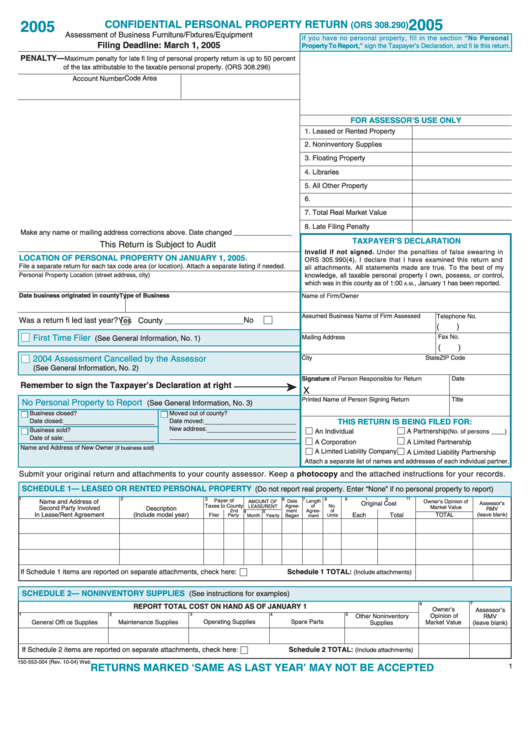

2005

2005

CONFIDENTIAL PERSONAL PROPERTY RETURN

(ORS 308.290)

Assessment of Business Furniture/Fixtures/Equipment

If you have no personal property, fill in the section “No Personal

Filing Deadline: March 1, 2005

Property To Report,” sign the Taxpayer’s Declaration, and fi le this return.

PENALTY—

Maximum penalty for late fi ling of personal property return is up to 50 percent

of the tax attributable to the taxable personal property. (ORS 308.296)

Clear Form

Code Area

Account Number

FOR ASSESSOR’S USE ONLY

1. Leased or Rented Property

2. Noninventory Supplies

3. Floating Property

4. Libraries

5. All Other Property

6.

7. Total Real Market Value

8. Late Filing Penalty

Make any name or mailing address corrections above. Date changed _______________

TAXPAYER’S DECLARATION

This Return is Subject to Audit

Invalid if not signed. Under the penalties of false swearing in

LOCATION OF PERSONAL PROPERTY ON JANUARY 1, 2005.

ORS 305.990(4), I declare that I have examined this return and

File a separate return for each tax code area (or location). Attach a separate listing if needed.

all attachments. All statements made are true. To the best of my

Personal Property Location (street address, city)

knowledge, all taxable personal property I own, possess, or control,

which was in this county as of 1:00

.

., January 1 has been reported.

A

M

Date business originated in county

Type of Business

Name of Firm/Owner

Assumed Business Name of Firm Assessed

Telephone No.

Was a return fi led last year?

No

Yes County __________________

(

)

First Time Filer

Fax No.

Mailing Address

(See General Information, No. 1)

(

)

2004 Assessment Cancelled by the Assessor

City

State

ZIP Code

(See General Information, No. 2)

Signature of Person Responsible for Return

Date

➤

Remember to sign the Taxpayer’s Declaration at right

X

Printed Name of Person Signing Return

Title

No Personal Property to Report

(See General Information, No. 3)

Business closed?

Moved out of county?

Date closed:

Date moved:

THIS RETURN IS BEING FILED FOR:

New address:

Business sold?

An Individual

A Partnership

(No. of persons ____)

Date of sale:

A Corporation

A Limited Partnership

Name and Address of New Owner

(if business sold)

A Limited Liability Company

A Limited Liability Partnership

Attach a separate list of names and addresses of each individual partner.

Submit your original return and attachments to your county assessor. Keep a photocopy and the attached instructions for your records.

SCHEDULE 1— LEASED OR RENTED PERSONAL PROPERTY

(Do not report real property. Enter “None” if no personal property to report)

11

1

2

3

6

7

8

9

10

Payer of

Name and Address of

Date

Length

Owner’s Opinion of

AMOUNT OF

Original Cost

Assessor’s

Taxes to County

No.

Agree-

of

LEASE/RENT

Market Value

Second Party Involved

Description

RMV

of

2nd

ment

Agree-

4

5

In Lease/Rent Agreement

(Include model year)

(leave blank)

Each

Total

TOTAL

Filer

Party

Month

Yearly

Began

Units

ment

If Schedule 1 items are reported on separate attachments, check here:

Schedule 1 TOTAL:

(Include attachments)

SCHEDULE 2— NONINVENTORY SUPPLIES

(See instructions for examples)

7

6

REPORT TOTAL COST ON HAND AS OF JANUARY 1

Owner’s

Assessor’s

1

2

3

4

5

Opinion of

Other Noninventory

RMV

Spare Parts

Maintenance Supplies

Operating Supplies

General Offi ce Supplies

Supplies

Market Value

(leave blank)

If Schedule 2 items are reported on separate attachments, check here:

Schedule 2 TOTAL:

(Include attachments)

150-553-004 (Rev. 10-04) Web

RETURNS MARKED ‘SAME AS LAST YEAR’ MAY NOT BE ACCEPTED

1

1

1 2

2 3

3 4

4