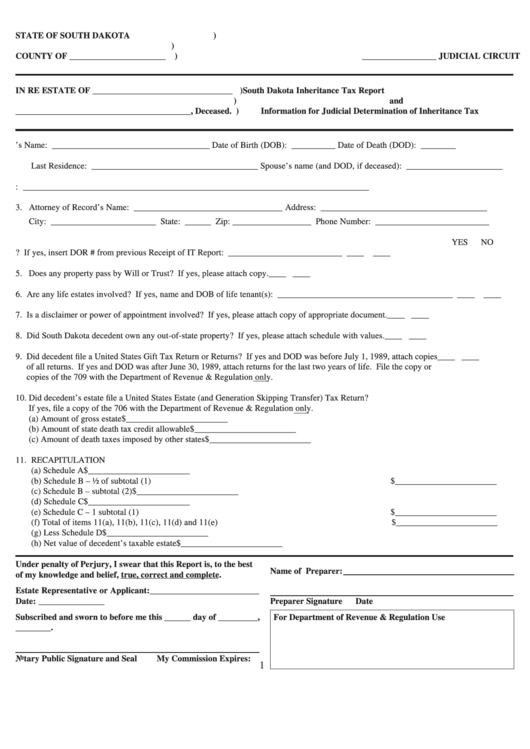

South Dakota Inheritance Tax Report And Information For Judicial Determination Of Inheritance Tax Form

ADVERTISEMENT

STATE OF SOUTH DAKOTA

)

IN CIRCUIT COURT

)

COUNTY OF ______________________

)

_________________ JUDICIAL CIRCUIT

IN RE ESTATE OF ________________________________ )

South Dakota Inheritance Tax Report

)

and

________________________________________, Deceased. )

Information for Judicial Determination of Inheritance Tax

1. Decedent’s Name: ____________________________________ Date of Birth (DOB): __________ Date of Death (DOD): ________

Last Residence: ______________________________________ Spouse’s name (and DOD, if deceased): ______________________

2. Estate Representative or Applicant: _______________________________________________________________________________

3. Attorney of Record’s Name: __________________________________

Address: ______________________________________

City: ________________________ State: ______ Zip: __________________ Phone Number: __________________________

YES

NO

4. Is this an Amended Report? If yes, insert DOR # from previous Receipt of IT Report: __________________________ ____ ____

5. Does any property pass by Will or Trust? If yes, please attach copy.

____ ____

6. Are any life estates involved? If yes, name and DOB of life tenant(s): ________________________________________ ____ ____

7. Is a disclaimer or power of appointment involved? If yes, please attach copy of appropriate document.

____ ____

8. Did South Dakota decedent own any out-of-state property? If yes, please attach schedule with values.

____ ____

9. Did decedent file a United States Gift Tax Return or Returns? If yes and DOD was before July 1, 1989, attach copies

____ ____

of all returns. If yes and DOD was after June 30, 1989, attach returns for the last two years of life. File the copy or

copies of the 709 with the Department of Revenue & Regulation only.

10. Did decedent’s estate file a United States Estate (and Generation Skipping Transfer) Tax Return?

____ ____

If yes, file a copy of the 706 with the Department of Revenue & Regulation only.

(a) Amount of gross estate

$_______________________

(b) Amount of state death tax credit allowable

$_______________________

(c) Amount of death taxes imposed by other states

$_______________________

11. RECAPITULATION

(a) Schedule A

$_______________________

(b) Schedule B – ½ of subtotal (1)

$_______________________

(c) Schedule B – subtotal (2)

$_______________________

(d) Schedule C

$_______________________

(e) Schedule C – 1 subtotal (1)

$_______________________

(f) Total of items 11(a), 11(b), 11(c), 11(d) and 11(e)

$_______________________

(g) Less Schedule D

$_______________________

(h) Net value of decedent’s taxable estate

$_______________________

Under penalty of Perjury, I swear that this Report is, to the best

Name of Preparer:

of my knowledge and belief, true, correct and complete.

Estate Representative or Applicant:_________________________

Date: _______________

Preparer Signature

Date

Subscribed and sworn to before me this ______ day of _________,

For Department of Revenue & Regulation Use

________.

Notary Public Signature and Seal

My Commission Expires:

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1