Form Bcc - Credit Certificate - Brownfields

ADVERTISEMENT

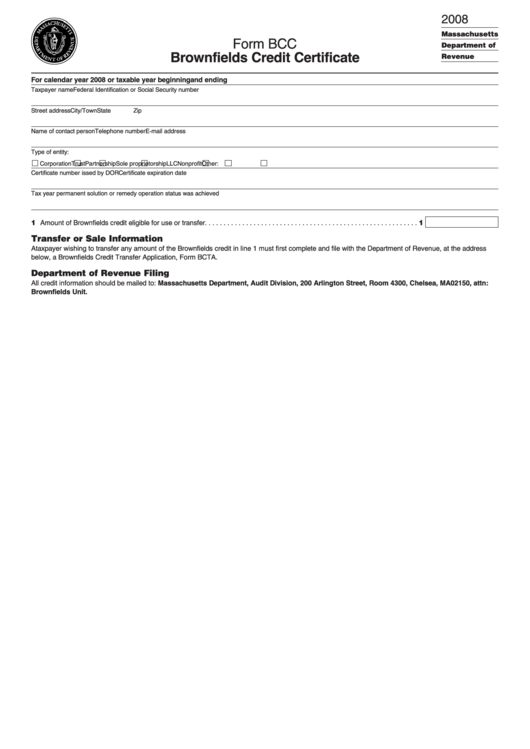

2008

Massachusetts

Form BCC

Department of

Brownfields Credit Certificate

Revenue

For calendar year 2008 or taxable year beginning

and ending

Taxpayer name

Federal Identification or Social Security number

Street address

City/Town

State

Zip

Name of contact person

Telephone number

E-mail address

Type of entity:

Corporation

Trust

Partnership

Sole proprietorship

LLC

Nonprofit

Other:

Certificate number issed by DOR

Certificate expiration date

Tax year permanent solution or remedy operation status was achieved

1 Amount of Brownfields credit eligible for use or transfer . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

Transfer or Sale Information

A taxpayer wishing to transfer any amount of the Brownfields credit in line 1 must first complete and file with the Department of Revenue, at the address

below, a Brownfields Credit Transfer Application, Form BCTA.

Department of Revenue Filing

All credit information should be mailed to: Massachusetts Department, Audit Division, 200 Arlington Street, Room 4300, Chelsea, MA 02150, attn:

Brownfields Unit.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1