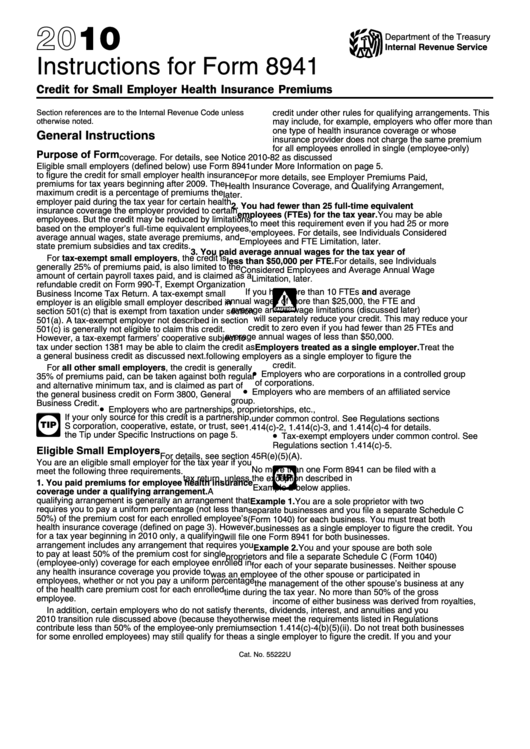

Instructions For Form 8941 - Credit For Small Employer Health Insurance Premiums - 2010

ADVERTISEMENT

2010

Department of the Treasury

Internal Revenue Service

Instructions for Form 8941

Credit for Small Employer Health Insurance Premiums

Section references are to the Internal Revenue Code unless

credit under other rules for qualifying arrangements. This

otherwise noted.

may include, for example, employers who offer more than

one type of health insurance coverage or whose

General Instructions

insurance provider does not charge the same premium

for all employees enrolled in single (employee-only)

Purpose of Form

coverage. For details, see Notice 2010-82 as discussed

Eligible small employers (defined below) use Form 8941

under More Information on page 5.

to figure the credit for small employer health insurance

For more details, see Employer Premiums Paid,

premiums for tax years beginning after 2009. The

Health Insurance Coverage, and Qualifying Arrangement,

maximum credit is a percentage of premiums the

later.

employer paid during the tax year for certain health

2. You had fewer than 25 full-time equivalent

insurance coverage the employer provided to certain

employees (FTEs) for the tax year. You may be able

employees. But the credit may be reduced by limitations

to meet this requirement even if you had 25 or more

based on the employer’s full-time equivalent employees,

employees. For details, see Individuals Considered

average annual wages, state average premiums, and

Employees and FTE Limitation, later.

state premium subsidies and tax credits.

3. You paid average annual wages for the tax year of

For tax-exempt small employers, the credit is

less than $50,000 per FTE. For details, see Individuals

generally 25% of premiums paid, is also limited to the

Considered Employees and Average Annual Wage

amount of certain payroll taxes paid, and is claimed as a

Limitation, later.

refundable credit on Form 990-T, Exempt Organization

If you had more than 10 FTEs and average

Business Income Tax Return. A tax-exempt small

!

annual wages of more than $25,000, the FTE and

employer is an eligible small employer described in

average annual wage limitations (discussed later)

section 501(c) that is exempt from taxation under section

CAUTION

will separately reduce your credit. This may reduce your

501(a). A tax-exempt employer not described in section

credit to zero even if you had fewer than 25 FTEs and

501(c) is generally not eligible to claim this credit.

average annual wages of less than $50,000.

However, a tax-exempt farmers’ cooperative subject to

tax under section 1381 may be able to claim the credit as

Employers treated as a single employer. Treat the

a general business credit as discussed next.

following employers as a single employer to figure the

credit.

For all other small employers, the credit is generally

•

Employers who are corporations in a controlled group

35% of premiums paid, can be taken against both regular

of corporations.

and alternative minimum tax, and is claimed as part of

•

Employers who are members of an affiliated service

the general business credit on Form 3800, General

group.

Business Credit.

•

Employers who are partnerships, proprietorships, etc.,

If your only source for this credit is a partnership,

under common control. See Regulations sections

S corporation, cooperative, estate, or trust, see

TIP

1.414(c)-2, 1.414(c)-3, and 1.414(c)-4 for details.

•

the Tip under Specific Instructions on page 5.

Tax-exempt employers under common control. See

Regulations section 1.414(c)-5.

Eligible Small Employers

For details, see section 45R(e)(5)(A).

You are an eligible small employer for the tax year if you

No more than one Form 8941 can be filed with a

meet the following three requirements.

tax return, unless the exception described in

TIP

1. You paid premiums for employee health insurance

Example 2 below applies.

coverage under a qualifying arrangement. A

qualifying arrangement is generally an arrangement that

Example 1. You are a sole proprietor with two

requires you to pay a uniform percentage (not less than

separate businesses and you file a separate Schedule C

50%) of the premium cost for each enrolled employee’s

(Form 1040) for each business. You must treat both

health insurance coverage (defined on page 3). However,

businesses as a single employer to figure the credit. You

for a tax year beginning in 2010 only, a qualifying

will file one Form 8941 for both businesses.

arrangement includes any arrangement that requires you

Example 2. You and your spouse are both sole

to pay at least 50% of the premium cost for single

proprietors and file a separate Schedule C (Form 1040)

(employee-only) coverage for each employee enrolled in

for each of your separate businesses. Neither spouse

any health insurance coverage you provide to

was an employee of the other spouse or participated in

employees, whether or not you pay a uniform percentage

the management of the other spouse’s business at any

of the health care premium cost for each enrolled

time during the tax year. No more than 50% of the gross

employee.

income of either business was derived from royalties,

In addition, certain employers who do not satisfy the

rents, dividends, interest, and annuities and you

2010 transition rule discussed above (because they

otherwise meet the requirements listed in Regulations

contribute less than 50% of the employee-only premium

section 1.414(c)-4(b)(5)(ii). Do not treat both businesses

for some enrolled employees) may still qualify for the

as a single employer to figure the credit. If you and your

Cat. No. 55222U

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8