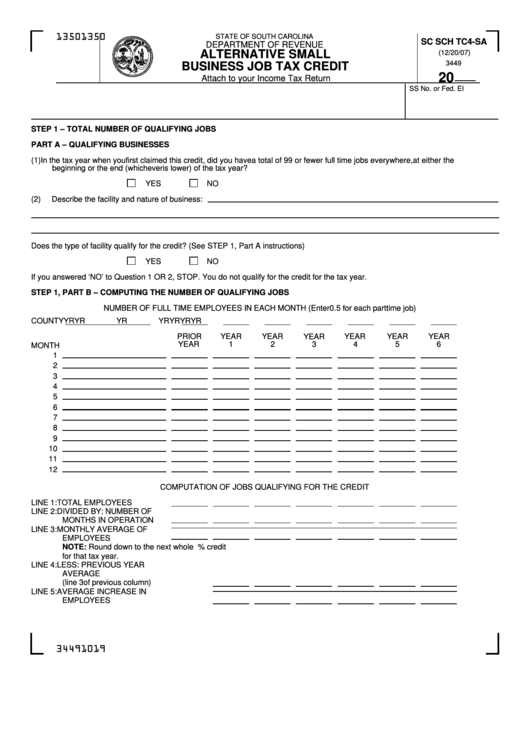

Form Sc Sch Tc4-Sa - Alternative Small Business Job Tax Credit - State Of South Carolina Department Of Revenue

ADVERTISEMENT

1350

1350

STATE OF SOUTH CAROLINA

SC SCH TC4-SA

DEPARTMENT OF REVENUE

ALTERNATIVE SMALL

(12/20/07)

3449

BUSINESS JOB TAX CREDIT

20

Attach to your Income Tax Return

Name As Shown On Tax Return

SS No. or Fed. EI No.

STEP 1 – TOTAL NUMBER OF QUALIFYING JOBS

PART A – QUALIFYING BUSINESSES

(1)

In the tax year when you first claimed this credit, did you have a total of 99 or fewer full time jobs everywhere, at either the

beginning or the end (whichever is lower) of the tax year?

YES

NO

(2)

Describe the facility and nature of business:

Does the type of facility qualify for the credit? (See STEP 1, Part A instructions)

YES

NO

If you answered ‘NO’ to Question 1 OR 2, STOP. You do not qualify for the credit for the tax year.

STEP 1, PART B – COMPUTING THE NUMBER OF QUALIFYING JOBS

NUMBER OF FULL TIME EMPLOYEES IN EACH MONTH (Enter 0.5 for each part time job)

COUNTY

YR

YR

YR

YR

YR

YR

YR

PRIOR

YEAR

YEAR

YEAR

YEAR

YEAR

YEAR

YEAR

1

2

3

4

5

6

MONTH

1

2

3

4

5

6

7

8

9

10

11

12

COMPUTATION OF JOBS QUALIFYING FOR THE CREDIT

LINE 1: TOTAL EMPLOYEES

LINE 2: DIVIDED BY: NUMBER OF

MONTHS IN OPERATION

LINE 3: MONTHLY AVERAGE OF

EMPLOYEES

NOTE: Round down to the next whole number. Enter -0- if the increase is less than 2. You do not qualify for the 100% credit

for that tax year.

LINE 4: LESS: PREVIOUS YEAR

AVERAGE

(line 3 of previous column)

LINE 5: AVERAGE INCREASE IN

EMPLOYEES

34491019

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4