Clear Form

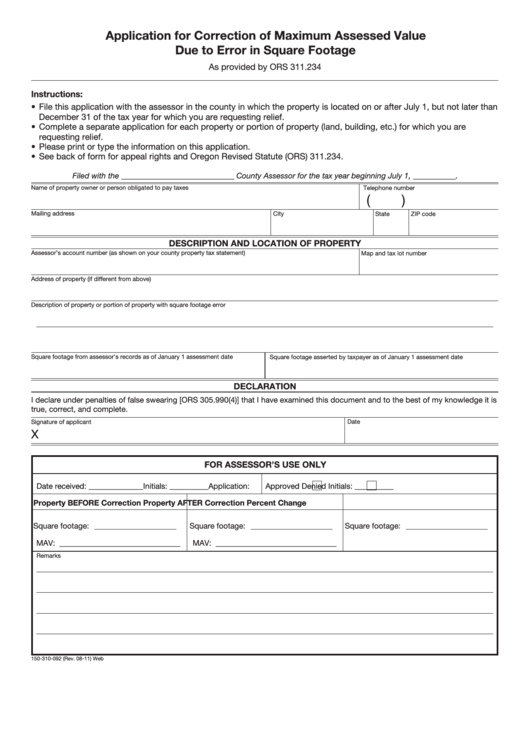

Application for Correction of Maximum Assessed Value

Due to Error in Square Footage

As provided by ORS 311.234

Instructions:

• File this application with the assessor in the county in which the property is located on or after July 1, but not later than

December 31 of the tax year for which you are requesting relief.

• Complete a separate application for each property or portion of property (land, building, etc.) for which you are

requesting relief.

• Please print or type the information on this application.

• See back of form for appeal rights and Oregon Revised Statute (ORS) 311.234.

Filed with the _____________________________ County Assessor for the tax year beginning July 1, ___________.

Name of property owner or person obligated to pay taxes

Telephone number

(

)

Mailing address

City

State

ZIP code

DESCRIPTION AND LOCATION OF PROPERTY

Assessor’s account number (as shown on your county property tax statement)

Map and tax lot number

Address of property (if different from above)

Description of property or portion of property with square footage error

Square footage from assessor’s records as of January 1 assessment date

Square footage asserted by taxpayer as of January 1 assessment date

DECLARATION

I declare under penalties of false swearing [ORS 305.990(4)] that I have examined this document and to the best of my knowledge it is

true, correct, and complete.

Date

Signature of applicant

X

FOR ASSESSOR’S USE ONLY

Date received: ______________

Initials: __________

Application:

Approved

Denied

Initials: __________

Property BEFORE Correction

Property AFTER Correction

Percent Change

Square footage: _____________________

Square footage: _____________________

Square footage: _____________________

MAV: _______________________________

MAV: _______________________________

Remarks

150-310-092 (Rev. 08-11) Web

1

1 2

2