Form Rpd-41278 - Cigarette Stamp Inventory Tax Return - New Mexico Taxation And Revenue Department

ADVERTISEMENT

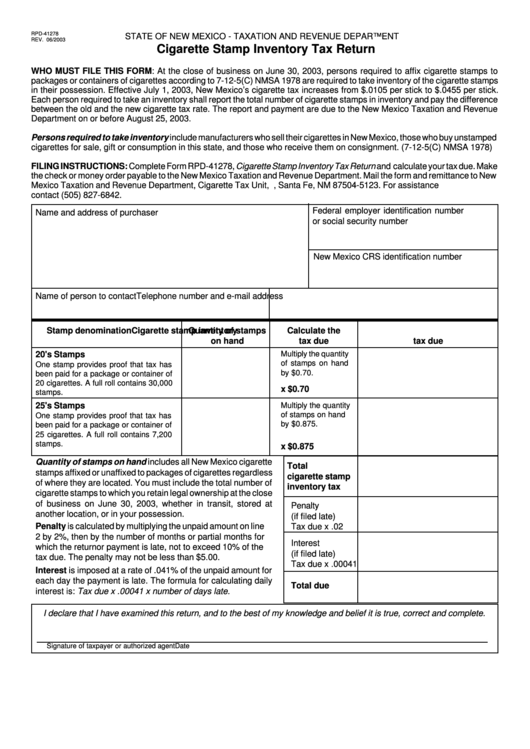

RPD-41278

STATE OF NEW MEXICO - TAXATION AND REVENUE DEPARTMENT

REV. 06/2003

Cigarette Stamp Inventory Tax Return

WHO MUST FILE THIS FORM: At the close of business on June 30, 2003, persons required to affix cigarette stamps to

packages or containers of cigarettes according to 7-12-5(C) NMSA 1978 are required to take inventory of the cigarette stamps

in their possession. Effective July 1, 2003, New Mexico’s cigarette tax increases from $.0105 per stick to $.0455 per stick.

Each person required to take an inventory shall report the total number of cigarette stamps in inventory and pay the difference

between the old and the new cigarette tax rate. The report and payment are due to the New Mexico Taxation and Revenue

Department on or before August 25, 2003.

Persons required to take inventory include manufacturers who sell their cigarettes in New Mexico, those who buy unstamped

cigarettes for sale, gift or consumption in this state, and those who receive them on consignment. (7-12-5(C) NMSA 1978)

FILING INSTRUCTIONS: Complete Form RPD-41278, Cigarette Stamp Inventory Tax Return and calculate your tax due. Make

the check or money order payable to the New Mexico Taxation and Revenue Department. Mail the form and remittance to New

Mexico Taxation and Revenue Department, Cigarette Tax Unit, P.O. Box 25123, Santa Fe, NM 87504-5123. For assistance

contact (505) 827-6842.

Federal employer identification number

Name and address of purchaser

or social security number

New Mexico CRS identification number

Name of person to contact

Telephone number and e-mail address

Stamp denomination

Quantity of stamps

Calculate the

Cigarette stamp inventory

on hand

tax due

tax due

20's Stamps

Multiply the quantity

of stamps on hand

One stamp provides proof that tax has

by $0.70.

been paid for a package or container of

20 cigarettes. A full roll contains 30,000

x $0.70

stamps.

25's Stamps

Multiply the quantity

of stamps on hand

One stamp provides proof that tax has

by $0.875.

been paid for a package or container of

25 cigarettes. A full roll contains 7,200

stamps.

x $0.875

Quantity of stamps on hand includes all New Mexico cigarette

Total

stamps affixed or unaffixed to packages of cigarettes regardless

cigarette stamp

of where they are located. You must include the total number of

inventory tax

cigarette stamps to which you retain legal ownership at the close

of business on June 30, 2003, whether in transit, stored at

Penalty

another location, or in your possession.

(if filed late)

Penalty is calculated by multiplying the unpaid amount on line

Tax due x .02

2 by 2%, then by the number of months or partial months for

Interest

which the return or payment is late, not to exceed 10% of the

(if filed late)

tax due. The penalty may not be less than $5.00.

Tax due x .00041

Interest is imposed at a rate of .041% of the unpaid amount for

each day the payment is late. The formula for calculating daily

Total due

interest is: Tax due x .00041 x number of days late.

I declare that I have examined this return, and to the best of my knowledge and belief it is true, correct and complete.

Signature of taxpayer or authorized agent

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1